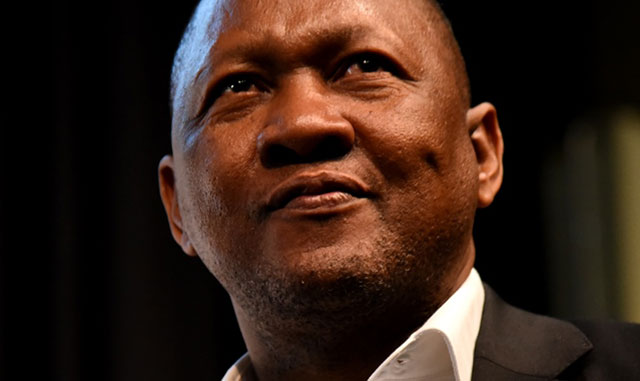

Convergence Partners, the investment management firm controlled by Dimension Data Middle East and Africa chairman Andile Ngcaba, has raised US$145m (about R1,5bn) in the “first close” of a new sub-Saharan Africa-focused communications infrastructure fund.

The fund, which has a targeted final close of $250m, will now begin investing in information and communications technology (ICT) projects and businesses across the region, with regional hubs being established in Southern Africa, East Africa and West Africa.

The fund will invest across the region, with no single country or region expected to dominate in terms of capital allocation. If will deploy capital on both a regional and country-specific basis.

Convergence Partners is already invested in a number of technology infrastructure businesses, including fibre telecommunications company FibreCo and undersea cable operator Seacom. In total, it has made 18 investments to date.

Ngcaba tells TechCentral in an interview that there is an urgent need for more investment in wireless and fixed ICT infrastructure on the continent.

The new fund, which enjoys financial backing from the International Finance Corporation, the European Investment Bank, the Dutch Development Bank, the Development Bank of Southern Africa and the CDC Group, will look specifically to invest in companies and projects building networks on an open-access basis.

Ncgaba says the horizontal open-access model — as opposed to the vertically integrated approach favoured by the incumbent operators of owning the entire network and providing retail services over it — will become the de facto one for telecoms in Africa over time.

“You don’t have to invest in huge computing infrastructure yourself any more. You can buy processing and storage in a utility model, and the same thing is happening in telco infrastructure,” Ngcaba says. “Because of this change, there is going to be a need for infrastructure players who would then provide infrastructure to different operators or to the layers of operators.”

Convergence Partners CEO Brandon Doyle says the company has already identified plenty of investment opportunities for the new fund. “If we invested in just 50% of the pipeline we are looking at, we will use the entire first round of the fund.”

The plan is to invest one-third of the money in early stage businesses or in greenfield developments. A further third of the fund will be invested in buying infrastructure from operators and changing the business model to one based on open access serving multiple companies instead of only one operator. The rest of the fund will be used for acquisitions.

While the first close involved raising funds from development finance institutions, Doyle says the focus of the second round is on sovereign wealth funds, commercial institutions and high-net-worth families.

He believes those sorts of investors will be more keen to come on board now that the development finance institutions have invested. Those institutions conduct detailed due diligence, and so their involvement is often regarded by other investors as a seal of approval, says Doyle. — (c) 2013 NewsCentral Media