As we approach the new year, businesses find themselves at the crossroads of opportunity and uncertainty. Navigating the market’s ever-evolving landscape requires not just vision but a strategic approach to financial management.

As we approach the new year, businesses find themselves at the crossroads of opportunity and uncertainty. Navigating the market’s ever-evolving landscape requires not just vision but a strategic approach to financial management.

One critical aspect is the careful consideration of cash investments. Ensuring your business enters 2024 on solid financial ground involves a mix of short-term liquidity and long-term growth. In this journey, Sasfin stands as a beacon, offering a range of investment options tailored to your business needs.

Visit sasfin.com/investments to learn more

The importance of a strategic cash Investment plan

In a world of economic flux, having a well-thought-out cash investment strategy is paramount. It provides stability in times of uncertainty and serves as a foundation for growth. A strategic plan helps businesses optimise returns on surplus cash while mitigating risks. Understanding the nuances of different investment vehicles is crucial for capitalising on opportunities and weathering economic storms in 2024.

Unlocking opportunities with Sasfin

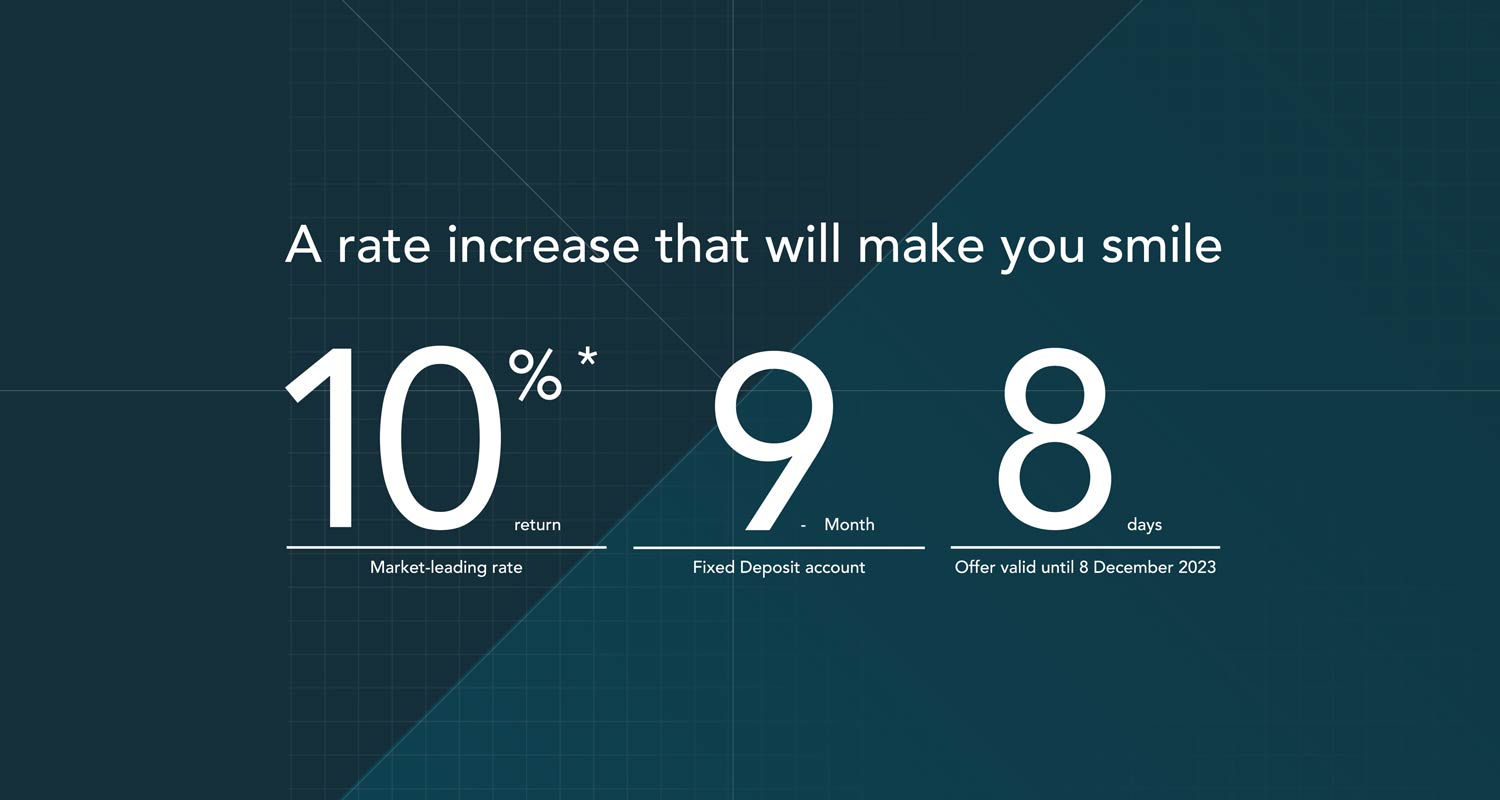

Limited offer: 10%* return on our nine-month fixed deposit account

As a testament to our commitment, Sasfin is pleased to announce a limited-time offer on our 9-month fixed deposits. Investors committing a minimum amount of £100 000 (R2.38-million) will enjoy an impressive 10%* return. This exclusive offer is valid until 8 December 2023, presenting an unparalleled opportunity for businesses to kick-start 2024 on a high note.

Short-term solutions: notice deposits

For immediate liquidity needs, notice deposits stand as a reliable short-term solution, offering flexibility and accessibility to your funds with a modest return. Businesses can capitalise on short-term market fluctuations, ensuring that their capital is both available and working for them.

Medium and long-term planning: fixed deposits

Medium and long-term planning: fixed deposits

When securing funds for medium to longer-term planned expenses, fixed deposits emerge as a preferred choice. With a fixed tenure and a predetermined interest rate, they offer stability and a higher return on investment. This is an excellent option for businesses looking to meet future financial obligations or capitalise on opportunities that may arise in the medium to long term.

Conclusion

“In crafting a winning cash investment strategy for 2024, businesses must strike a balance between agility and stability. Sasfin’s tailored investment options empower businesses to navigate uncertainty while seizing growth opportunities,” said Sasfin banking services executive Rodger Dunn.

As we stand on the brink of a new year, the importance of a sound cash investment strategy cannot be overstated. Sasfin, with its diverse range of investment options, stands as a reliable ally for businesses seeking financial growth and stability. Visit sasfin.com/investments to learn more.

*Annual effective. T&Cs apply.

- Read more articles by Sasfin on TechCentral

- This promoted content was paid for by the party concerned