It’s been 10 years since Apple unleashed a surge of innovation that upended the mobile phone industry. Electric cars, with a little help from ride-hailing and self-driving technology, could be about to pull the same trick on Big Oil.

The rise of Tesla and its rivals could be turbo charged by complementary services from Uber Technologies and Alphabet’s Waymo unit, just as the iPhone rode the app economy and fast mobile Internet to decimate mobile phone giants like Nokia.

The culmination of these technologies — autonomous electric cars available on demand — could transform how people travel and confound predictions that battery-powered vehicles will have a limited impact on oil demand in the coming decades.

“Electric cars on their own may not add up to much,” David Eyton, head of technology at London-based oil giant BP, said in an interview. “But when you add in car sharing, ride pooling, the numbers can get significantly greater.”

Most forecasters see the shift away from oil in transport as an incremental process guided by slow improvements in the cost and capacity of batteries and progressive tightening of emissions standards. But big economic shifts are rarely that straightforward, said Tim Harford, the economist behind a book and BBC radio series on historic innovations that disrupted the economy.

“These things are a lot more complicated,” he said. Rather than electric motors gradually replacing internal combustion engines within the existing model, there’s probably going to be “some degree of systemic change”.

iPhone lessons

That’s what happened 10 years ago. The iPhone didn’t just offer people a new way to make phone calls; it created an entirely new economy for multibillion-dollar companies like Angry Birds maker Rovio Entertainment or WhatsApp. The fundamental nature of the mobile phone business changed and incumbents like Nokia and BlackBerry were replaced by Apple and makers of Android handsets like Samsung Electronics.

Today, as Elon Musk’s Tesla and established automakers like General Motors are striving to make their electric cars desirable consumer products, companies such as Uber and Lyft are turning transport into an on-demand service and Waymo is testing fully autonomous vehicles on the streets of California and Arizona.

Combine all three, for example through an Alphabet investment in Lyft, and you have a new model of transport as a service that would be a cheap compelling alternative to traditional car ownership, according to RethinkX, a think tank that analyses technology-driven disruption.

One key advantage of electric cars is the lack of mechanical complexity, which makes them more suitable for the heavy use allowed by driverless technology, Francesco Starace, CEO of Enel, Italy’s largest utility, said in an interview.

