Amazon is a company that gets the benefit of the doubt. A lot. No technology company is as ambitious or as feared. Yet no one really knows Amazon’s business strategy, and that’s by design. Most investors are happy for Amazon to remain a mysterious fog as long as it keeps surprising with one successful business after another.

But there is one area where Amazon no longer deserves a pass from investors, and that’s its Internet video offerings.

Perhaps for the first time since Amazon started its own Netflix-like Web video service four year ago as a perk for Prime members, the company’s entertainment strategy has gone off the rails. That should raise fresh doubts about the wisdom of Amazon spending billions of dollars annually to feed its Internet video service. Amazon investors deserve a better justification now for what the company gets out of this business.

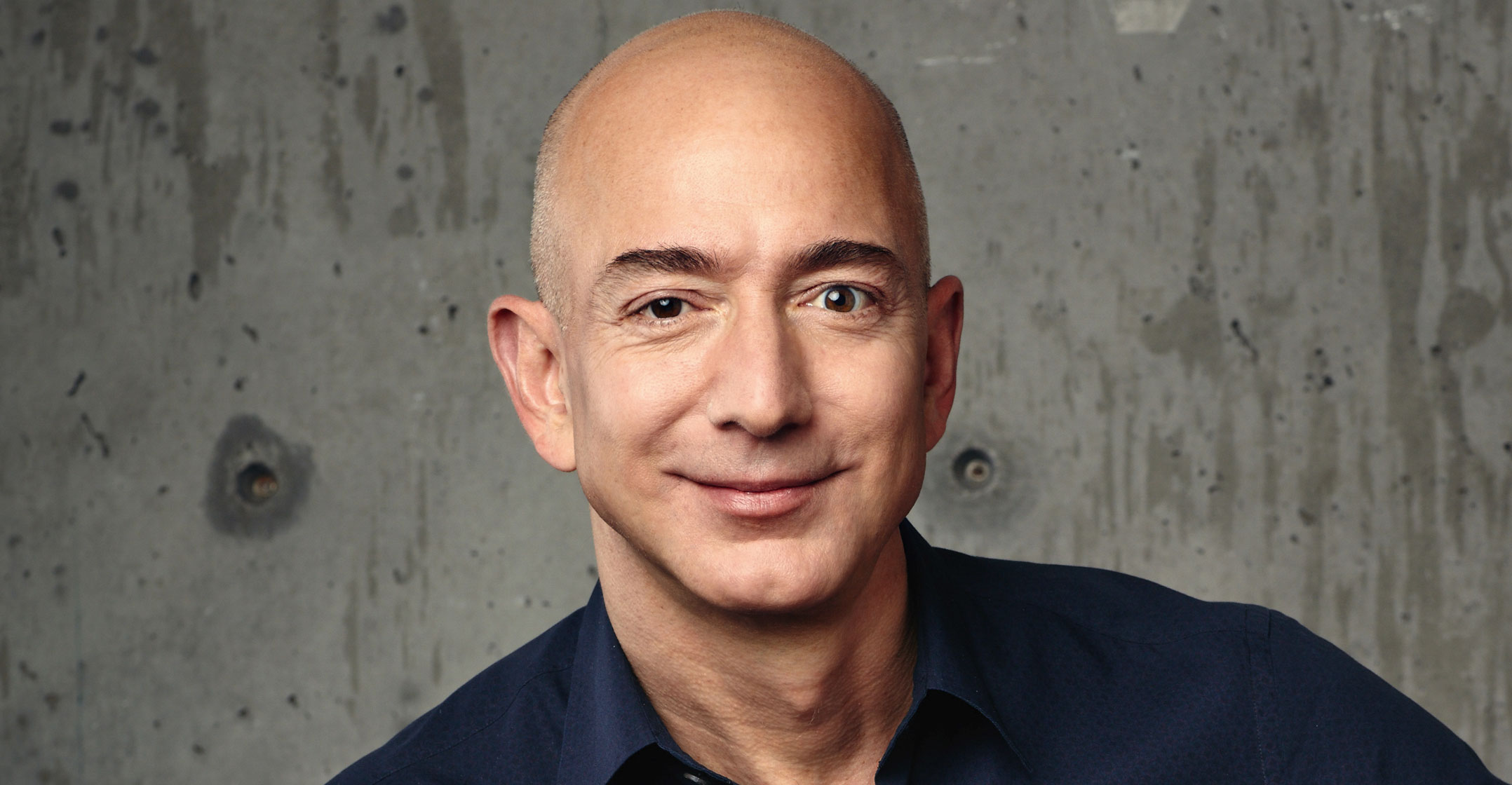

The explanation from Amazon CEO Jeff Bezos has long been that people who use the Prime Internet video service tend to stick with the shopping club, and become paying members after free trial offers, at a higher rate than people who don’t watch Amazon Internet video.

The video options, in short, are part of Amazon’s much-lauded “flywheel” for Prime. The trite phrase refers to the cycle in which people consider Prime a good value and therefore shop more on Amazon, which makes the company’s shopping mall more expansive and efficient, which makes more people sign up for Prime. Amazon has said video is an important element of this flywheel. As Bezos quipped in an interview last year: “When we win a Golden Globe, it helps us sell more shoes.”

Lately it seems as if Amazon is simply being trod into the dirt. Numerous articles have discussed Amazon hitting the reset button on its strategy for the original movies and TV shows it commissions for Prime members. The number of viewers has been too small for Bezos’s liking, and he has ordered his troops to make fewer gloomy dramas and more buzz-generating shows like HBO’s Game of Thrones.

$4bn spend

Even the US television programming with the biggest mass-market appeal, National Football League games, has so far drawn only a few hundred thousand people to Amazon’s streaming of Thursday night games. The entertainment industry awards that Bezos likes to brag about are getting harder to come by, and the costs are mushrooming. Wedbush Securities has figured Amazon will spend roughly US$4bn this year on TV series and movies, up from more than $1bn in 2014.

