Telkom’s financial results for the six months to end-September are a mixed bag. Headlines are focused on a fixed-line business under immense pressure, and a mobile one that is doing extraordinarily well. But it’s not quite as simple as that.

Telkom’s financial results for the six months to end-September are a mixed bag. Headlines are focused on a fixed-line business under immense pressure, and a mobile one that is doing extraordinarily well. But it’s not quite as simple as that.

Practically every single metric in the mobile business is positive. The unit has looked in better and better shape since achieving profitability in 2016.

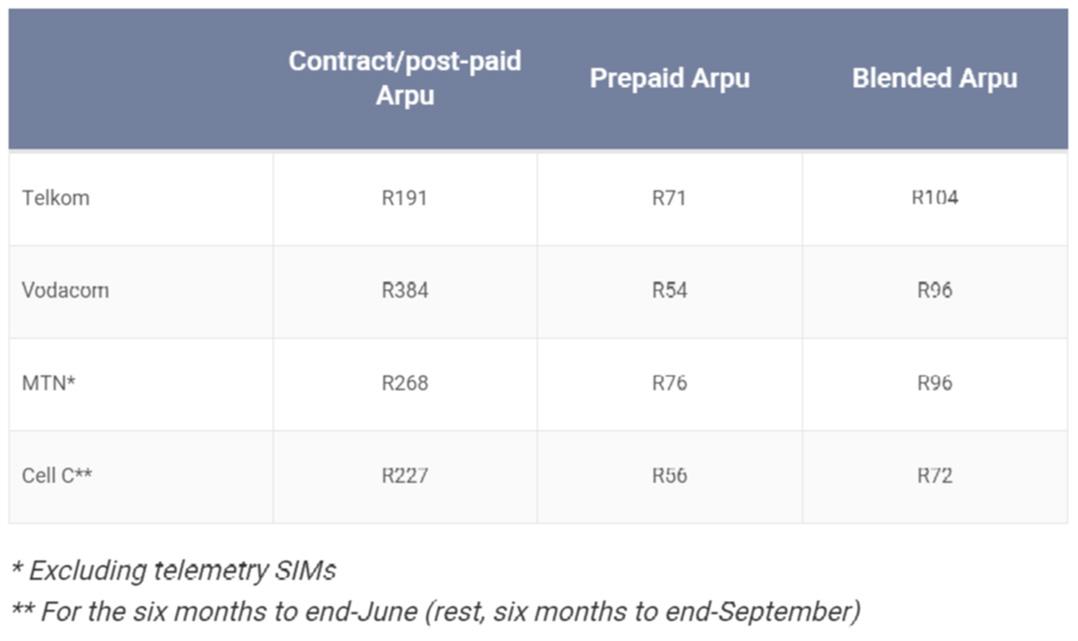

It has 1.7 million active post-paid (contract) customers who spend, on average, R191/month. Contrast this with Cell C, which at the end of June only had 1.1 million post-paid and hybrid (top-up) customers, with average revenue per user (Arpu) of R227.

Cell C’s prepaid Arpu is just R56, compared to Telkom’s R71. That Telkom managed to increase this by 33% over the past year speaks to the success of its strategy, which is premised almost entirely on data. Telkom’s blended Arpu is R104.28, higher than MTN’s and Vodacom’s (which for both was around R96 for the comparable six months).

