This is the end, people. Bitcoin is dead. Crypto is going to be cancelled by China, and the regulators and crypto investors are finally going to be proven wrong … again.

This is the end, people. Bitcoin is dead. Crypto is going to be cancelled by China, and the regulators and crypto investors are finally going to be proven wrong … again.

If you’ve lost count of how many times the media has assured us that crypto is about to go the way of cassette tapes and laser disc, you’re not alone. Popular opinion still seems to be that crypto is perpetually teetering on the edge of the abyss and that it takes just a few consecutive days of bitcoin price drops to spell the end. It’s a narrative that is great at keeping teary eyes on news sites, but it amounts to a myopic perspective that a savvy investor should steer well clear of.

To make it easier to avoid boarding the train to panic town every time it stops at your station, let’s discuss some information that is objectively more deserving of your attention than the opinion of totallylegitcryptonews.com’s latest intern. You’ll find that the numbers tell a far more exciting story about the near-term future of bitcoin — and crypto in general.

Cycles, not crashes

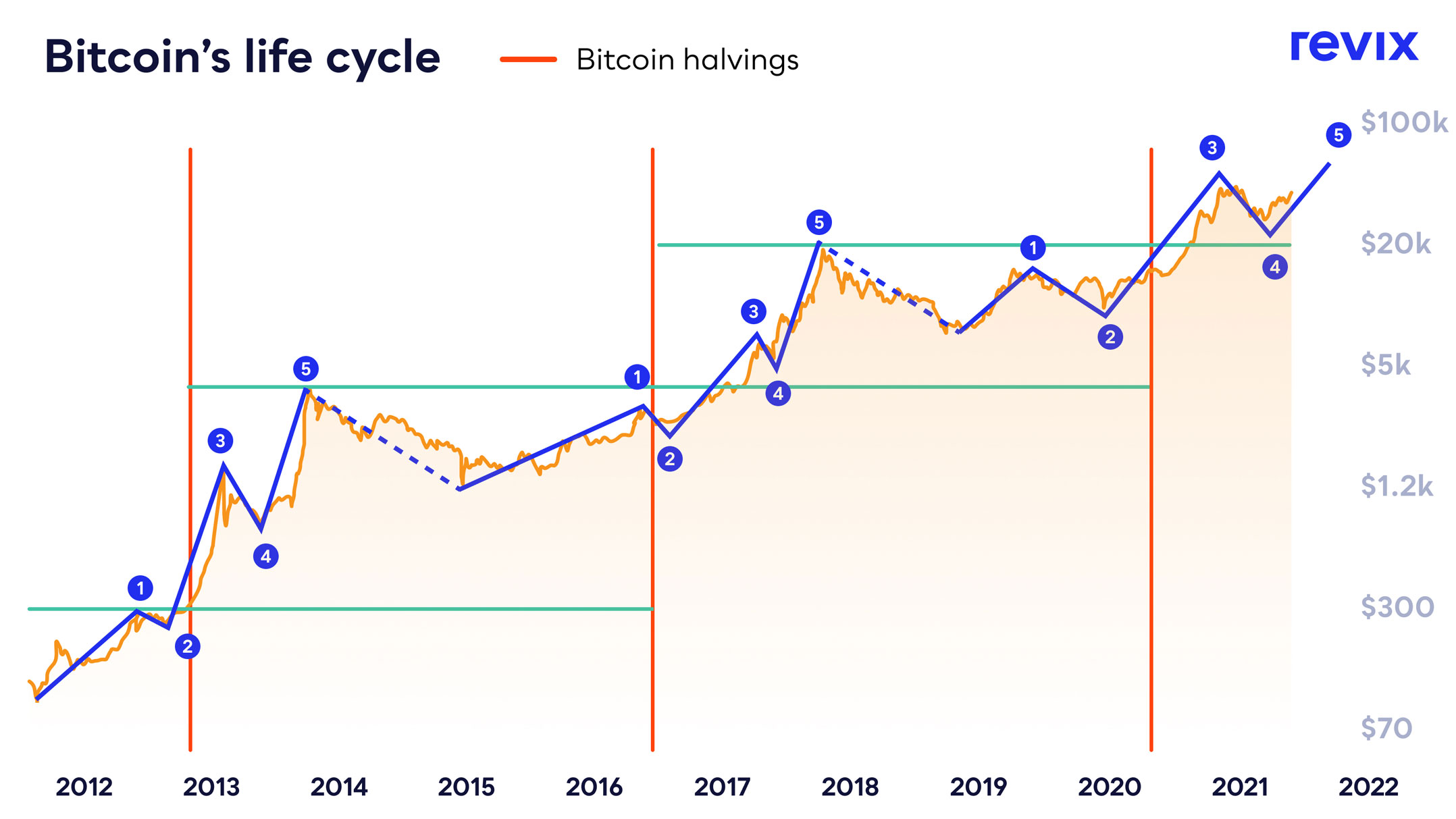

Take a look at the graph above, which plots the bitcoin price over time since 2012. You don’t need to be a financial analyst to notice a pattern here, right? Patterns like this are an almost universal phenomenon among publicly traded assets. You’ll see price patterns emerge in price charts of everything from the world’s most valuable stocks to the most commonplace commodities. Finance nerds refer to these patterns as cycles, and when you start to become aware that bitcoin’s price goes through cycles, too, you’ll immediately begin to realise how misplaced the rabid fearmongering is when prices take a dip.

Take a look at the graph above, which plots the bitcoin price over time since 2012. You don’t need to be a financial analyst to notice a pattern here, right? Patterns like this are an almost universal phenomenon among publicly traded assets. You’ll see price patterns emerge in price charts of everything from the world’s most valuable stocks to the most commonplace commodities. Finance nerds refer to these patterns as cycles, and when you start to become aware that bitcoin’s price goes through cycles, too, you’ll immediately begin to realise how misplaced the rabid fearmongering is when prices take a dip.

As we can see in the graph, there is way more evidence to suggest that bitcoin is roughly halfway through its fourth price cycle than there is to support the idea that it is crashing. Does this mean there is no chance of bitcoin dropping out of the bottom of its pattern and taking a dive? No. But it does put panic-driven narratives in context.

Supply vs demand is still a thing in crypto

One of the reasons why bitcoin is considered by many to be digital gold is the fact that there is a finite supply of it. What’s more, many bitcoin owners would part with their first-born child before they considered parting with their bitcoin. The result is that that a large portion of the mined bitcoin is effectively not for sale.

One of the reasons why bitcoin is considered by many to be digital gold is the fact that there is a finite supply of it. What’s more, many bitcoin owners would part with their first-born child before they considered parting with their bitcoin. The result is that that a large portion of the mined bitcoin is effectively not for sale.