Television networks and Hollywood movie studios shake up their strategies often, so Amazon is in familiar company. The more worrying sign is that Amazon doesn’t seem to have a coherent strategy for what programming it should be serving up.

Roy Price, the executive who shepherds Amazon’s exclusive entertainment programmes, said earlier this year that the company didn’t necessarily harness viewership information to decide what series or movies to commission. “You can look at what people watch, but you can’t be too deterministic about that,” he said in April. A recent Wall Street Journal article about Amazon’s entertainment headaches included this brutal assessment from a company executive: “We were supposed to bring the best practices of one of the most successful companies in America to Hollywood. Instead, we’re getting chewed up.”

It sure sounds as if Amazon’s approach to TV series and movies is quite similar to the hit-or-miss tactics of a Hollywood mogul, and it’s not working. And if Amazon isn’t being analytically rigorous about selecting which programming to splurge on, why should investors trust that the company is being rigorous about the causal relationship between usage of Amazon’s Internet video service and loyalty to Prime?

The business validity of Amazon’s Internet video ambitions is more crucial now because the company is expanding on multiple fronts. It has a growing physical footprint, in part thanks to its acquisition of the Whole Foods supermarket chain. It sells an array of consumer electronics. It is adding package shipping centres and merchandise warehouses rapidly and branching out internationally.

Analysts keep being surprised at the size of these investments, which have crimped the company’s already skinny profit margins. Still, Amazon has been rewarded for its ambitions because the Prime shopping club has changed retailing and made a mint for the company. Fees from Prime and other subscription options amounted to $6.4bn last year, more than double the 2014 figure. And analysts think Prime members tend to spend more on Amazon.

But we only have Amazon’s say-so that its spending on Internet video is fuelling the Prime flywheel. To go back to Bezos’s quip, it’s time for Amazon to prove the link between winning Golden Globe awards and ringing up sales of shoes. — Reported by Shira Ovide, (c) 2017 Bloomberg LP