Promoted | At SnapScan we know that people want to assist their communities when they can, but we also know that complicated payment processes can be time consuming and become a barrier.

Browsing: SnapScan

Promoted | South Africans are increasingly adopting mobile technology and our trust in various apps and online processes is strengthening.

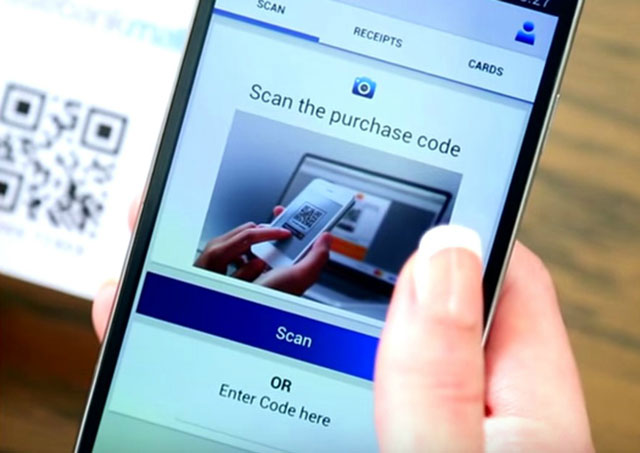

Nedbank, working with Mastercard and Entersekt, has launched QR code (or quick-response code) payments to Masterpass, Pay@, SnapScan and Zapper merchants and billers in its Money app – for use online or in-store.

Duncan McLeod and Regardt van der Berg celebrate the 200th episode of TalkCentral. In the podcast this week, they chat about the dramatic fall in EOH’s share price and why it happened. Also this week, MultiChoice’s troubles over its channel supply

Father of capitalism Adam Smith once called money “one of the three great inventions, along with the written word and mathematics”. Money has helped business grow more efficiently, enabled markets to expand

Standard Bank has acquired a majority stake in Firepay, the company that develops popular mobile payments platform SnapScan. Terms of the deal have not been disclosed. Firepay launched SnapScan in partnership with Standard Bank

Mastercard’s Masterpass now claims to be the most widely accepted digital wallet in South Africa after concluding a deal to allow consumers to use its wallet at the more than 30 000 SnapScan merchants in South Africa. Mastercard and SnapScan

System maintenance will once again necessitate downtime at Standard Bank this weekend. “Standard Bank wishes to advise customers of routine system maintenance due to take place on Sunday, 12 June 2016. This will affect

Every online shopper in South Africa knows the inconvenience of waiting impatiently for a courier to arrive. The package could arrive now, just now or now-now – that is about as precise as your information about the delivery time will be. Given that

Standard Bank has warned its customers that it will be offline this Sunday, 7 February, while it performs scheduled system updates. The system changes require planned downtime, which will affect the ability of clients to perform “certain banking activities and transactions