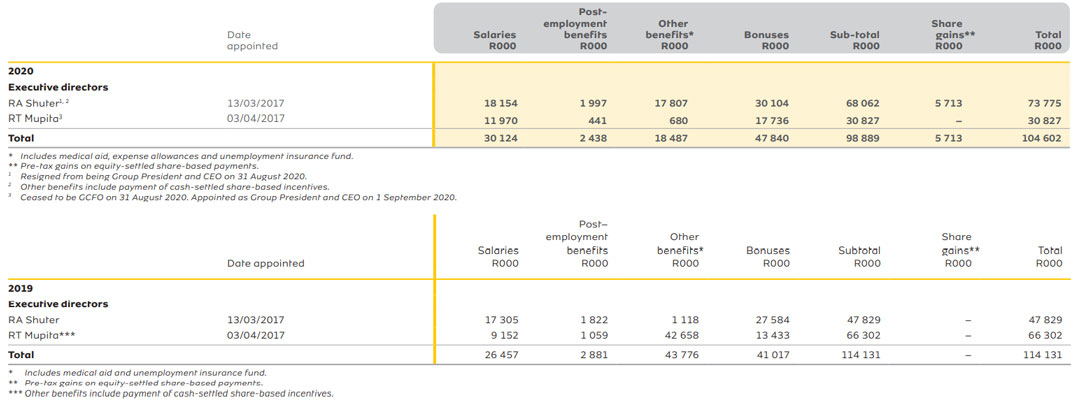

Rob Shuter, who resigned as CEO of MTN Group last year and who has since taken a senior role at the UK’s BT Group, was paid R73.8-million in his final eight months at the JSE-listed telecommunications firm.

Shuter, who was replaced in the top job on 1 August 2020, was paid R18.2-million as a base salary. On top of that, he received R30.1-million in bonuses and R17.8-million in other benefits. That, coupled with pre-tax gains on equity-settled share-based settlements of R5.7-million and post-employment benefits of R2-million brought his total remuneration to R73.8-million. MTN’s financial year runs from January to December.

Shuter’s replacement in the hot seat, Ralph Mupita — who had served as chief financial officer until end-August 2020 — was paid a total of R30.8-million, less than half he took home in in the previous financial year, despite working five months of the period as CEO.

The reason for the sharp fall in Mupita’s remuneration is that a big portion of the R66.3-million he was paid in 2019 was made up of “other benefits”, mostly related to a special “cash-settled on-boarding incentive” awarded in lieu of the loss of equity in his previous employer, Old Mutual, where he was CEO of the Emerging Markets business.

Mupita earned a base salary of R12-million and was paid a bonus of R17.7-million, the 2020 annual report shows.

Sharply criticised

MTN, which has been sharply criticised by investors over its remuneration practices, said in its latest annual report that its remuneration committee has “taken heed of the comments, inputs and feedback from various shareholder institutions received in the 2020 AGM and from other investor engagements”.

The group failed to receive 75% of votes in favour of its remuneration policy and implementation report and “responded by engaging openly with our shareholders on the concerns and feedback”.

As a result of these engagement, MTN has announced several “enhancements to some of our remuneration elements and policy”.

Effective from 1 January 2021, the group introduced minimum shareholding requirement standards for members of the executive committee. Also, while “malus and clawback provisions” were introduced to MTN’s long-term incentive (LTI) scheme in 2017, it has now introduced similar provisions for its short-term (STI) scheme as well.

Furthermore, it has revised its LTI performance share plan condition by replacing the return on average capital employed with return on equity, which is aligned with its medium-term guidance framework.

It has also redefined its STI revenue performance condition to be measured on service revenue, which is aligned with targets provided in its medium-term guidance. And, effective from the December 2020 share allocation, MTN has excluded the non-performance-based retention element as a condition under the performance share plan for group exco members.

Disclosure enhancements were also made on non-executive director fees and general executive remuneration benchmarking.

The group said it has increased disclosure detail on both STI and LTI payments by providing a retroactive breakdown of the goals, the achievements against these goals and corresponding payments linked to these goals. — © 2021 NewsCentral Media