Chinese technology shares rallied in Hong Kong on Monday as bargain hunters pounced in the wake of the sector’s worst rout in months.

Browsing: Tencent

Even a $1.5-trillion selloff may not provide an attractive entry point for equity investors as they grapple with cascading risks in China’s technology sector.

The JSE equities trading market failed to open on Wednesday for technical reasons, causing enormous frustration in the investment community.

Chinese gaming and social media giant Tencent Holdings posted a 29% rise in second quarter profit, a slower pace of growth after the coronavirus pandemic led to a boom in online gaming last year.

Billionaire Richard Li’s streaming business is on a roll, mulling a potential initial public offering after its platform Viu beat Netflix in subscribers in one of Asia’s most competitive markets.

Chinese regulators on Tuesday issued a lengthy set of draft regulations for the Internet sector, banning unfair competition and restricting the use of user data.

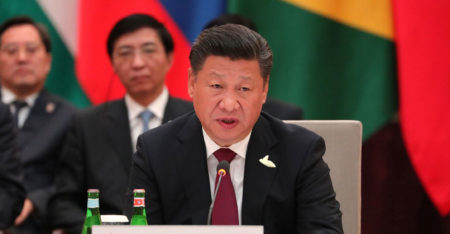

As $1-trillion evaporated from Chinese stocks last week, some investors realised they hadn’t paid enough attention to the country’s most important man: President Xi Jinping.

It turns out even the most compliant Chinese billionaires aren’t immune to the regulatory onslaught sweeping the world’s second largest economy.

Shares in both Naspers and its European spinoff Prosus tumbled on Tuesday, following Tencent’s sharp fall after a Chinese state media article described online videogames as “spiritual opium”.

Tencent shares were on track to fall by their most in a decade on Tuesday after a Chinese state media outlet branded online videogames “spiritual opium”.