Snapchat’s parent company Snap has filed for its initial public offering (IPO) on the New York Stock Exchange. Hoping to raise US$3bn, the IPO would value Snap at between $20bn and $25bn, putting it at almost twice the expected valuation of Twitter when it went public in 2013.

Snapchat’s parent company Snap has filed for its initial public offering (IPO) on the New York Stock Exchange. Hoping to raise US$3bn, the IPO would value Snap at between $20bn and $25bn, putting it at almost twice the expected valuation of Twitter when it went public in 2013.

Snap’s filing reveals more details about the company and how CEO Evan Spiegel and chief technology officer Robert Murphy plan to justify the valuation.

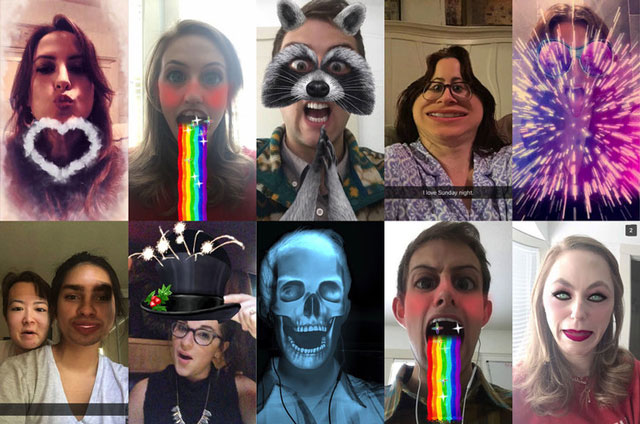

Snap has positioned itself as a “camera company” which has been misinterpreted by some as meaning that it will be somehow making money from selling its own camera hardware. This is not really what was meant by the statement. Snap believes that it is making the mobile phone camera more interactive and expressive by adding the features incorporated into Snapchat.

Actual hardware products like Spectacles, sunglasses fitted with a camera, are extremely unlikely to bring in significant revenue. If anyone is in any doubt as to how hard it is to make money selling cameras, they need only look at GoPro who has been consistently losing money over the past four quarters.

Probably the most startling aspect of the Snap filing is the presentation of the financial results for the last two years. Snapchat made $405m in revenue for 2016 with costs of $925m. Specifically, its cost of revenue was $452m. In other words, unless Snap can find a way to make more money out of each of its existing users, it is never going to make money.

Snap says as much when it states in its filing: “We have incurred operating losses in the past, expect to incur operating losses in the future, and may never achieve or maintain profitability.”

For Facebook at least, there would be little value in [buying Snapchat] because it has made Instagram a better product than Snapchat will ever be

The other confounding factor is that by the end of 2016, Snapchat had 158m daily active users. Although this number is impressive, growth is already showing signs of slowing. In the meantime, Instagram, which also has around 150m daily active users, added the last 50m in just the past four months!

What is worse for Snap, however, is the fact that Facebook and Instagram are implementing features found in Snapchat as fast as Snapchat can create them. Instagram stories has essentially stolen users, traffic and advertising interest from Snapchat’s version of the same feature.

As with Twitter, it is hard to see how Snap is going to convince advertisers to spend significant portions of their budgets on its platforms instead of Google and Facebook. Unlike Facebook, which covers the entire age spectrum, Snapchat appeals predominantly to 18-34-year-olds. Persuading older people to send each other ephemeral photos with “funny” filters is going to be a big ask.

Snapchat users who are 25 and older tend to open the app about 12 times a day and spend about 20 minutes in total on the app. Younger users visit over 20 times a day and spend about 30 minutes. Essentially, users are spending about the same amount of time on the app each time they open it, suggesting that they are doing it for a specific reason rather than to access content being provided by advertisers and content providers. This again compares to Facebook where the average user spends more than 50 minutes a day on its different apps.

Reading Snap’s IPO filing document one gets the overwhelming sense that the amount of time spent on outlining the risks facing the company far outweigh the potential upside. From that perspective, anyone investing in this IPO cannot complain that they were not warned of the consequences. Even the market is seeing the main benefit of Snapchat’s IPO as offering an opportunity for Facebook or some other company to acquire it. For Facebook at least, there would be little value in doing that because it has made Instagram a better product than Snapchat will ever be.

As others have said, Snap’s valuation is absurdly overpriced compared to any preceding IPO. It is five times more expensive than Facebook, and Facebook was making a profit when it went public. It is very hard to see why anyone would want to spend money on shares in this company.![]()

- David Glance is director of the UWA Centre for Software Practice, University of Western Australia

- This article was originally published on The Conversation