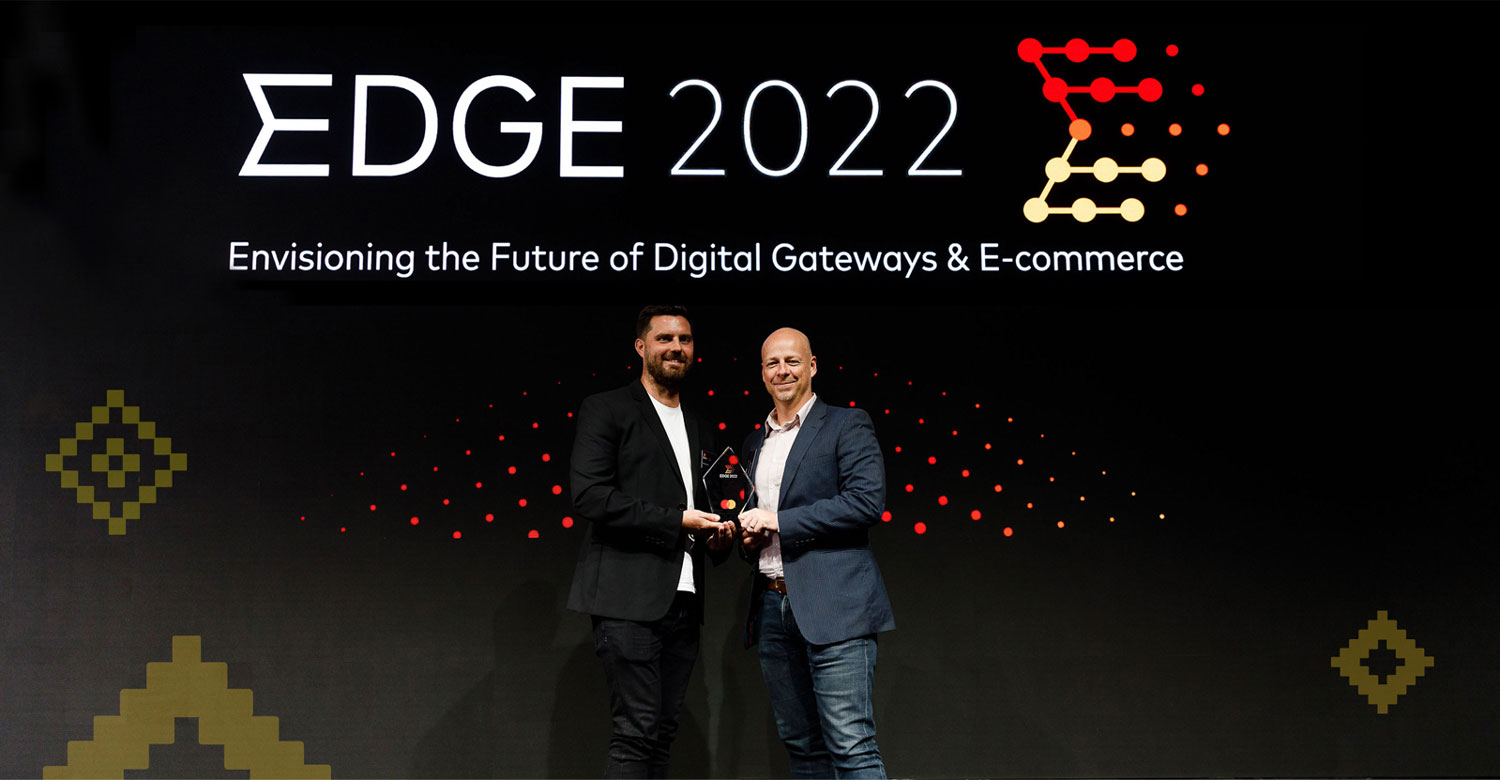

Durban-based fintech pioneer iKhokha has won top honours at Mastercard’s EMEA Edge Conference in Dubai.

The Mastercard Edge conference brought together payment technology innovators and tech industry experts to celebrate the efforts of fintech companies making strides in the evolution of payment technology.

Bringing home the prestigious Accelerating Digital Acceptance in Africa award, iKhokha was recognised for its latest product, iK Tap on Phone, and its impact on SMEs across South Africa.

“iKhokha is honoured and humbled to be the only South African fintech recognised by the Mastercard EMEA team for our Tap on Phone product innovation and efforts to reduce the barrier to financial inclusion for SMEs in South Africa,” said iKhokha CEO and co-founder Matt Putman.

Though a challenging sector to navigate, iKhokha continues to champion small businesses by serving one of their most important needs: access to affordable payment solutions.

iKhokha’s latest launch, iK Tap on Phone, is a game changer. Thanks to near-field communication (NFC), business owners can now receive card payments with a simple tap of a customer’s bank card on their smartphone.

Through this mobile innovation, iKhokha seeks to end the financial exclusion small businesses have historically faced. With payment solutions like iK Tap on Phone, all business owners can finally participate in the digital economy and experience what it feels like to transact with ease, regardless of their business size.

Free app

What’s more, the barriers to entry are now lower than ever as this freemium payment solution enables anyone to start accepting card payments with no upfront hardware costs and nominal transaction fees.

All merchants need to do to access iK Tap on Phone is download the free iKhokha app.

“We are firmly focused on achieving our mission of helping bring the millions of cash-based SMEs in our country into the digital economy to continue to make business easier for the businesses which form the backbone of our economy,” says Putman.

As more digital and contactless solutions emerge to challenge the historical ascendency of physical cash, businesses are quickly embracing these payment alternatives for a variety of reasons, such as safety, hygiene and convenience. This shift has led to an increase in demand for new financial products and services.

iKhokha’s rapidly growing product suite now offers business owners a wide variety of payment solutions to suit their business needs.

iKhokha continues to drive small business enablement and growth through iK Cash Advance

In addition to freemium products, like iK Tap on Phone and iK Pay Link, which are available on the free iKhokha app, iKhokha also offers card machines for businesses at various stages of development.

The rise of e-commerce has also prompted the payment provider to explore remote payment solutions like iK Pay Gateway, the payment gateway for Wix and WooCommerce that makes it easier and more affordable for e-commerce businesses to receive online payments.

iKhokha also offers businesses the opportunity to accelerate their business growth by accessing quick business funding. Having already advanced hundreds of millions of rands in working capital to SMEs, iKhokha continues to drive small business enablement and growth through iK Cash Advance.

“We are doubling down on our mission to make it easier for the millions of vital SME businesses in South Africa to start, manage and grow, as well as exploring opportunities for future expansion in the region,” said Putman.

For more information on iKhokha’s range of products, please visit www.ikhokha.com.

This promoted content was paid for by the party concerned