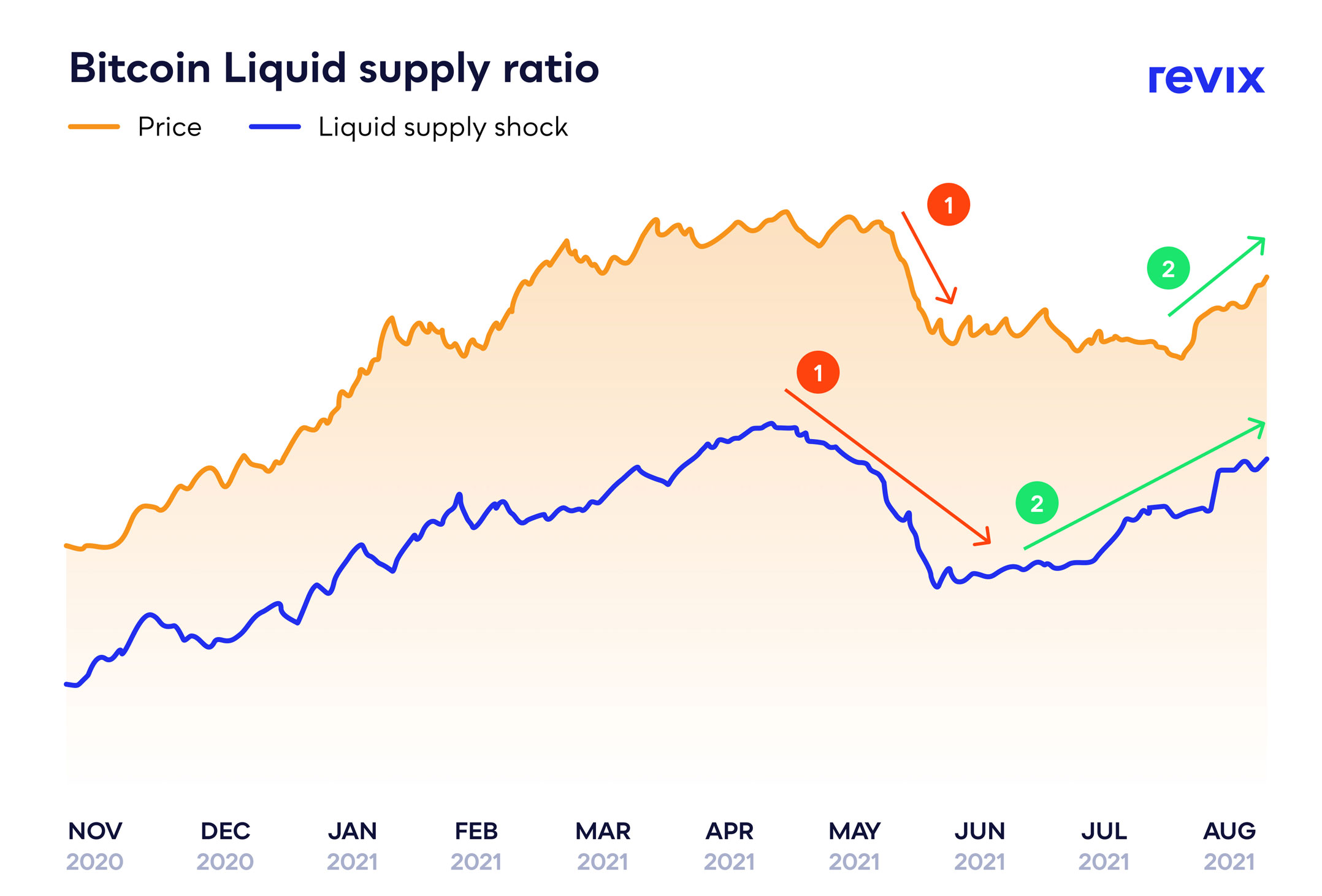

The graph above plots the bitcoin liquid supply shock (LSS) ratio against the bitcoin price. The LSS ratio measures the number of bitcoin stashed under digital mattresses vs the number of bitcoin actually in circulation — being bought and sold on exchanges, and so on. At first glance, it looks like the LSS ratio and the bitcoin price keep pace with each other. But pop in your monocle (standard issue for any self-respecting investor), and you’ll notice that the LSS ratio actually leads the bitcoin price.

This means that the LSS ratio is a darn fine indicator of investor intent. If long-term bitcoin investors are moving their troves of coins to an exchange, those coins will be reclassified as liquid, and the LSS ratio will change, along with the supply of available bitcoin. If those same investors are hanging on to their coins, it makes sense to assume they’re expecting the price to increase.

With your newfound knowledge of what the LSS ratio usually means for the bitcoin price, take a look at the tail end of this graph and ask yourself if the numbers suggest the impending death of Bitcoin or a somewhat rosier future.

Whale watching

Whales are people who hold more than a thousand bitcoins. Given how directly their actions have been shown to predict bitcoin price movements in the past, it’s certainly worth examining another way of understanding their take on where the price is going. The graph above shows that, overall, whales sell when the bitcoin price increases.

Whales are people who hold more than a thousand bitcoins. Given how directly their actions have been shown to predict bitcoin price movements in the past, it’s certainly worth examining another way of understanding their take on where the price is going. The graph above shows that, overall, whales sell when the bitcoin price increases.

