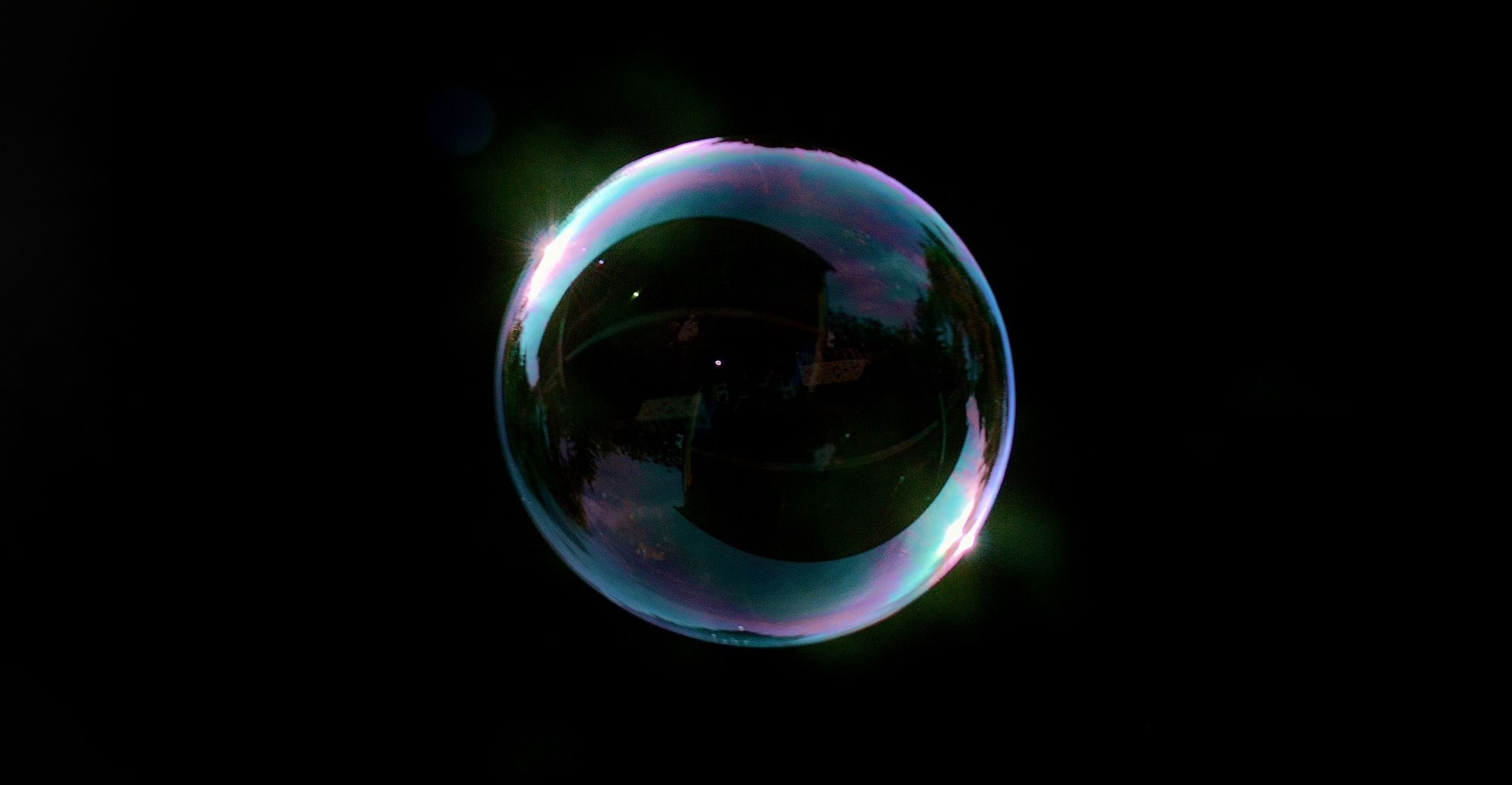

As America’s tech titans report earnings this week, one question looms large: is the artificial intelligence boom that has inflated valuations headed for the next big bubble?

