South Africa’s wealthiest individuals will bear the brunt of higher taxes introduced by finance minister Pravin Gordhan to plug a revenue shortfall as economic growth falters.

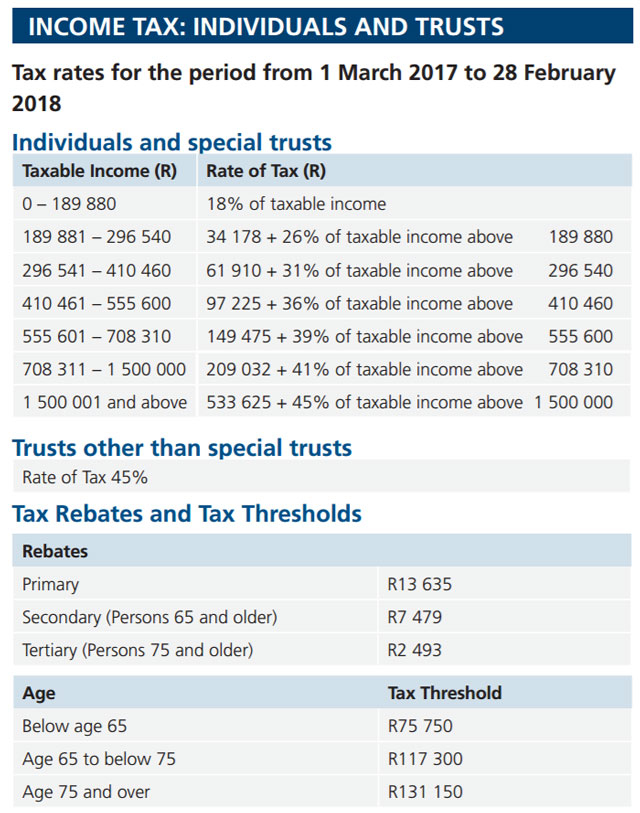

The top marginal income-tax rate for about 103 000 people earning more than R1,5m/year will be raised to 45% from 41%, Gordhan said in his annual budget, released in Cape Town on Wednesday (see table below). He also raised the dividend withholding tax rate to 20%, from 15%, and increased levies on fuel, alcohol and tobacco.

“Raising taxes when the economy is struggling is undesirable but unavoidable given the current fiscal circumstances,” the national treasury said in the annual budget review.

“Government is acutely aware of the difficult economic conditions facing the majority of South Africans, but deferring tax increases by accumulating more public debt would ultimately impose a greater burden on citizens.”

South Africa has struggled to gain traction since a 2009 recession, while political turmoil and policy uncertainty have deterred private investment.

Lower commodity prices and weak demand from Europe and Asia have also weighed on exports, while a drought curbed agricultural output.

Gordhan has had to balance efforts to boost the economy against the need to contain rising debt and preserve the nation’s investment-grade rating.

The treasury expects to collect R1,14 trillion in taxes in the year to March, R30,4bn less than it projected a year ago and the biggest shortfall in seven years.

It anticipates raising an additional R16,5bn from the new top tax bracket and also by limiting relief for inflation, an extra R6,8bn from a higher dividend tax and R5,1bn from increased fuel taxes and duties on tobacco and alcohol.

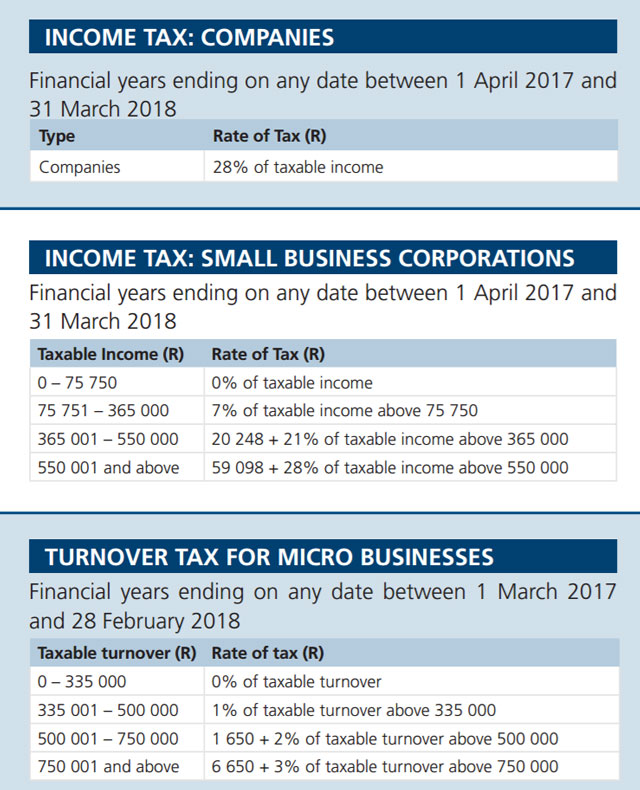

Gordhan shied away from raising the 14% VAT rate, saying poor households would be adversely affected, and from raising the 28% tax rate for companies.

More tax increases are planned next year, with the treasury needing to raise an additional R15bn. It’s proposed removing the VAT zero-rating on fuel, while a tax on sugary drinks will be implemented as soon as the necessary laws have been finalised. A revised carbon tax bill will be published by mid-year, it said.

The treasury left its growth estimates unchanged from the mid-term budget in October, with the economy forecast to expand 1,3% this year, 2% next year and 2,2% in 2019.

While a rebound in commodity prices, a more stable rand exchange rate, an easing of the drought and improved labour relations will help support the economy, the growth rate is still too low to reduce unemployment or impact significantly on poverty or inequality, Gordhan said.

The treasury expects the budget deficit target to narrow to 2,6% in the year through March 2020, from 3,4% in the current fiscal year.

“Acting too quickly to reduce the deficit would harm service delivery, delay economic recovery and compromise tax revenue collection,” Gordhan said. “But to ignore our fiscal targets would result in interest rate hikes, unsustainable commitments and credit rating downgrades. This is a scenario in which short-term gains would quickly give way to financial stress, capital flight and cutbacks in service delivery.” — (c) 2017 Bloomberg LP