Whales didn’t become whales by letting opportunities pass them by, though. The graph also shows (highlighted with the circles and arrows) that when whales foresee a period of upward price action approaching, they buy. Judging by this graph, bitcoin whales are looking mighty hungry.

Safety first

So, contrary to what crypto journalists running naked through the streets with burning bitcoin posters might be trying to tell you, it’s looking like a fantastic time to get in on bitcoin. Whether it’s your first-ever crypto purchase or you’re one of those aforementioned hungry whales, Revix should be your first port of call.

Revix, a Cape Town-based crypto investment platform, makes buying cryptocurrencies absurdly simple. You can buy bitcoin, ethereum, polkadot, uniswap, solana and many more.

Revix also offers crypto bundles. These crypto bundles allow you to effortlessly own an equally weighted basket of the world’s largest and, by default, most successful cryptocurrencies — without having to build and manage a crypto portfolio yourself. They’re like the JSE Top40 or S&P 500 but for crypto. There’s a bundle that includes the top 10 cryptocurrencies by market cap, and others themed around the most exciting advancements in the crypto space, like payments and smart contracts.

Crypto is still a scary space for many investors, which is why Revix has taken a massive step towards redefining what users should expect from crypto platforms. Revix has partnered with Mazars, a leading global audit, tax and accounting partner, to obtain an independent, verified audit in order to prove that its investors’ funds are properly held. So, if simplicity and safety are what you’re looking for in your crypto platform, it’s high time you give Revix a shot.

About Revix

Revix brings simplicity, trust and great customer service when investing in cryptocurrencies. Its easy-to-use online platform enables anyone to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.

To learn more, visit www.revix.com.

- This promoted content was paid for by the party concerned