During the weekend starting Friday, 3 December, bitcoin’s price dropped from US$52 000 to $40 000 in a matter of minutes. At one point, the 24-hour price chart showed a 22% loss. So, if you were among the unfortunate millions whose weekend was spent obsessively tracking the bitcoin price, you can hardly be blamed. Despite what some media will tell you, though, it is certainly not time to start choosing which flowers will be displayed at bitcoin’s funeral.

During the weekend starting Friday, 3 December, bitcoin’s price dropped from US$52 000 to $40 000 in a matter of minutes. At one point, the 24-hour price chart showed a 22% loss. So, if you were among the unfortunate millions whose weekend was spent obsessively tracking the bitcoin price, you can hardly be blamed. Despite what some media will tell you, though, it is certainly not time to start choosing which flowers will be displayed at bitcoin’s funeral.

Understanding what drives events like last weekend’s dip is exceptionally valuable to us as crypto investors. It can also help to build resistance to the media storm that accompanies events like this, which can cause us to make emotional, rather than reasonable, investment decisions.

So, let’s discuss the events of the past weekend and find out why, terrifying as it was, bitcoin isn’t going anywhere.

The influence of traditional markets

Bitcoin is no longer an obscure cryptocurrency that only tech-savvy early adopters are investing in. There is enough institutional investment in bitcoin now that its price is heavily influenced by the traditional, global markets.

The level of risk that investors are willing to tolerate changes over time. Sometimes, such as during the 2009 economic recovery period, investors are more likely to invest in higher-risk assets and/or financial instruments, which characterises a risk-on period. Conversely, the 2008 financial crisis was considered a risk-off year, which saw investors looking to reduce the risk they are exposed to by selling volatile assets and liquidating risky positions.

On Friday, 3 December, traditional markets were in risk-off mode. There were multiple factors driving this. Global equities (risk-on asset) took a steep downturn, while the benchmark US bonds (safe-haven asset) showed strength on Friday after data showed US job growth had slowed in November. Meanwhile, investors are still nervous about how the Omicron variant of the coronavirus is going to affect global markets.

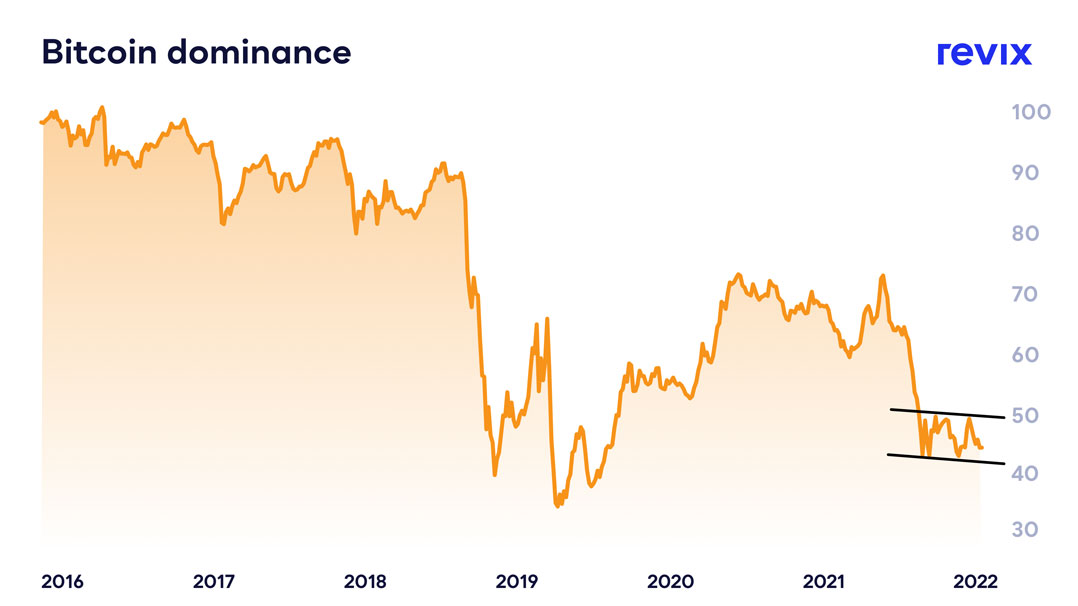

Bitcoin has also retreated significantly from its dominant position in the crypto market in recent weeks, giving way to several large-cap altcoins.

So, where an investment in bitcoin once meant significant exposure to the crypto market as a whole, that is no longer the case. The graph below shows just how much ground altcoins have gained on bitcoin in terms of market cap.

These factors combined to bring about the most likely reason for bitcoin’s tragic weekend, a market flush.

What is a flush?

When investors are nervous about the market and risk-off assets are selling off, we can see a market flush out in assets with high leverage.

Let’s imagine that one enterprising kid at school buys five bags of marbles with 10 marbles in each. He gives one bag of marbles to each of his five friends and sets them a challenge. Each kid must try to sell their marbles at the highest possible price to classmates before the end of the day. They get to keep the money they make from these sales, but there’s a catch. His friends have to buy all 10 of their marbles from him at the end of the day, for R1 each.

The best salesmen in the group will likely drive the marble price up over R1/marble to make a profit. But new marble buyers can also become marble sellers, so the price is likely to stabilise quickly. As the day draws to a close, any friends with marbles remaining in their bag will begin to get nervous. They will start to sell marbles at lower and lower prices.

