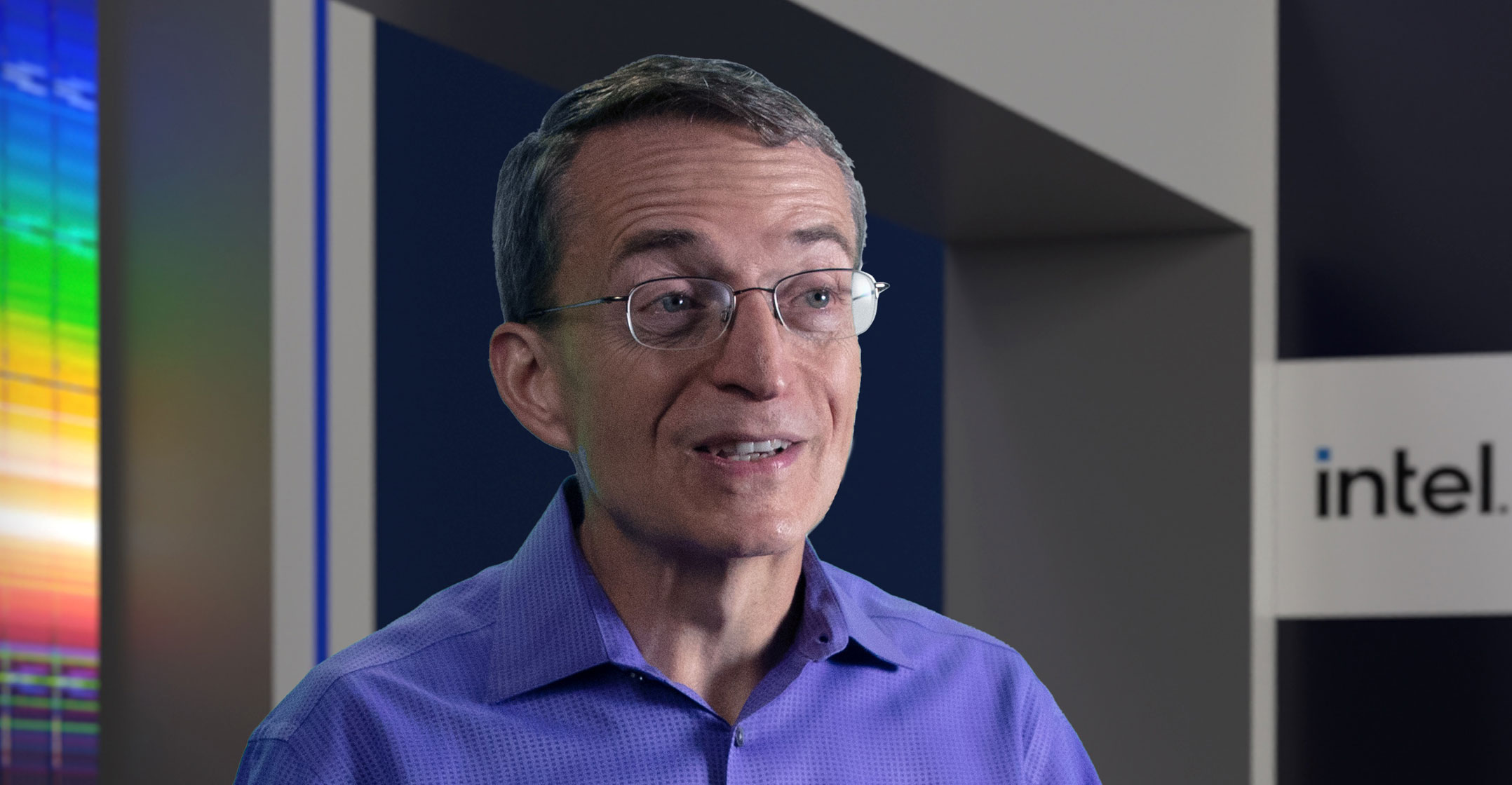

Intel CEO Pat Gelsinger has embarked on one of the largest factory-building sprees in chip industry history, part of an audacious plan to revitalise the Silicon Valley pioneer. But he’s missing a key ingredient: enough paying customers.

Gelsinger’s turnaround plan for Intel hinges on it becoming a foundry — a contract manufacturer that makes chips for other companies — and he’s promised Wall Street that he’ll start revealing the names of those customers this year. Even just one big name would help investors justify bidding up Intel shares 47% over the past 12 months, at a time when sales are sliding and the chip maker’s once-vaunted profit margins have narrowed.

The foundry expansion is the company’s biggest pivot in decades. Intel’s business model since the start has been to design and build its own chips — with names like Pentium, Celeron and Xeon — that would power the world’s computers. But the company lost its technological edge. That led some computer makers to switch to AMD, and data centre operators even began designing their own chips or turned to Nvidia.

