Ethiopia’s telecommunications regulator said on Tuesday it had invited a request for proposals for a second national telecoms licence.

Author: Agency Staff

TikTok hit a billion monthly active users globally this past southern hemisphere winter, the company said, marking a 45% jump since July 2020.

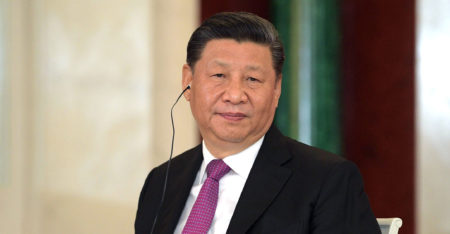

President Xi Jinping handed down orders for handling the case of Huawei Technologies executive Meng Wanzhou, China said.

Google criticised EU antitrust regulators for ignoring rival Apple as it launched a bid to get Europe’s second highest court to annul a record €4.3-billion fine.

For years, Facebook shares have been a must-own. But investors should be starting to worry.

The cryptocurrency market made a swift comeback from the turbulence last week triggered by China’s latest crackdown volley.

Cryptocurrency exchanges and providers of crypto services are scrambling to sever business ties with mainland Chinese clients.

China’s multiyear crackdown on the crypto industry may have reached its apex on Friday, cementing a shift in the balance of power away from one of the countries that first embraced the digital currency world.

China intensified a crackdown on cryptocurrency trading on Friday, vowing to root out “illegal” activity and banning crypto mining nationwide.

Huawei chief financial officer Meng Wanzhou has reached an agreement with US prosecutors to resolve the bank fraud case against her, sources said.