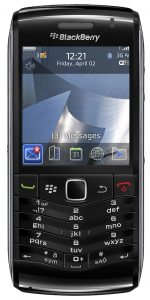

The BlackBerry. Traditionally used by men in grey suits — bankers, accountants and lawyers. If you used a BlackBerry, you were a corporate nerd, tied to your company’s e-mail system.

Not anymore. These days, you’re more likely to see the latest BlackBerry smartphone in the hands of school kids and the trendy set.

What happened?

Over the past two years, Canadian’s Research In Motion (RIM), which makes the BlackBerry, has embarked on a concerted effort to throw off the corporate suit, to make its phone appeal to the trendier consumer market.

It’s paid off in spades.

Surprisingly, RIM didn’t focus on changing the actual hardware. For the most part it kept the business-like form factor, only later introducing phones in colours other than black.

Instead, it made the phones more “social” through software, adding services like instant messaging.

Deon Liebenberg, RIM’s regional director for sub-Saharan Africa, says the company still focuses on the corporate market. “But we know that consumer technologies often drive adoption in the enterprise.”

Liebenberg says that in the last quarter, 80% of devices the group sold globally were not to the enterprise market.

SA retail consumers have also taken to BlackBerry in a big way. Both MTN and Vodacom tell TechCentral that they’re enjoying a boom in sales of the devices.

Vodacom corporate communications head Nomsa Thusi says the number of prepaid customers using BlackBerrys on its network has jumped 1 000% in 12 months.

MTN device portfolio head Teddy Maduna says sales of BlackBerry have been “exceptional”. Though he won’t put a figure to the growth, he says lower and middle-income markets are where the growth is coming from.

“BlackBerry has shown consistent growth in the past year,” Maduna says. “However, we do think that [Google] Android devices will probably outgrow it in the long term.”

Why has the BlackBerry become so popular among consumers? Part of the answer lies in the unmetered bandwidth. For a minimal monthly amount — typically around R60/month, customers gain access to uncapped on-device Web browsing, which includes access to social networking sites such as Facebook and Twitter.

MTN says non-BlackBerry smartphones are also selling well. However, according to Maduna, BlackBerry’s unlimited data access for a fixed fee service has given it an advantage in the SA market.

“User behaviour has definitely changed over the last year. With the inclusion of the consumer applications, there has definitely been higher adoption by the youth market. It has suddenly become more relevant,” says Maduna.

Full-time access to chat, e-mail and social networking applications has changed the way ordinary consumers use mobile phones.

Liebenberg says gaining consumer buy-in is no longer about the handset. “It’s about what services you provide on top of the hardware.”

He says one of the biggest drivers of growth is BlackBerry Messenger (BBM), an instant messaging system not dissimilar to the popular MXit platform.

Lower handset prices also help. RIM’s low-end Pearl device has proved a hit among a much broader number of people.

But, as smartphone prices from other manufacturers come down — especially as the cost of Android-based devices falls, will RIM be able to maintain its growth in the SA consumer market? That’s hard to predict. — Candice Jones, TechCentral

- Subscribe to our free daily newsletter

- Follow us on Twitter or on Facebook