As America’s tech titans report earnings this week, one question looms large: is the artificial intelligence boom that has inflated valuations headed for the next big bubble?

Microsoft, Alphabet, Amazon and Meta Platforms are poised to report that revenue rose at a brisk pace in the July-September quarter, according to LSEG data. The companies themselves are likely to say they will continue to pour billions into AI because it holds promise in the long term.

But business leaders including OpenAI CEO Sam Altman, Amazon.com founder Jeff Bezos and Goldman Sachs CEO David Solomon have warned in recent months that the frenzy in tech stocks has outrun fundamentals.

Investors, unnerved by the exuberance yet wary of betting against it, have started shifting away from hyped-up stocks, using dot-com-era strategies to dodge AI bubble risks.

The four tech giants and other major cloud firms are together expected to spend US$400-billion on AI infrastructure this year — but returns for businesses adopting the technology remain uncertain.

A widely cited MIT study earlier this year found that of the more than 300 AI projects analysed, only about 5% delivered measurable gains. Most AI projects stall at the pilot stage due to weak integration into workflows and models that fail to scale, the study found.

“Overall, the models are not there. I feel like the industry is making too big of a jump and is trying to pretend like this is amazing, and it’s not. It’s slop,” OpenAI co-founder and Tesla’s former AI head Andrej Karpathy said earlier this month.

Trouble ahead?

That could spell trouble for the AI-fuelled rally that has added about $6-trillion to the big tech companies’ market value since ChatGPT’s November 2022 debut — and for the broader US economy, which some economists say has been propped up by AI spending offsetting the drag from US President Donald Trump’s tariffs.

Adding to the unease is a web of circular deals reminiscent of the 1990s dot-com boom, including Nvidia’s potential $100-billion investment in OpenAI, one of its largest customers. OpenAI has signed AI compute deals worth $1-trillion with few details on how it will fund them, including a commitment to purchase $300-billion in computing power from Oracle.

Read: AI mania grips the markets – and investors are getting twitchy

Debt is also playing a growing role in financing Big Tech’s AI infrastructure spree in a departure from past investment cycles. Meta recently signed a $27-billion financing deal with private-credit firm Blue Owl Capital for its largest data centre.

“When the same companies are both funding and relying on each other, decisions may no longer be based on real demand or performance but on reinforcing growth expectations,” said Ahmed Banafa, engineering professor at San Jose State University. “These deals aren’t necessarily problematic on their own, but when they become the norm, they increase systemic risk.”

Some investors said beneath the froth, real value is emerging — pointing to double-digit revenue growth and strong cash flows keeping Big Tech balance sheets healthy.

“Adoption may be low right now but that’s not a forward indicator. With greater spend and greater innovation in these models, the adoption is going to grow,” said Eric Schiffer, CEO of Los Angeles-based investment firm Patriarch Organization, which holds shares in all the “Magnificent Seven” companies. “I don’t think we are at a bubble stage yet.”

In the July-September quarter, the cloud computing units of Amazon, Microsoft and Google are all expected to report strong growth despite capacity constraints limiting their ability to meet AI demand. They are also likely to reaffirm their capital spending plans.

Microsoft Azure revenue likely rose 38.4% in the period, outpacing expected growth of 30.1% for Google Cloud and 18% for Amazon Web Services, Visible Alpha data shows.

AWS remains the largest player but has lagged Microsoft, which has benefited from its OpenAI tie-up, and Google, whose models have gained traction with start-ups. A recent AWS outage that disrupted several popular apps drew fresh scrutiny.

Overall, Microsoft is expected to report revenue growth of 14.9% in the quarter, while Alphabet’s will likely rise 13.2%, according to LSEG data. Amazon and Meta are likely to deliver revenue growth of 11.9% and 21.7%, respectively.

Profit growth, however, is expected to slow for the companies as costs jump, with all barring Microsoft expected to post their weakest increase in 10 quarters.

Read: Optasia targets up to R23-billion valuation in JSE debut

Microsoft, Alphabet and Meta will report results on Wednesday, followed by Amazon on Thursday. — Aditya Soni, (c) 2025 Reuters

Get breaking news from TechCentral on WhatsApp. Sign up here.