The online betting boom has sparked alarm as vulnerable South Africans gamble away their social grants.

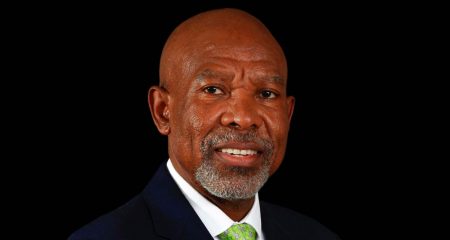

Browsing: Tim Masela

The Reserve Bank’s plan to overhaul the payments ecosystem should help expand participation by fintechs.

The Reserve Bank has released a position paper outlining how it intends modernising the payments ecosystem.

Myriad factors have contributed to the “slow” adoption of digital payment rails in South Africa.

Instant payments are key to growing the regional economy, but the use of the US dollar adds unnecessary costs.

The Reserve Bank is working to drive financial inclusion by digitising cash and making instant payments across borders an everyday reality.

Financial inclusion requires that non-banks be able to clear and settle payments, the Reserve Bank has told TechCentral.

FNB now facilitates real-time cross border payments in South Africa, Namibia, Lesotho and Eswatini.

The South African Reserve Bank is open to issuing a national digital currency, which would likely be based on blockchain or distributed ledger technology. “If we go the route of issuing a digital currency, the objective would be to take