Pushing into the foundry market is a chance to show the industry that Intel has restored its manufacturing prowess.

“If we’re going to be big, we must, in my view, also be a foundry,” Gelsinger, 62, said in an interview. “We’re starting to land some of our foundry customers right now.”

Though Intel hasn’t named a major customer for this business, there have been some early steps. Ericsson has committed to making some networking chips in Intel’s factories, and Amazon.com is considering using it to package semiconductors that are manufactured elsewhere. Qualcomm, meanwhile, is taking a look at chip-making technology that Intel intends to introduce in 2025.

What analysts and investors are waiting for is a flagship customer willing to pay in advance to guarantee supply. If that is indeed coming this year, as Gelsinger has said, the deadline is just a couple months away. One customer, which Gelsinger hasn’t named, has prepaid for future supply, he’s said.

“That’s something that people are waiting for,” said Stacy Rasgon, an analyst at Sanford C Bernstein. But even when the announcement comes, actually posting revenue from such a deal could be years away. “We’ve got a long slog ahead of us,” he said.

Intel dominated

The chip maker had dominated its industry for decades before making manufacturing mistakes and losing market share. Intel now has less revenue than Taiwan’s TSMC and Korea’s Samsung Electronics, and only a fraction of the market capitalisation of Nvidia, whose chips have fuelled the artificial intelligence boom.

Gelsinger, an Intel veteran who left to run VMware, returned to the company in 2021 to get it back on track. His plan is to reclaim technological leadership by 2025. As part of the comeback plan, Intel is building factories in Arizona, Ireland, Israel and Germany. Its biggest bet of all is a new facility in Ohio that it said will become the industry’s largest.

It’s been a costly undertaking. Upgrading and expanding factories have wiped out profit and eaten into cash reserves, which once led the industry. The Santa Clara, California-based company has to catch and pass TSMC, whose factories produce the majority of the advanced components designed by Apple, Amazon and Nvidia. It also has to somehow convince longtime competitors that it can be trusted to make their chips.

Gelsinger knows this is a huge challenge. He runs the data to see how Intel compares with TSMC and Samsung multiple times in a week. He knows his products aren’t yet “world class”. And he knows companies will only use Intel’s foundry services when the company can prove it has the goods.

“We fully realise that we have to earn our way into this business,” Gelsinger said. “Samsung, but particularly TSMC, is really good at this. They’ve been at it for 30 years. I’ve been at it for two years, right? Well, that’s a lot of learnings that we still have to go through.”

“We fully realise that we have to earn our way into this business,” Gelsinger said. “Samsung, but particularly TSMC, is really good at this. They’ve been at it for 30 years. I’ve been at it for two years, right? Well, that’s a lot of learnings that we still have to go through.”

The expense of outfitting a cutting-edge chip plant is staggering. In Intel’s new Fab 34 in Leixlip, Ireland — currently its most advanced production site — there’s a line of seven ASML machines that are so valuable they’re known as “billion-dollar row”. Even the more rudimentary Muratec machines, which run on tracks overhead to move chips around the factory, each cost the equivalent of a new car.

In Gelsinger’s favour, demand for the most advanced chip production is only growing. And there’s a desire to spread out the manufacturing so it’s not so concentrated in East Asia.

So, who could Intel’s marquee foundry customer be? Some investors are hoping it’s Nvidia, according to Bernstein’s Rasgon. Nvidia’s CEO, Jensen Huang, has said that he’s open to the idea.

Intel’s longtime rival AMD is another possibility, but a long shot. That company gave up on manufacturing its own chips more than a decade ago. Like Nvidia, it contracts out its manufacturing to TSMC. When recently asked about the possibility of going to her competitor for supply, AMD CEO Lisa Su avoided answering directly and praised the relationship with TSMC.

It may be easier to land customers such as Amazon, Google or Microsoft because they don’t have the baggage of competing with Intel, according to Wolfe Research analyst Chris Caso.

But any big customer will need assurances that Intel’s manufacturing missteps are behind it, he said.

“The challenge that Intel has is that they need to prove to these customers that its manufacturing is on the mend,” he said. “You’re staking your business on it. TSMC has been reliable.”

Read: Intel to spin out programmable chip unit

Gelsinger thinks he’s starting to convince naysayers that Intel is back. The rally in the shares this year underscores that. But he acknowledges that he needs to be able to land a big fish.

At the end of the day, Gelsinger said, it will come down to whether “Nvidia or Amazon or Google or Microsoft or Qualcomm or Apple” believe they can build a better product with Intel. — (c) 2023 Bloomberg LP