If the price gets to 90c, some of the kids will start to realise that they stand to lose 10c per marble at the end of the day. It’s easy to see why, as the ring of the final bell approaches, those kids will start to panic sell because getting even a fraction of the price they will have to pay for the marbles at the end of day is better than nothing. So, the kids look to liquidate their remaining marbles at almost any cost, even if that cost is less than the R1 they will have to pay for each marble at the end of the day. Replace the kids with institutional investors and the marbles with trillions of dollars in risky leveraged positions, and you have the makings of a flush.

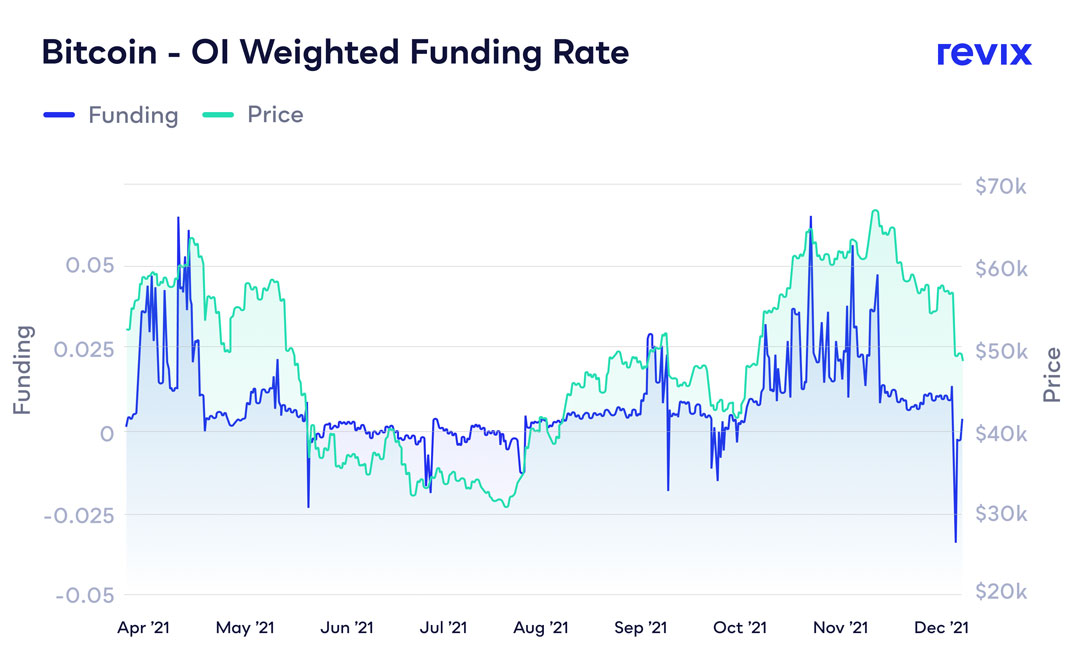

To gauge how exposed a market is to a flush, analysts look at a metric called funding rates. These rates are a measure of how costly it is to take out leverage. In other words, how expensive it is to lend marbles… Sorry, money in order to place bigger bets on the direction that the price of an asset is going to take.

After the recent pullback in the bitcoin price, the funding rate for bitcoin reached the lowest it has been since the crash in early September, as demonstrated in the graph above. That means that leverage, or money that investors borrowed to take larger positions has been flushed out of the market, creating a market reset.

What makes this crash weird?

A market flush having such dramatic effects on the bitcoin price is nothing new and something that bitcoin investors will no doubt have to weather again. One thing about this crash, however, certainly is unusual.

Bitcoin’s status as the safe haven of crypto investments is well earned. Since growing beyond a market cap of $1-trillion, it has been the least affected by market-wide price dips. This time around, though, it is ethereum that has held its footing throughout the storm. While losses ravaged essentially the entire crypto market, the ETH/BTC trading pair actually moved higher.

Interestingly, this is perhaps the most striking piece of evidence to suggest that what we experienced over the past weekend was, indeed, a good old flush and not a case of the market being genuinely fearful, leading to a mass selloff.

In conclusion, while this level of volatility demands that investors take extra care with new investments, whales and institutional investors are not panic selling their bitcoin, and neither should you!

Meanwhile, why not wear your bitcoin on your sleeve?

Whether you’re new to crypto investing or someone who has paid for a pizza with bitcoin, the original cryptocurrency’s legendary status won’t be lost on you. So, you’ll be excited to discover that Revix, a Cape Town-based crypto investment platform, is running a competition to win a prize that will make it easy to show the world that you’ve taken the crypto revolution seriously.

Predict what you think the bitcoin price will be on the 3 January 2022 at 12pm (South African time), and make an investment of R500 or more in bitcoin via Revix’s platform, and you could win one of three exclusive pairs of Tateossian Blockchain Cufflinks. Follow the instructions on this link to enter.

Predict what you think the bitcoin price will be on the 3 January 2022 at 12pm (South African time), and make an investment of R500 or more in bitcoin via Revix’s platform, and you could win one of three exclusive pairs of Tateossian Blockchain Cufflinks. Follow the instructions on this link to enter.

- This promoted content was paid for by the party concerned