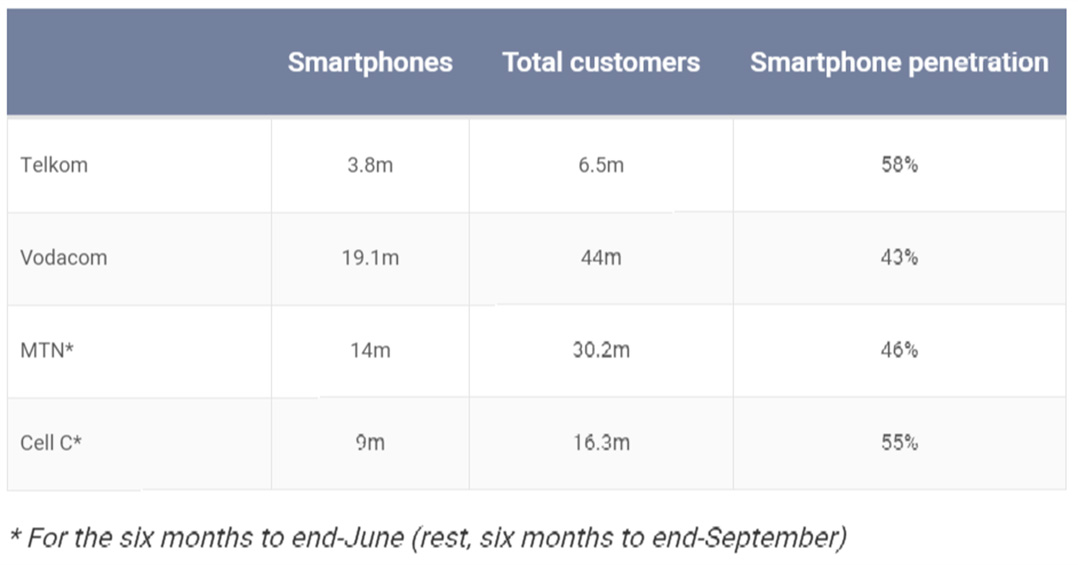

Smartphone customers on its mobile network almost doubled over the past year (up 83.9%) to 3.8 million, and mobile data service revenue is at R2.7-billion for the six months, very close to the R2.96-billion reported by Cell C for the period between January and end-June.

Telkom has also been successful at converting ADSL customers to its fibre-to-the-home (FTTH) services, in so doing driving the so-called “attachment” rate up to 35.6% of the nearly 400 000 homes passed. This means it has just under 140 000 FTTH subscribers, many of whom are using Telkom as their Internet service provider as well.

Copper dying

Copper dying

However, the number of Telkom ADSL customers has fallen sharply. At the end of September 2016, it had a touch under one million ADSL lines (and only 19 000 active fibre connections). This dropped to 925 687 by end September 2017 and to 834 237 at the end of this September. That’s a loss of 165 000 ADSL subscribers (or 17%) in 24 months, and with that typically the fixed telephone line service too.

Here you can see the effects of a blurred strategy, where up until about a year ago, the group was preaching that it would leverage its copper network, which it then described as a “good enough” technology. Happily, the group has realised it needs to move customers still on the legacy copper network to either fixed LTE or fibre. Telkom says it intends to “accelerate” this migration “in order to retain our customers and maintain market share”. It has also said, for the first time, it would look to “decommission” components of its network as it shifts customers from copper.

Telkom wholly-owned subsidiary BCX is still struggling, and the group commenced a section 189 (retrenchment) process last week. Revenue remains under pressure as its voice business deteriorates further (overall revenue was down 4.3%, with voice revenue down 11.9% in the six months). Worryingly, the group expects a “continued decline in voice and spend”. Structurally, this business has lower margins (13.3%) than the average for the group (25.5%) and it will continue to drag the overall earnings before interest, tax, depreciation and amortisation (Ebitda) margin lower. One gets the sense that the turnaround of BCX is taking longer than management expected.

While there is certainty on the glide path of call termination rates over the next three years, the impact on Telkom’s business is, as yet, unclear. All the group says is that the new glide path “will further put our margins under pressure”. The only lever it has to counter this is to contain costs, but one gets the sense that by far the bulk of the easy cuts have been made across the business (excluding BCX).

The group has embarked on a campaign called “Serving is the New Selling” to improve customer experience. Aside from implementing specialist service teams and the automation of certain processes, the key here is extending service capabilities to its stores. This seems like an obvious concept but, previously, customers walking into stores with queries would effectively be handed a phone which had been dialed to a call centre. Now, the staff at stores are able to resolve many queries themselves. This is a profound shift and will surely help the group rehabilitate its service reputation.

- Hilton Tarrant works at YFM. This article was originally published on Moneyweb and is used here with permission