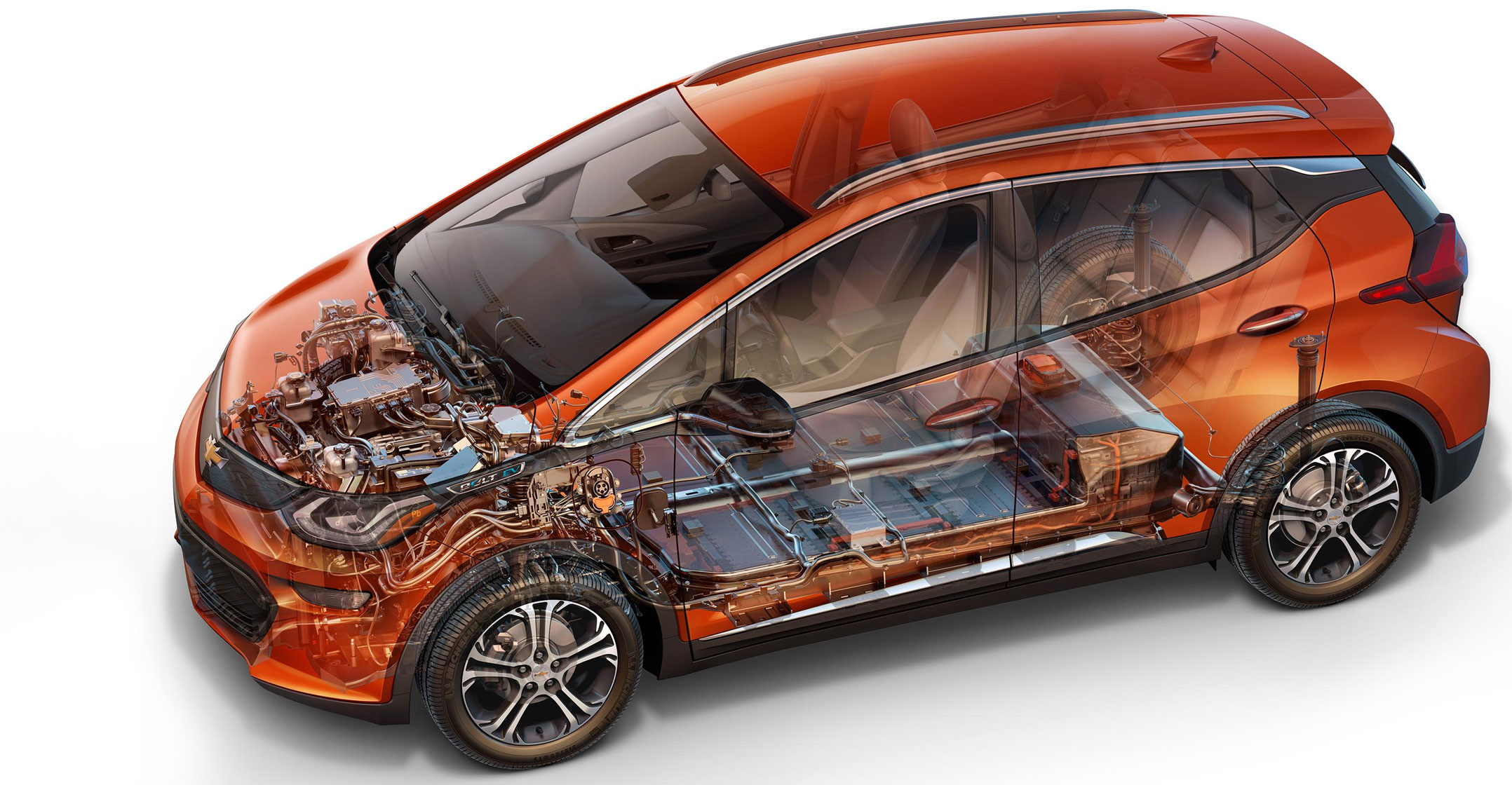

After disassembling General Motors’ Chevrolet Bolt, UBS Group concluded it required almost no maintenance, with the electric motor having just three moving parts compared with 133 in a four-cylinder internal combustion engine.

“Competitiveness very much depends on the utilisation of the car,” Laszlo Varro, chief economist at the International Energy Agency, said in an interview. The average Uber vehicle covers a third more distance than the typical middle-class family car in Europe, amplifying the benefit of lower running costs to the point that “the oil price at which it makes sense to switch to electric is US$30/barrel lower,” he said.

The total cost of ownership of electric and oil-fuelled vehicles will reach parity in 2020 for shared-mobility fleets, five years earlier than for individually-owned vehicles, according to Bloomberg New Energy Finance.

Already in London, Uber plans for its UberX service to be hybrid or fully electric by the end of 2019. Its rival Lyft aims to provide at least a billion rides a year in autonomous electric vehicles by 2025, saying they can be used much more efficiently than petrol-powered cars.

This combination would be “the Uber model on steroids”, Steven Martin, chief digital officer and vice president of General Electric’s Energy Connections unit, said in an interview. “Once you have complete autonomous operation of a vehicle, then my desire to own one is going to go down and I’ll be more willing to sign up to a subscription service.”

The transition to fully autonomous fleets may not match the speed of the smartphone revolution because of the many regulatory, legal, ethical and behavioural hurdles. Self-driving technology should become available in the 2020s, but won’t be widely adopted until 2030, BNEF says.

Oil demand

Even so, the shift to electric cars could displace about eight million barrels a day of oil demand by 2040, more than the seven million barrels a day Saudi Arabia exports today, the London-based researcher says. That could have a significant impact on oil prices — a drop of 1.7m barrels a day in global consumption during the 2008-2009 financial crisis caused prices to slump from $146 a barrel to $36.

That doesn’t mean oil giants such as BP and Exxon Mobil are heading for an inevitable Nokia-style downfall. While transport fuels account for the majority of their sales, they also have huge businesses turning crude into chemicals used for everything from plastics to fertiliser. They also pump large volumes of natural gas and generate renewable energy, both of which could benefit from increased electricity demand.

Even if electric vehicles do grow as rapidly as BNEF forecasts, the world currently consumes 95m barrels a day and other sources of demand will keep growing, said Spencer Dale, BP’s chief economist. The London-based energy giant expects battery-powered cars to reduce oil demand by just a million barrels a day by 2035, while also acknowledging the potential for a much larger impact if the industry has an iPhone moment.

The sheer breadth of the potential disruption makes it hard to predict what will happen. When Steve Jobs unveiled the iPhone, few people anticipated that it meant trouble for makers of everything from cameras to chewing gum.

“The smartphone and its apps made new business models possible,” said Tony Seba, a Stanford University economist and one of the founders of RethinkX. “The mix of sharing, electric and driverless cars could disrupt everything from parking to insurance, oil demand and retail.” — Reported by Jessica Shankleman and Hayley Warren, (c) 2017 Bloomberg LP