The US joined Britain, France, Germany and the European Union on Tuesday in a multibillion-dollar partnership to help South Africa finance a quicker transition from coal, which they hope will provide a model for other countries.

British Prime Minister Boris Johnson told the United Nations Cop26 meeting in Glasgow that the initiative was valued at US$8.5-billion (R131-billion) overall and would help move the world towards meeting its climate targets by “choking off international finance for coal”.

South Africa, which is the world’s 12th biggest emitter of climate-warming gases and heavily reliant on ageing coal-fired power stations for its electricity, said the money would help it deliver on a more ambitious pledge to reduce emissions by 2030.

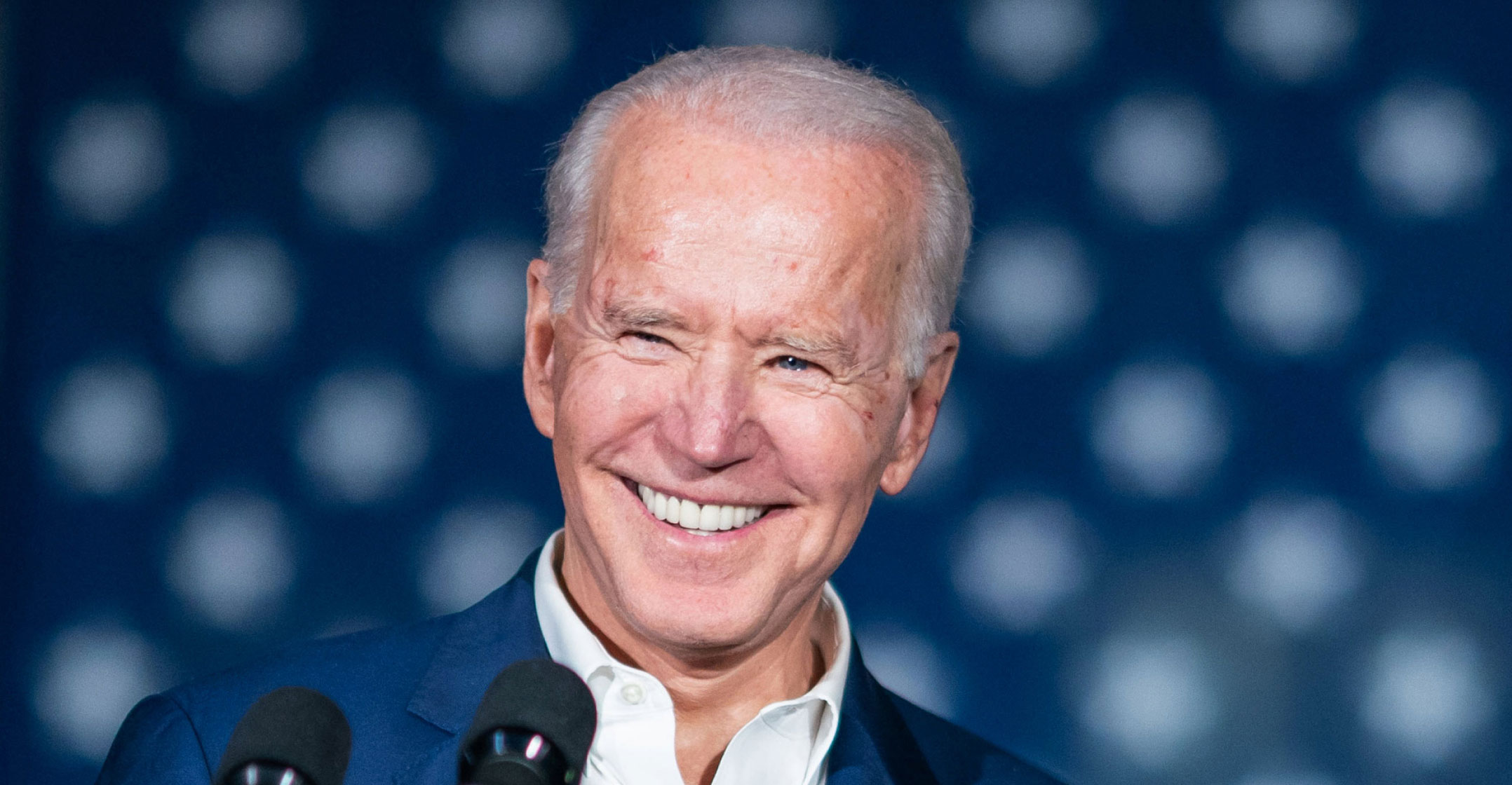

Biden announced US participation in the project at a joint event at Cop26 with European Commission president Ursula von der Leyen, who first discussed it last week.

He said the US would provide financing to bolster global efforts to reach net zero emissions “by closing South Africa’s coal plants ahead of schedule and investing in clean alternatives … for the people of South Africa”.

President Cyril Ramaphosa said that the agreement marked a “watershed moment” for South Africa and the world, while Von der Leyen that the “just energy transition partnership” could provide a blueprint for work with other countries.

“It is proof that we can take ambitious climate action while increasing our energy security, creating jobs and harnessing new opportunities for investment, with support from developed countries,” Ramaphosa said in a statement.

‘This is a big deal’

Biden did not specify Washington’s financial contribution, but underscored its commitment to follow through on pledges made by the Group of Seven advanced economies in June to accelerate the transition away from coal in developing countries.

Germany said it would spend €700-million on the initiative.

Coal is the most polluting fossil fuel, and phasing it out quickly is seen as crucial if the world is to meet the Paris Agreement’s target to limit global warming to 1.5ºC and avert the most catastrophic impacts of climate change.

Many poorer countries say they cannot go further without funds from richer nations with historical responsibility for climate change, putting climate finance centre stage at Cop26.

Biden said the funding would ensure “equitable, inclusive transitions in South Africa’s coal sector” by helping regions and workers in coal industries affected by the phase-out.

More than 90 000 people were employed in coal mines alone in 2020 in South Africa, which pledged to cut emissions by 2030 in an updated contribution to global efforts.

“A first of its kind agreement between a coal-intensive developing country and a group of donor governments to work together and fund a just transition away from coal. This is a big deal,” Jesse Burton, an energy policy researcher focused on South Africa’s coal sector, said on Twitter.

South Africa said the money will help it to accelerate investment in renewable energy and the development of new sectors like electric vehicles and green hydrogen, and ensure Eskom has access to funds to repurpose coal-fired power stations due to be decommissioned in the next 15 years.

The money will help South Africa to accelerate investment in renewable energy and the development of new sectors like electric vehicles and green hydrogen

Funds are also needed to ensure communities reliant on coal mining or coal power stations for jobs have greener alternatives to make a living as part of that process.

John Morton, a former private equity adviser and top climate adviser to US treasury secretary Janet Yellen, told reporters the initiative with South Africa underscored the importance of transitioning away from coal and could be a template for partnerships with other carbon-intensive economies.

Mafalda Duarte, who heads the Climate Investment Funds (CIF), which has financed over 300 climate-friendly projects in some 72 countries, said her group had been working for months to develop the new Accelerating Coal Transition (ACT) facility, the first such instrument for developing countries.

It will work through multilateral development bank partners to offer South Africa and other countries a financial toolkit combining low-cost loans with technical assistance, to help attract investment from the private sector and other sources. — Reported by Jeff Mason, Andrea Shalal and Emma Rumney, (c) 2021 Reuters