Qualcomm is struggling to keep up with demand for its processor chips used in smartphones and gadgets, as a chip shortage that first hit the car industry spreads across the electronics business, sources said.

Browsing: TSMC

China has pledged to boost spending and drive research into cutting-edge chips and artificial intelligence in its latest five-year targets, laying out a technological blueprint to vie for global influence with the US.

Apple has partnered with Taiwan Semiconductor Manufacturing Co to develop micro OLED displays, which it plans to use in its upcoming augmented reality devices, according to a report.

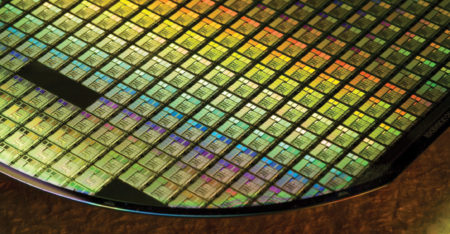

TSMC said on Tuesday it would raise nearly $9-billion from the debt markets to help fund expansion and spend around $178-million to open a Japanese material research subsidiary.

Intel’s surprise resolve to stick with chip manufacturing is a move that ought to bring a sigh of relief to leading foundry Taiwan Semiconductor Manufacturing Co.

Intel gave an upbeat forecast for the current quarter on continued demand for PCs that enable working and studying from home. The stock jumped.

TSMC expects to boost capital spending to as much as $28-billion this year to safeguard its lead in advanced technologies that made it chip maker of choice to the world’s technology and car giants.

Intel plans to tap Taiwan Semiconductor Manufacturing Co to make a second generation discrete graphics chip for PCs that it hopes will help it combat the rise of Nvidia.

Samsung Electronics rose the most in almost 10 months after Intel was said to be considering asking the South Korean giant and TSMC to make some of its most sophisticated chips.

Huawei this year will likely see slower 5G business and push further into software, while hoping its smartphones get a reprieve from US sanctions which last year struck the chip-reliant heart of its group, analysts said.