Facebook showed that its business can weather all kinds of regulatory scrutiny — as long as people keep flocking to Facebook.

The company seemed to be facing dire consequences as months of regulatory drama came to a head all at once this week. There was a US$5-billion US Federal Trade Commission settlement on privacy, and a separate $100-million accord with the Securities and Exchange Commission related to the same issue. The US department of justice announced a looming antitrust probe late on Tuesday, and then Facebook said on Wednesday afternoon that the FTC opened an official investigation into antitrust issues.

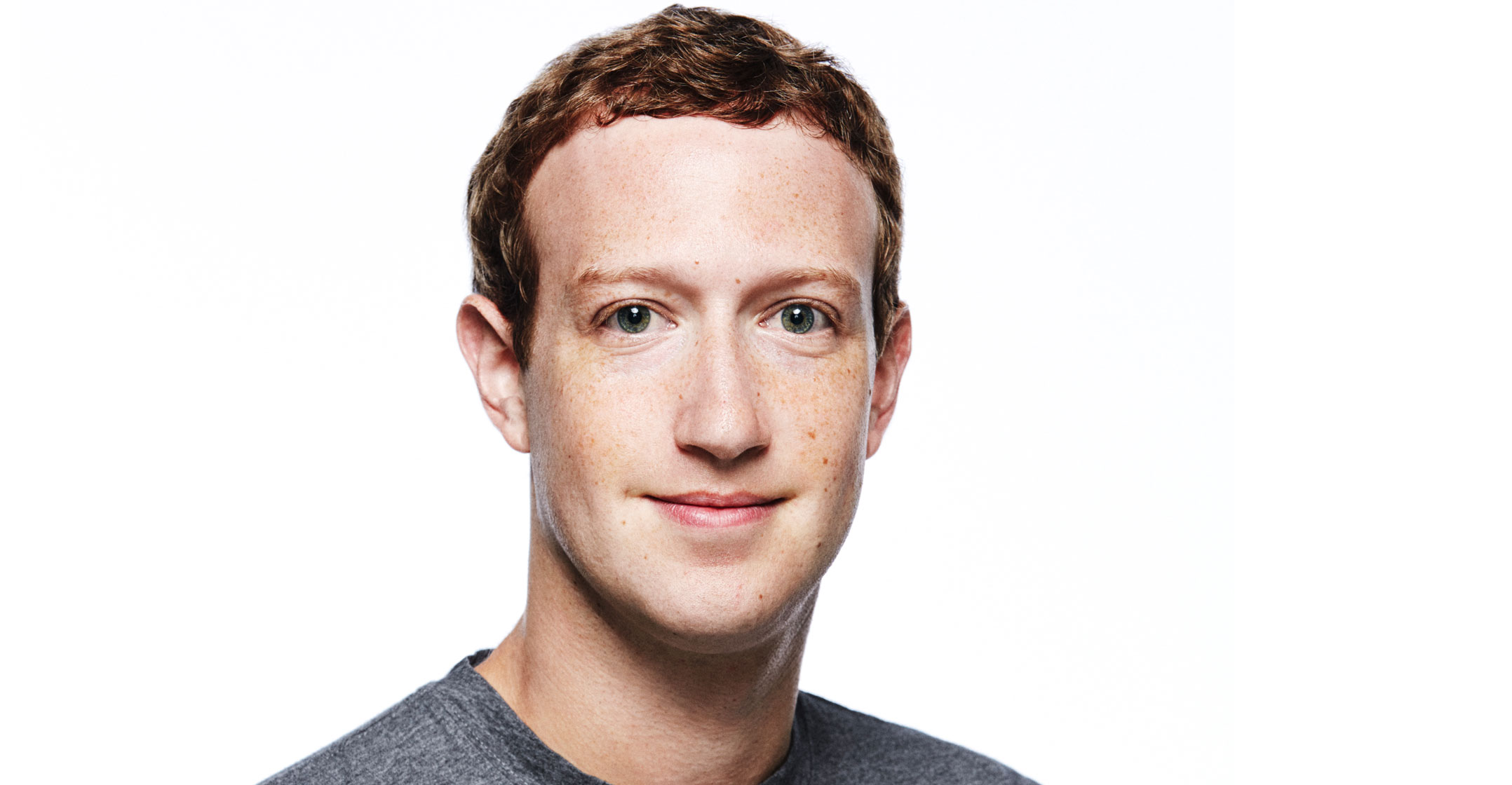

Many of these inquiries have been brewing for more than a year. But none of it has affected the company’s ability to reel in new users or advertisers. In the second quarter, Facebook topped analysts’ sales estimates and delivered solid user growth. In addressing the company’s results and the fresh FTC scrutiny, CEO Mark Zuckerberg said that he welcomed new rules from regulators, so that he has greater clarity about how to operate the world’s largest social-media company.

