Are South Africans really paying too much for mobile data? Tariffic, a South African company that helps businesses and individuals save on their cellphone bills, has set out to determine exactly that by looking at the price of data-only packages locally against a range of other countries. And the results don’t reflect well on local operators.

The research was conducted by identifying data contract prices from the leading mobile network operators in other Brics-member countries (Brazil, Russia, India and China) as well as Kenya and Australia. The prices were compared against the average data contract prices across all of the South African mobile network operators.

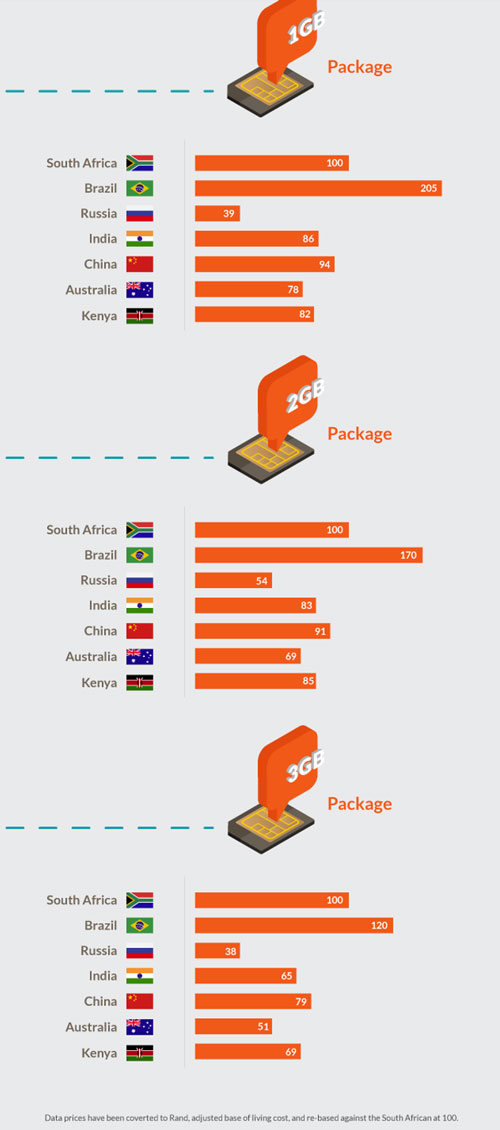

They show that South Africa has the second highest data contract prices in the group, coming second only to Brazil.

Tariffic didn’t do a simple currency conversion to make its calculations, it said, as this does not take into account the cost of living in the various countries. “In order to ensure that the company compared apples with apples, all figures were re-based against the ‘cost of living index’,” it said.

Once prices were converted to rand and re-based for the cost of living, South Africa was consistently the second most expensive for 1GB, 2GB and 3GB data contracts, with Brazil being the most expensive in all three cases. Data prices for South Africa were on average 134% more expensive than the cheapest prices in the group.

Tariffic CEO Antony Seeff said it is clear that data prices in South Africa can and must fall.

“Research conducted by Research ICT Africa has shown that users, especially those in the lower income category, are spending significant portions of their income (around 20%) on relatively small amounts of data,” Seeff said in a statement.

“How can one be expected to pay for accommodation, transport, food and other living expenses when you’re forced to pay 20% of your income on data?

“Your 1GB of data won’t get you as far as it would have a few years ago, and you would expect the prices to come down accordingly so that users will, at a minimum, continue getting the same value for the same price. However, data prices haven’t come down to nearly the same degree over the years,” Seeff added.

In conducting its research, Tariffic compared all international data contract prices available on the websites of the largest or second largest cellular operators in each country.

The prices for South Africa were calculated by taking an average of the data contract prices (and not data bundle prices) from all four mobile network operators.

Where a certain country didn’t have a 1GB, 2GB or 3GB bundle available, Tariffic extrapolated the theoretical price for this bundle based on other bundle prices offered by the operator. All prices were then converted to rand and divided by the cost of living index. — (c) 2016 NewsCentral Media