When was the last time you were excited about the interest in your savings account or loan rates? Do you think the fees you pay for your banking services are worth the expense, or have you started keeping money in a shoebox under your bed? We live in a time when our most important financial system is completely outdated, expensive and frustrating to use. Where do savvy investors turn for yield on their finances?

When was the last time you were excited about the interest in your savings account or loan rates? Do you think the fees you pay for your banking services are worth the expense, or have you started keeping money in a shoebox under your bed? We live in a time when our most important financial system is completely outdated, expensive and frustrating to use. Where do savvy investors turn for yield on their finances?

The answer is NOT the bank.

Throughout the history of money, innovation has replaced outdated systems. Just as metal coins replaced seashells, debit cards and Internet banking has replaced much of our use of printed money. We’re familiar with new technology disrupting old technology in our modern age. The combustion engine replaced horse and cart, Kodak Film all but disappeared in the wake of digital cameras, and Blockbuster Video was rendered obsolete by video-streaming services like Netflix. In the age of rapid innovation, we will see many outdated models giving way to new and better ways of operating.

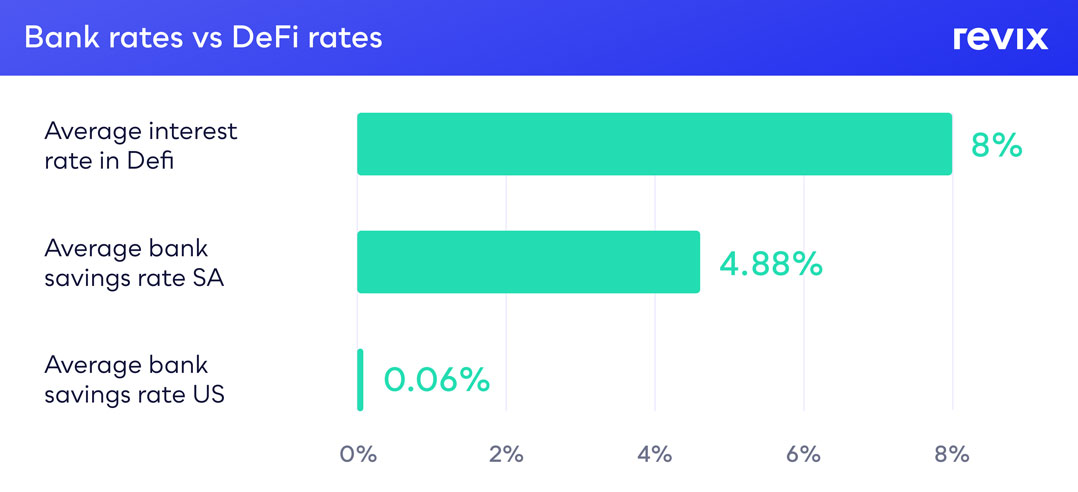

Innovation has never been more necessary when you think about the most outdated financial institution, the bank. Gone are the days of savings accounts offering worthwhile returns, and the expense, apathy and hassle of a bank no longer make sense.

We need a new financial model.

DeFi (decentralised finance) describes the rapidly growing sector of personal finance products built on blockchains, replacing the functions of traditional financial institutions like banks. Slow, expensive and prone to human error, banks are outdated systems that have not kept up with technological innovation. DeFi offers all the functions of a bank: interest and loans, without the queues, waiting and endless admin.

What if we told you that you could earn 20% interest on a savings account? Impossible! What about taking out a loan without a credit history, with the lowest rates on the market? Do we have your attention yet? DeFi makes it all possible without the high fees that banks charge. The key is replacing redundant systems and people with advanced programs called smart contracts, built to act out specific actions, managing vast pools of money at speed and without error. Thanks to blockchain innovation, DeFi is secure and available to anyone with an Internet connection.

DeFi resolves an age-old problem of a middleman taking his cut of your personal finance for holding or lending. DeFi cuts out the middleman, making finance cheaper, faster and more secure. It does this by facilitating peer-to-peer finance, making you the primary earner of your financial transactions. You no longer need to hand your finances over to a bank (which earns yield off your money). You earn the yield yourself!

How do you get involved?

Start by purchasing the picks and shovels of this rapidly developing industry — the digital tokens used by the leading DeFi platforms to facilitate the most secure yield in the world today. It’s a lot like buying property off-plan in a great neighbourhood. To say we’re early in the adoption cycle is an understatement, and 2022 looks to be the year institutions adopt DeFi.

While DeFi networks are already managing over US$200-billion, it is complicated to use, and you need to know what you’re doing. This won’t be the case for long, as companies like Revix, a Cape Town-based investment platform backed by JSE-listed Sabvest, build easy-to-use, customer-friendly portals. Early adopters are enjoying the benefits and gains, and you should, too.

This week, Revix launches a new, themed DeFi top 10 bundle, offering an indexed collection of the world’s leading Defi tokens. These are the cryptos building the future of personal finance, and the bundle is your front-row seat to the most significant innovation in finance. In 2022, the top 10 DeFi projects saw over 1 000% price growth. When the market dipped, so did the price of DeFi, making the asset class an incredibly undervalued investment.

This bundle automatically rebalances (slight changes to the weighting and assets in the bundle) on the 1st of every month. It takes advantage of opportunities available from the most reputable DeFi cryptocurrencies through buying or selling each asset. This dynamic and fully automated approach makes investing effortless, maximising your returns and saving you time.

About Revix

Revix brings simplicity, trust and great customer service to investing in cryptocurrencies. Its easy-to-use online platform allows you to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Disclaimer

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more visit www.revix.com.

- This promoted content was paid for by the party concerned