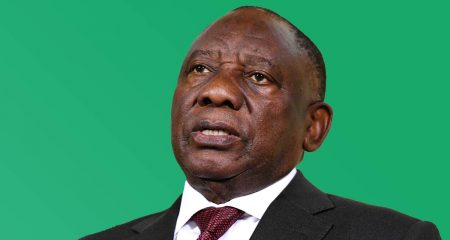

South Africa’s benchmark stock index plummeted to the lowest in more than six years after President Cyril Ramaphosa’s declaration of a national state of disaster over the coronavirus outbreak stoked investor concern about its impact on an already fragile economy.

South Africa’s benchmark stock index plummeted to the lowest in more than six years after President Cyril Ramaphosa’s declaration of a national state of disaster over the coronavirus outbreak stoked investor concern about its impact on an already fragile economy.

The president announced tough measures on Sunday to stem the spread of the virus locally, including halting flights and shutting schools, and said the government was finalising a crisis package.

An emergency cut in the US Federal Reserve rate, as well as those by other central banks to try to stem the impact of the virus, only accelerated the sell-off sweeping through global equities.

“The JSE is taking cues from global markets, which will also be reacting to the US Fed cut that only increased fear,” Nolwandle Mthombeni, an analyst at Mergence Investment Managers, said by e-mail. “There additionally will be some local investors worried about our economy after the president’s speech last night.”

The FTSE/JSE Africa All-Share Index sank as much as 11% in Johannesburg, the steepest drop since October 1997. Naspers, South Africa’s biggest stock, fell 11% to weigh most on the overall market, while heavyweight Richemont declined 12%. Only three of the benchmark’s 158 members managed gains.

Volatile

The index’s 30-day price volatility rose to 51% on Monday, the highest since the global financial crisis of 2008.

“I expect there will be more negative days than positive over the next few weeks as further data comes out that confirms growth slowdown,” Mthombeni said. — Reported by Adelaide Changole, (c) 2020 Bloomberg LP