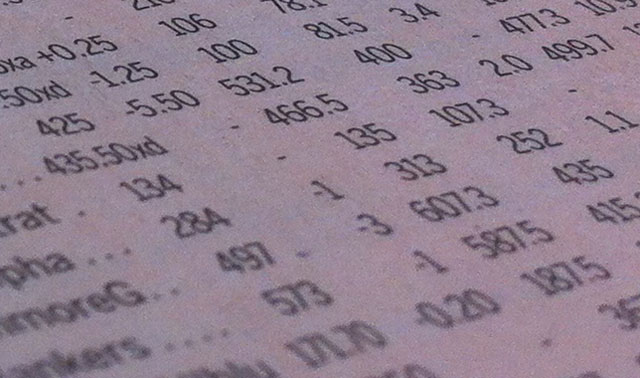

JSE-listed technology services group Business Connexion (BCX), currently the subject of a takeover by Telkom, has reported normalised headline earnings per share of 39,8c for the year ended 31 August 2014, down from 45,1c in the 2013 financial year.

Normalised gross margins fell only slightly, from 29,6% to 29% — despite difficult economic conditions and a highly competitive market – while operating profit margin slipped from 5,2% to 4,9%.

Revenue climbed by 5,5% to R6,5bn thanks to new client wins. Organic revenue growth, or growth stripping out the effect of mergers and acquisitions, was 7,2%.

Earnings before interest, tax, depreciation and amortisation climbed by 17,8% to R660m, while operating profit was 30,4% higher at R421m. The group ended the year with R223m in cash on its balance sheet, from R197m before.

BCX declared a normal dividend of 20c/share, the same as in 2013. A special gross cash dividend of 20c/share was declared on 7 August.

The group is still awaiting the approval of a number of regulatory agencies for its acquisition by Telkom.

In August, BCX shareholders voted overwhelmingly in favour of a R2,7bn all-cash offer from Telkom, paving the way for the review by competition and telecommunications regulators.

It said on Tuesday that the proposed transaction is still awaiting approval from the Competition Commission, the Common Market for Eastern and Southern Africa Commission and the Independent Communications Authority of South Africa.

“Upon receipt of the above approvals, final approval will be sought from the Takeover Regulations Panel and the Johannesburg Stock Exchange,” BCX said.

Unconditional approvals have already been obtained from the Namibian Competition Commission, the Tanzania Fair Competition Commission and the Competition Authority in Botswana. — © 2014 NewsCentral Media