Facebook and its partners said their libra cryptocurrency project will now support multiple versions of the digital coins, the majority of which will be backed by individual fiat currencies like the US dollar, as part of changes made to appease sceptical regulators worldwide.

Facebook and its partners said their libra cryptocurrency project will now support multiple versions of the digital coins, the majority of which will be backed by individual fiat currencies like the US dollar, as part of changes made to appease sceptical regulators worldwide.

The Libra Association, the governing body overseeing the proposed project, redesigned the currency and made other changes responding to financial regulators concerned the effort could undermine the power and control of central banks. The group said on Thursday it plans to support multiple libra stablecoins, with each working like a digital version of a country’s existing currency.

The organisation has also begun talks with Swiss regulators for a payments licence, and hopes to register with FinCEN, the US Financial Crimes Enforcement Network, as a “money services business”, according to Dante Disparte, head of policy for the Libra Association. “We’re working toward a late 2020 readiness timeline” to launch the libra network, Disparte added.

When Facebook unveiled libra 10 months ago, it intended to create a single global currency that would be pegged to a basket that included fiat currencies, like the US dollar and euro, and securities like treasuries. That plan faced criticism from politicians and regulators worried that libra could usurp some power from central banks, who use money creation as a tool to influence and protect markets, or be used for black-market purposes, like money laundering.

After months of discussions, the Libra Association has backpedalled on those initial plans, though it still hopes to create a version of the libra currency made up of “a digital composite of some of the single-currency stablecoins”, the organisation wrote in a white paper published on Thursday. Facebook has said it won’t launch libra without regulatory approval, but it’s unclear whether the changes will appease critics and financial officials.

‘Will vary’

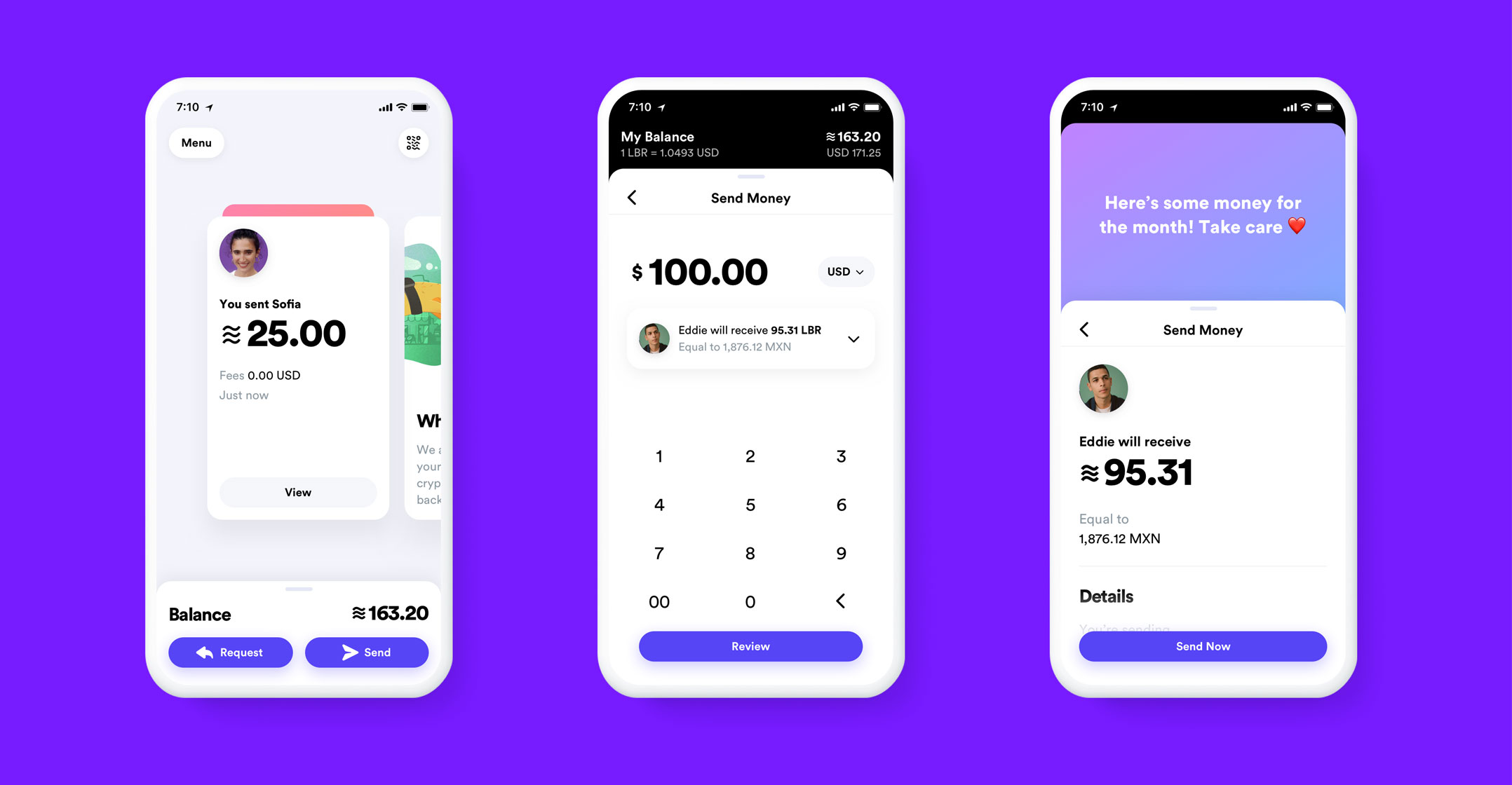

“Which currency will be adopted and used will vary by use cases,” said Christian Catalini, head economist for Facebook’s Calibra division, which created the project. He suggested that when sending money across borders, the multicurrency libra could be a better option, whereas the single-currency stablecoins would make more sense for everyday purchases in a consumer’s home country.

The restructuring could help libra with regulation. The original plan led some to characterise libra as a security, a designation that brings much greater regulatory oversight. Some central banks also worried that a popular coin backed by a basket of currencies would undermine their ability to manage fluctuations of their home currency, a concern the Libra Association acknowledged in its white paper.

The changes could also potentially clear the way for more companies to join the association as members, perhaps lowering the risk of backlash from regulators. Many of the original high-profile participants left the organisation before it signed a charter, including Visa, Mastercard and PayPal. South Africa’s Naspers remains a backer.

Included in the association’s update was a change in plans for its libra blockchain. Last year, the group said it planned to eventually let anybody participate in running its network — not just members — the way anyone can participate in the bitcoin network. Now libra is backpedalling to say that anyone who wants to verify transactions on the network will need to gain certain approvals. The exact approvals process is still being worked out.

Included in the association’s update was a change in plans for its libra blockchain. Last year, the group said it planned to eventually let anybody participate in running its network — not just members — the way anyone can participate in the bitcoin network. Now libra is backpedalling to say that anyone who wants to verify transactions on the network will need to gain certain approvals. The exact approvals process is still being worked out.

The Libra Association, which was officially formed in October, is still taking shape, Disparte said. The group has added two new members since concluding its charter, including Shopify, which provides e-commerce tools, and now has 22 in total. It also hopes to hire a CEO by the end of the second quarter.

Member companies have contributed financially to pay for the association’s operations, Disparte said, adding that Facebook, the largest member and the project’s founder, is providing less than 10% of this money. Still, that means it’s likely paying more than some of the association’s other 21 members. An association spokesperson declined to explain why. — Reported by Kurt Wagner and Olga Kharif, (c) 2020 Bloomberg LP