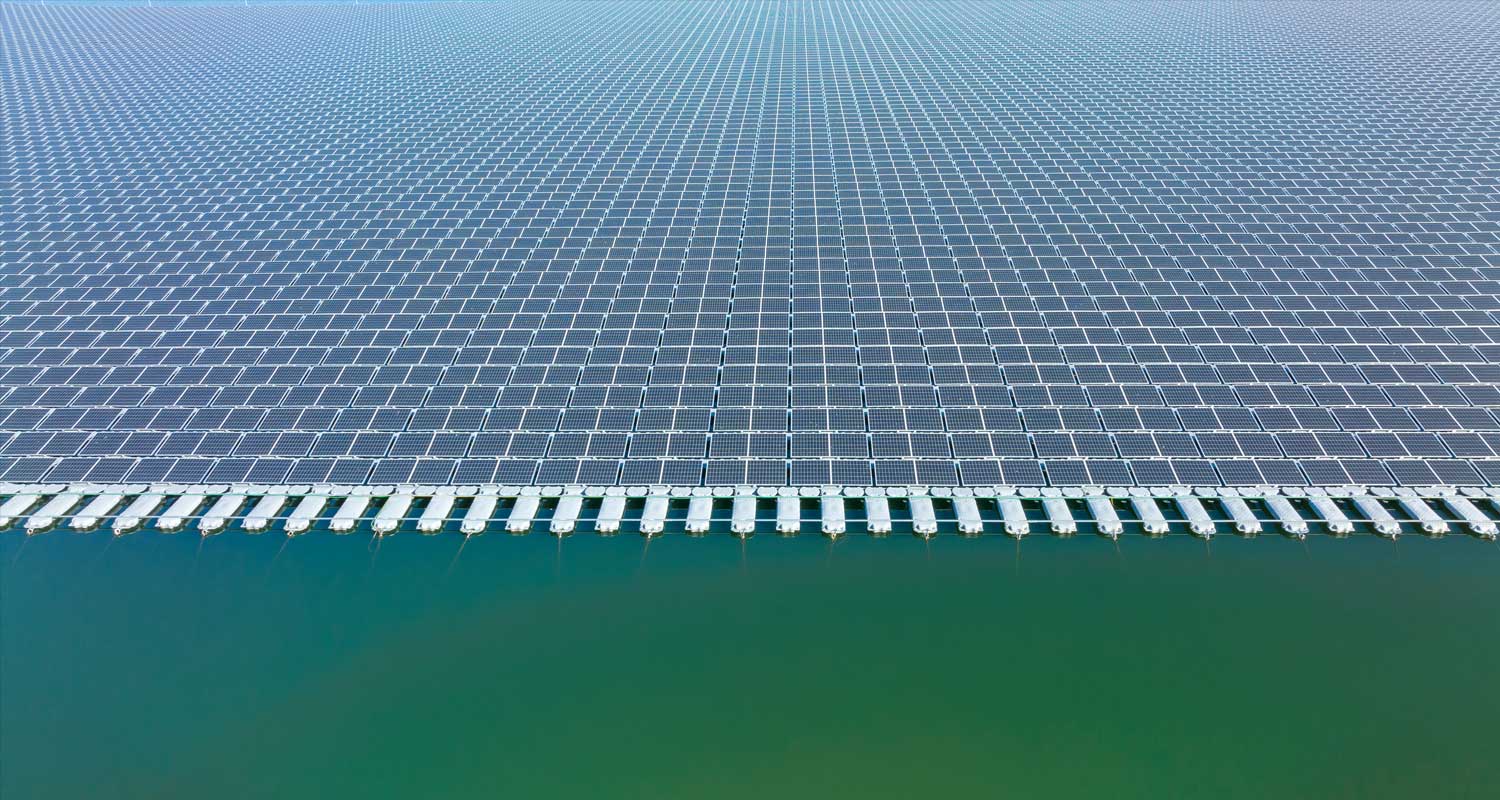

Zimbabwe’s industrial electricity consumers and exporters aim to raise R4.7-billion (US$250-million) to build the first phase of floating solar panels on the world’s largest dam.

Zimbabwe’s industrial electricity consumers and exporters aim to raise R4.7-billion (US$250-million) to build the first phase of floating solar panels on the world’s largest dam.

Members of the Intensive Energy User Group, which also includes mining companies, will own 52% of a development company for the project to be located on the Kariba Dam, between Zimbabwe and Zambia, according to a pre-feasibility study. The electricity generated by the station, initially planned for 250MW, will be sold to the group and other qualifying customers under a 25-year power-purchase agreement.

Zimbabwe is facing acute electricity shortages that have resulted in blackouts lasting more than half a day because of low water levels that stifle generation from a hydropower plant on the dam and a thermal power station that experiences frequent breakdowns. Any excess output could also be exported throughout the region, according to the developers.

“It is envisaged that the generated electricity will be fed directly into the national grid for consumption by the IEUG, and/or sold to other suitable off-takers including trading on the Southern African Power Pool,” the Kariba Floating Solar Power Station Development Co said in its report.

The Zimbabwe government sovereign wealth fund will hold a 10% stake in the company, with the remaining 38% available to investors including development banks.

Infrastructure investors including African Finance Corp and Africa50 as well as private energy companies will be approached, according to Caleb Dengu, non-executive director at IEUG and a managing partner of CDF Trust and Consulting, a promoter of the project. A prospectus is being prepared for a road show, he said in an interview in Harare.

Read: R5-billion W Cape solar projects reach financial close

1GW of capacity could be built at the site by having 1.8 million photovoltaic panels installed on 146 modular units, according to a March report compiled for Zimbabwe Power Co by China Energy Engineering Group.

“We can save our mining companies from power cuts,” said Dengu, who added that such consumers can pay in sought after US dollars. — Godfrey Marawanyika, (c) 2023 Bloomberg LP