A special meeting of 4Sight Holdings shareholders on Friday looks set to be a fiery affair after a leading director quit on Monday, describing his continued presence on the board of the listed technology company as untenable.

A special meeting of 4Sight Holdings shareholders on Friday looks set to be a fiery affair after a leading director quit on Monday, describing his continued presence on the board of the listed technology company as untenable.

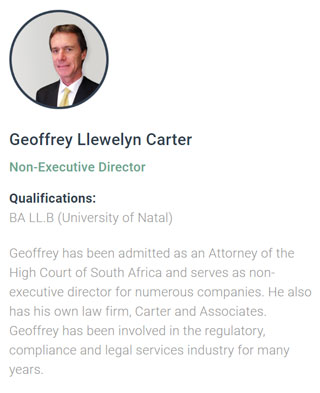

In a statement issued on the JSE’s stock exchange news service on Monday, Geoffrey Carter — chairman of 4Sight’s audit and risk committee — spoke of “belligerent breaches in corporate governance, ill-disciplined financial transgressions and continuous disagreements” regarding the “interpretation to (sic) certain clauses in the sale of shares agreement”.

“This all raises pertinent statutory and regulatory questions in relation to the JSE Limited.”

It’s not immediately clear what is happening at 4Sight, which is incorporated in Mauritius, though shareholders have taken fright at the latest developments, sending the share price tumbling almost 24%, to 16c, at the close in Johannesburg on Monday.

The drama appears to have started on or before 23 August, when 4Sight issued a statement informing shareholders that the board had received correspondence from a shareholder holding at least 5% of the voting rights in the company that required it to call a special meeting, the aim being to reconstitute the board.

Attempts by TechCentral to get comment from 4Sight at the time about the developments were stonewalled. All it would say was that it had “received a request for a special meeting from a shareholder. In accordance with JSE requirements, we have issued a Sens announcement. 4Sight Holdings is engaging with our advisors and will make an announcement in compliance with JSE requirements,” it said in a tersely worded statement.

Board shake-up

On 5 September, two weeks after the initial statement to shareholders, the company said the special meeting would take place on Friday, 11 October at 4Sight’s offices in Fourways, Johannesburg. It also provided further details about the reason for the meeting. It would be held to comply with a demand from shareholders Morne Swanepoel (who holds 14.6% of the company’s equity); Jaco Botha (12.4%); Mari-Louise Zitzke (11.6%); and Tertius Zitzke (3.1%). All four individuals had sold their companies to 4Sight in the 2018 financial year.

According to the 5 September statement, the shareholders wanted the meeting to vote on the removal Gary Lauryssen, Vincent Raseroka, Geoffrey Carter and Jason du Plessis as directors and the appointment of Tertius Zitzke, RP Dreyer and E van der Merwe to the board. In a later statement, an additional resolution was added, seeking the election of Botha — the 12.4% shareholders — as a director.

Then, on 19 September, 4Sight Holdings said it had received a “credible, non-binding expression of interest, with a request for exclusivity, for the acquisition of all the shares in 4Sight”. The board granted the unnamed bidder the exclusivity sought.

Monday’s statement has only added the intrigue. According to the latest statement, Carter resigned from the board “with immediate effect … due to the untenable situation at a major subsidiary level, which has led to such subsidiary executives sending a variety of e-mails containing … false accusations and … looking to reconstitute the board as separately announced”.

The statement quoted Carter as saying: “The lengthy diatribe below (a reference to e-mails not published in the stock exchange notice) is delusional in content, incorrect in law and in my view equates to ‘Trumpism strategy’ (sic) — attack is the best form of defence and rule by division.

“As for the latest barrage of e-mails, it is becoming incomprehensible, apparently personal and diabolical. I feel deeply sorry and concerned that the board and specifically Vincent (Raseroka) and Gary (Lauryssen) are embroiled with various subsidiaries regarding belligerent breaches in corporate governance, ill-disciplined financial transgressions and continuous disagreements as to the interpretation to certain clauses in the sale of shares agreement.”

‘Clash of characters’

Carter continued: “This all raises pertinent statutory and regulatory questions in relation to the JSE Limited. As chairperson of the audit and risk committee, I am further of the view that my position is being compromised to a point of no return, where serious issues of financial irregularities have occurred, yet (there have been) no consequences, except an all-out battle of egos and clash of characters. I have never experienced such hostility on any board of directors that I have been privileged to serve on — never. I am therefore unwilling to serve and provide my services under these circumstances.”

In the statement, 4Sight said the board has informed the JSE of the “situation with certain subsidiaries and the challenges” it faces.

“The resignation of Mr Carter is deeply regretted, and he has served the board in an ethical, constructive and professional manner from before the original listing of the company.” — © 2019 NewsCentral Media