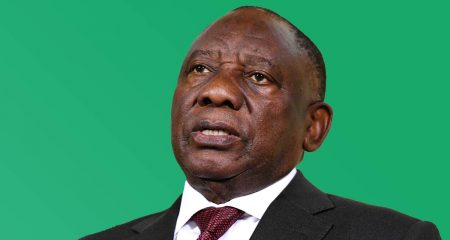

President Cyril Ramaphosa reiterated that his administration wasn’t moving to privatise state-owned companies as the government initiates reforms to clean up their balance sheets and revive their performance.

Private-sector investment was necessary to mobilise funds for economic infrastructure given the government’s limited fiscal space, Ramaphosa said at a meeting of the ANC. The involvement would be “subject to stringent regulations”, which would enable energy security and exporting of critical goods.

In a plan to reverse the collapse of the ports and freight-rail sector under state-owned Transnet that’s cost the economy at least R500-billion since 2010, the presidency said it intends to allow private companies to access rail lines and will offer them rights to operate ports and rail routes.

“We see this as an enabling process by restructuring our state-owned entities,” the president said. “By mobilising investment, we will help to improve their financial position, enhance their performance and increase their competitiveness.”

The road map for Transnet’s reform agenda will be submitted to the cabinet for consideration by the first week of November, the presidency said Monday.

“The ultimate objective is to move from a system in which Transnet has a monopoly in rail operations and container terminal operations, with associated inefficiencies to a full competition in operations,” Rudi Dicks, head of the presidency’s project management office, said in a separate briefing on Monday.

Interventions

The plan seeks to maximise volumes on the nation’s core network, which carries general freight, by opening access to as many operators as possible. Volumes of goods and commodities, including iron ore and coal for export, have dropped because of issues including vandalism, idle locomotives and cable theft.

The interventions at Transnet come weeks after the government announced a bill to set up a holding company for state-owned entities. The presidency said that not all government-run firms would automatically migrate to the new company. — (c) 2023 Bloomberg LP