Nvidia forecast second quarter revenue above analysts’ estimates on Wednesday. However, it could not say how much of its recent revenue rise was driven by the cryptocurrency market.

Browsing: Intel

ARM on Tuesday deepened its rivalry with Intel by releasing a batch of new chip technology aimed at grabbing more market share among laptop computers.

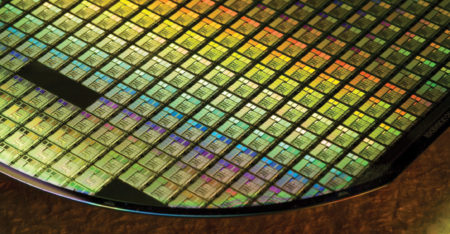

Taiwan has suffered a sudden reversal of fortunes. The pandemic comes just as a drought triggers power outages, stoking economic uncertainty and threatening the world’s chip supply.

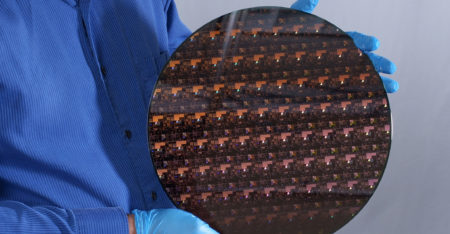

IBM on Thursday said that silicon has at least one more generational advance in store, promising faster computers and smartphones that use considerably less power.

Promoted | In the fifth and final episode of the Dell Technologies Work from Anywhere Tech Talk Series, company executives Jonathan Ryall and Tony Bartlett unpack the promise of 5G.

Promoted | In the fourth episode of the Dell Technologies’ Work from Anywhere Tech Talk Series, Jonathan Ryall engages with Greg McDonald on the subject of “hybrid cloud for a hybrid workforce”.

Promoted | In the latest in Dell Technologies’ Work from Anywhere Tech Talk Series, Dell thought leaders look at how organisations can take advantage of market conditions to survive and thrive.

Promoted | Dell Technologies introduces another five-episode Work from Anywhere Tech Talk Series that tackles the latest tech trends in South Africa and the globe.

Dell Technologies will spin off its 81% stake in cloud computing software maker VMware in a move that will help the PC maker reduce its debt.

Nvidia plans to make a server processor chip based on technology from ARM, putting it in the most direct competition yet with rival Intel.