“If that doesn’t get put in place, then frustration with the industry will continue to grow,” he said on a conference call.

For more than a year, Facebook has been in constant crisis over leaks of users’ data, the spread of violent or false content on its apps, and scrutiny of its power to influence public discourse. That hasn’t deterred advertisers, who have kept spending on Facebook’s sites for the broad reach and precise targeting they offer. While growth at the main Facebook app has slowed, the company is still adding users quickly on other properties, and has embarked on a project to weave its platforms together, creating an even bigger network. A total of 2.7 billion people use at least one Facebook-owned app — Facebook, Instagram, WhatsApp or Messenger — every month.

“Despite horrific headlines for almost two years, usage trends remain strong,” said Benjamin Schachter, an analyst at Macquarie, in a note to investors. As long as the users are still coming, “we think advertisers will continue to show up”.

Sales rise 28%

Menlo Park, California-based Facebook said second quarter sales rose 28% to $16.9-billion, compared to an average analyst projection of $16.5-billion. In a statement on Wednesday, the company said 1.59 billion people log into the main social media service daily, compared to the 1.57 billion users projected in a Bloomberg survey.

The financial results came hours after the announcement of the record-breaking fine from the FTC — part of a deal that holds Zuckerberg personally accountable for following the new privacy guidelines. Facebook said it set aside $2-billion in the recent period to cover the remainder of that settlement, after allocating $3-billion in the previous quarter.

Both Facebook and the FTC worked to convince the public that the settlement would enact a fundamental shift in how the company operates. Facebook even released a video of Zuckerberg saying as much to employees. But the company will still be able to collect the same kinds of user data and target its promotions in the same way it does today.

Shares were little changed in extended trading late Wednesday, after fluctuating up and down following the report. The stock has gained 56% so far this year.

While the company’s growth hasn’t been throttled by regulatory changes or privacy restrictions yet, it’s possible new rules could slow future gains. The company said it expects revenue growth to decelerate, especially in the fourth quarter and into 2020.

On the call Wednesday, chief financial officer David Wehner gave three reasons for the expected slowdown in sales growth. First, there may yet be more pressure from new global regulations, such as Europe’s new rules governing data collection. Second, there may be changes to privacy rules governed by Apple’s iOS and Google’s Android mobile operating systems, where Facebook offers its app. Recently, Apple banned one of Facebook’s data-gathering apps. And third, Facebook is making its own privacy tweaks, Wehner said, which could rein in growth. For example, Facebook is expected to release a “Clear History” feature later this year, which could hamper ad targeting if Facebook can’t link users’ browsing histories to their profiles.

Facebook’s user gains by region for the second quarter showed that the main app has almost fully tapped out growth in Europe and the US, the company’s most lucrative ad markets. It added the most users in Asia, where it makes an average of only $3.04/user, compared to $33.27 in the US and Canada.

The main social network and its News Feed ads still bring in most of the company’s revenue, but the Instagram photo-sharing app, which has ads in its photo feed and recently added e-commerce tools, is becoming a more significant part of the business. Facebook’s business models for Messenger and WhatsApp, each with more than a billion users, are less mature.

Payments

As the advertising business expands more slowly, Facebook is pushing into new areas, including payments and e-commerce. Zuckerberg said that now that Facebook users are linked to large networks of people and organisations, his next step is to help them find value in those connections. In some ways, Zuckerberg meant “value” literally — through selling items on Facebook Marketplace or while using Instagram’s new shopping tools.

The most talked-about and controversial of the company’s new ideas is a plan for a new global cryptocurrency, called libra, that it hopes will lower the cost of sending money internationally. After its unveiling in June, libra quickly drew ire from politicians and regulators, and executive David Marcus testified before multiple congressional committees last week in Washington to explain the company’s plans. Facebook is now promising to appease all regulators before launching the cryptocurrency, a process that could take some time.

Including the costs set aside for the settlements and a tax-related charge, Facebook said quarterly net income was $2.62-billion, or $0.91/share. Excluding the items, the company said profit was $1.99/share, exceeding the $1.88/share average analyst estimate. A year earlier, Facebook posted earnings of $5.11-billion, or $1.74/share, on sales of $13.2-billion. — Reported by Sarah Frier and Kurt Wagner, (c) 2019 Bloomberg LP