Apple has a tried and true approach to launching new products: The company designs in-house, sources its own components, and works with a contract manufacturer to assemble it for sale.

Apple has a tried and true approach to launching new products: The company designs in-house, sources its own components, and works with a contract manufacturer to assemble it for sale.

As the tech giant plots a foray into the car market, it could adopt a similar strategy — working with a lesser known contract manufacturer — after talks with some brand name automakers stalled.

To build a vehicle, Apple has three primary options: partner with an existing car maker; build its own manufacturing facilities; or team up with a contract manufacturer such as Foxconn or Magna International.

The Cupertino, California-based company has reached out to automakers including Hyundai, but the discussions have not gone well. In this scenario, Apple would develop an autonomous system for the vehicle, the interior and external design, and on-board technology, while leaving the final production to the car maker. Such a deal would essentially ask an existing car company to shed its brand and become a contract assembler for a new rival.

A longtime manager at both Apple and Tesla said this would be like Apple asking bitter smartphone rival Samsung Electronics to manufacture the iPhone. Apple wants to challenge the assumptions of how a car works — how the seats are made, how the body looks, the person said. A traditional automaker would be reluctant to help such a potentially disruptive competitor, said the person, who asked not to be identified discussing private matters.

Fizzled

Indeed, discussions between Apple and the car industry seem to have fizzled in recent months. Hyundai and Kia Motors confirmed talks on the development of an electric car, but backtracked soon after. Apple’s self-driving car team met with representatives from Ferrari last year. It’s unclear what was discussed, but the talks didn’t advance, according to a person familiar with the meeting.

In February, Nissan said it wasn’t in talks with Apple. Volkswagen CEO Herbert Diess said he’s “not scared” of Apple’s entry into the industry. BMW’s CFO recently said he sleeps peacefully.

For its computers, phones and tablets, Apple relies on contract manufacturers such as Foxconn, Pegatron, Wistron, Flex and Luxshare. The iPhone maker has avoided building its own factories, an effort that would cost billions of dollars in construction, worker pay and training, along with new liabilities and complex deals with local governments.

Factories are generally low-margin businesses. Apple leaves that to partners, while focusing on product design and development. The company’s profit margins dwarf those of suppliers such as Foxconn and Pegatron.

Tesla, the most successful electric car maker to date, has lost billions of dollars running its own factories and only recently began generating regular income. Last year, the company reported a profit of almost US$700-million. Apple made more than $60-billion in the same period.

Auto industry “profit margins are lower than Apple’s current model”, Goldman Sachs analysts wrote in a recent note to investors. Some luxury brands, such as Ferrari, are more profitable, but those are “edge cases and potentially difficult to replicate at higher volumes”, the analysts added.

Apple is more likely to go with a contract manufacturer because that’s the business model they’re used to, said Eric Noble, president of consulting firm the CarLab. He thinks a partnership with an existing car maker would be a power struggle because both companies are used to tightly controlling their supply chains.

This is why Foxconn and Magna are two primary contenders for Apple’s business, according to industry insiders.

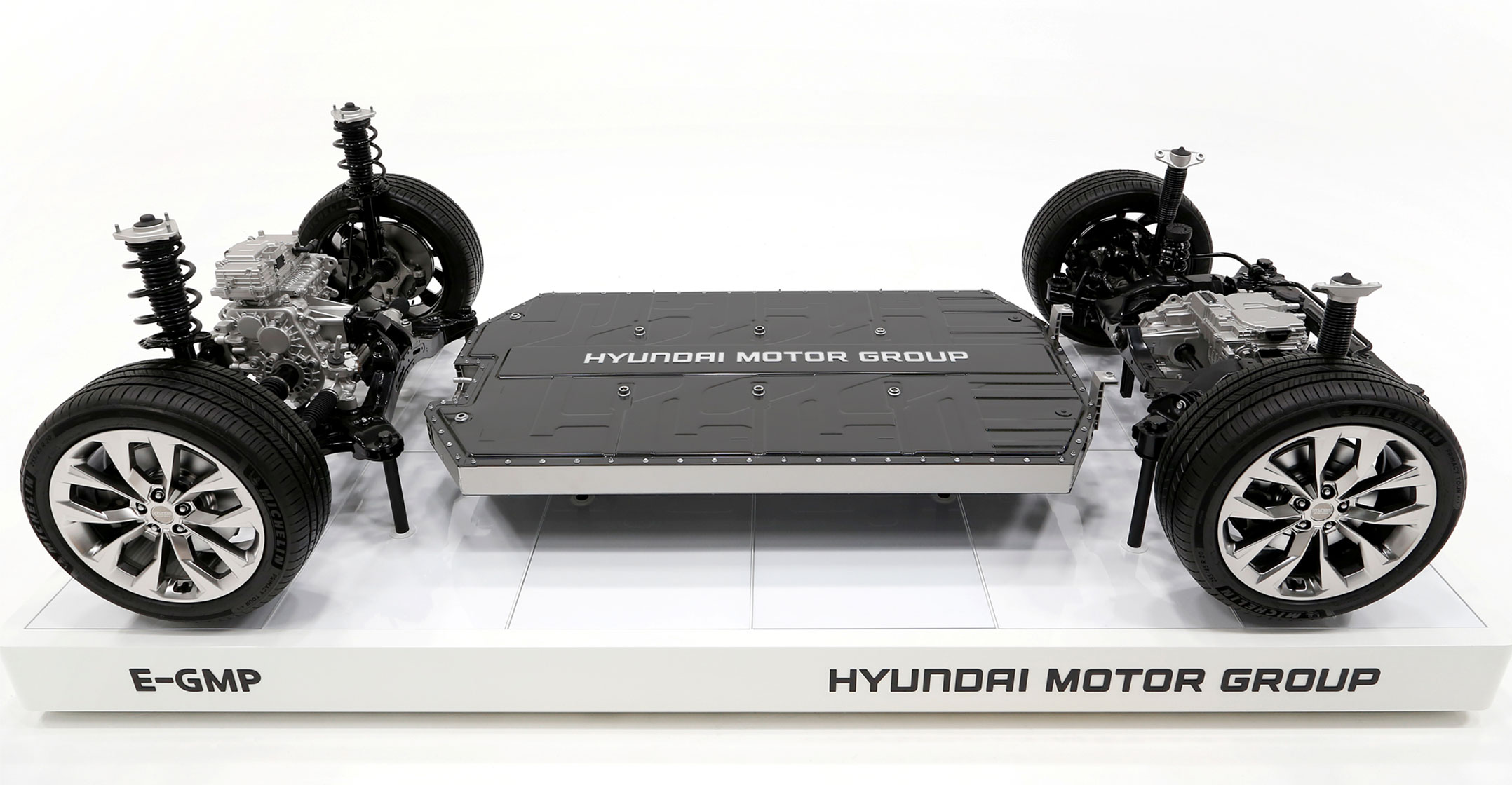

Foxconn, also known as Hon Hai Precision Industry, has an existing relationship with Apple as the main assembler of iPhones. And the Taiwanese company is already branching out into the car business. In October, it introduced an electric vehicle chassis and a software platform to help car makers bring models to market faster. Last month, it unveiled a deal to assemble more than 250 000 EVs a year for the start-up Fisker.

History with Apple

An Apple employee involved in manufacturing said Foxconn is used to having Apple engineers tell it what to do and that the company’s factories are already filled with Apple-designed equipment. The person asked not to be identified discussing sensitive matters.

Magna has some history with Apple, too. The two were in talks to build Apple’s car when the iPhone maker first set out on this path about five years ago. Magna is also a lot more experienced at making cars. It assembles luxury models for companies including BMW, Daimler and Jaguar Land Rover.

The CEO of a well-known self-driving car company was surprised to see Apple talking to existing car makers when an option like Magna exists.

Magna is the most logical choice, said Noble, who has worked with the Canadian auto supplier on projects in the past and calls the company “amazingly good” at what they do.

For its part, Apple appears to be designing its car with production in mind. The company recently posted a job listing seeking a “senior hands on manufacturing engineer” for its special projects group, the team leading its work on a car. The candidate will be responsible for growing a team of engineers focused on manufacturing strategy and the supply chain. The person is also required to have experience working with aluminium, steel and composites, key materials in cars. — Reported by Mark Gurman and Gabrielle Coppola, (c) 2021 Bloomberg LP