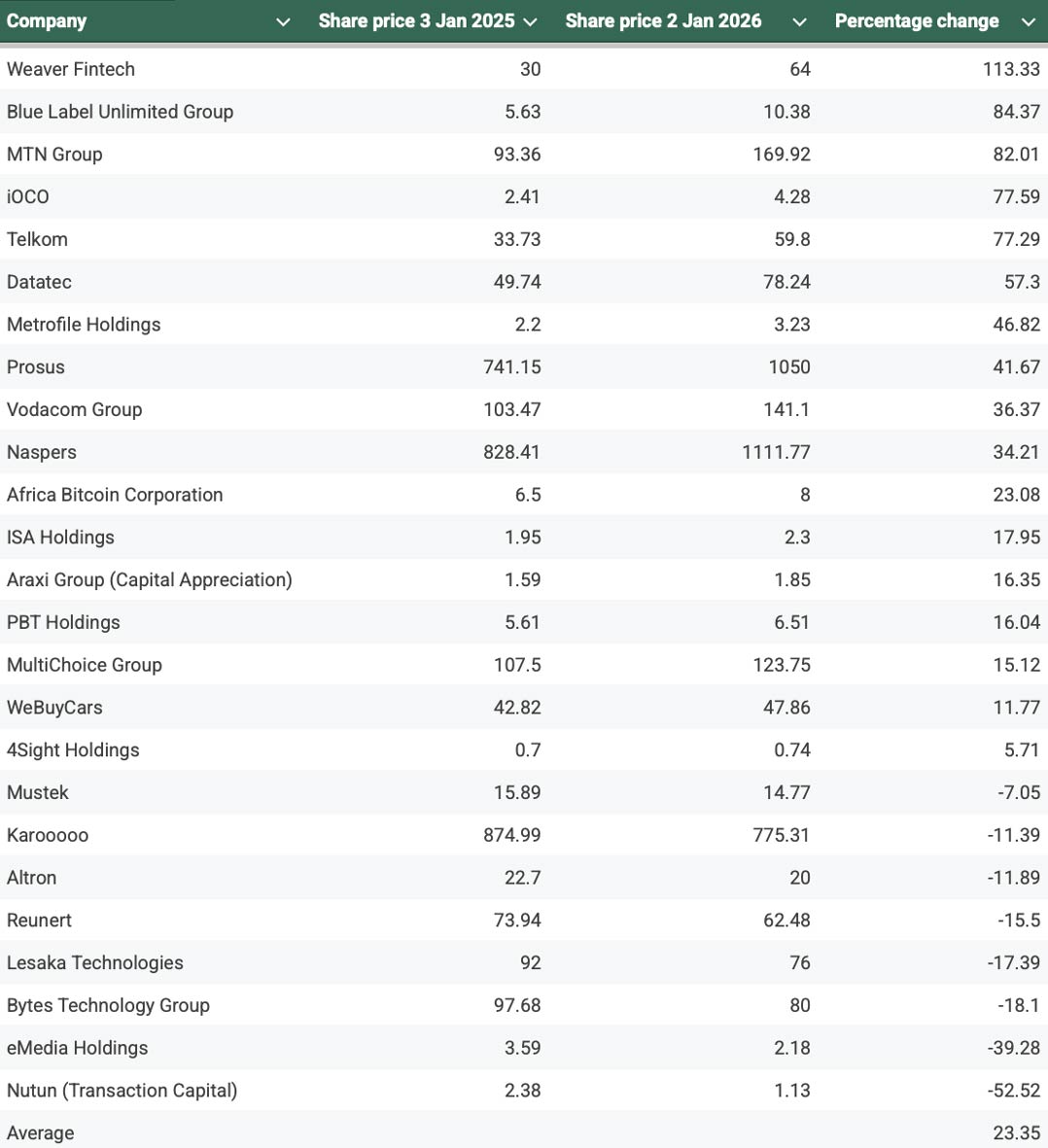

Many of South Africa’s JSE-listed technology companies performed well in 2025, with the likes of Weaver Fintech, Blu Label Unlimited, MTN Group, iOCO and Telkom improving their share prices by over 70% over the course of the year.

At the bottom end, however, some of South Africa’s biggest technology firms performed poorly, with the likes of Mustek, Altron, Reunert, Lesaka Technologies and Bytes Technology Group all showing a decline in value – excluding dividends.

TechCentral’s analysis looks at the share prices of the 12 companies listed under the technology sector on the JSE and includes others that are not in the category but whose businesses are technology driven.

These includes telecoms operators Vodacom Group, MTN Group and Telkom. Cell C, which only listed on 27 November 2025, has been excluded from the list. Also excluded is newly listed fintech Optasia.

The analysis compares the closing price of each share on 3 January 2025 to the same metric on 2 January 2026. The now-delisted MultiChoice Group has been included, but only up to the company’s delisting date, which was 10 December 2025.

Here, then, are the top-performing JSE-listed stocks of the previous calendar year.

1. Weaver Fintech (up 113%)

Formerly known as Homechoice International, Weaver Fintech has successfully shifted from being a mail order specialist to a data-driven fintech company offering lending, insurance and buy-now-pay-later (BNPL) services to over 3.7 million customers.

The company claims to have the number one BNPL service in the country, PayJustNow, which offers customers the option to pay in three instalments or stretch their payments out over six to 12 months for big-ticket items.

In its interim results to 30 June 2025, Weaver Fintech reported a 48% surge in profit to R370-million, up from R250-million in the first half of 2024. Group revenue increased by 29.4% to R2.6-billion over the same period, with earnings per share jumping 45% to R2.86/share. PayJustNow and its Finchoice digital lending product are the company’s primary growth drivers.

2. Blu Label Unlimited Group (up 84%)

Blu Label had a bumper 2025, which included a restructuring of the company’s operating model and the successful separate listing of Cell C in the fourth quarter. Along with the restructuring came a corporate rebranding, with the old Blue Label Telecoms making way for Blu Label Unlimited Group and a new company logo.

Blu Label’s share price followed a strongly positive trajectory for most of 2025, peaking above the R17 mark in August, more than three times its opening price in January. The company’s share price plummeted more than 20% following the release of its annual results in August, suggesting the market expected a quicker turnaround. Even so, Blu Label held onto some of the gains made throughout the year, with its closing price of R10.38 on 2 January representing an 84.4% increase over the R5.36 at the start of the year.

3. MTN Group (up 82%)

The positive upswing in MTN’s share price represented a significant turnaround in fortunes after a challenging 2024 caused by macroeconomic headwinds, especially in its largest market by both revenue and customer numbers, Nigeria.

In the first half of 2025, MTN Group’s service revenue surged 23.2% to R105.1-billion, with headline earnings per share skyrocketing 300% to R6.57, recovering major losses from the previous year. By November, MTN achieved another milestone, surpassing the 300 million customer mark.

MTN’s closing price of R169.92 on 2 January represents 82% growth over the previous year, only two percentage points behind Blu Label. Following the conclusion of the company’s Ambition 2025 strategy, MTN announced its new five-year vision in August. Under it, MTN will focus on three key pillars: the connected home, fintech and digital infrastructure.

Despite a resurgence across most of the group’s operating markets in 2025, MTN’s home market, South Africa, struggled with stagnant growth, especially in the prepaid segment. MTN Group CEO Ralph Mupita attributed the loss of market share to competitive offerings from rival Telkom, which also featured among the JSE’s top five performers.

4. iOCO (up 78%)

IT services group iOCO’s positive 2025 performance marked the company’s successful implementation of a turnaround strategy aimed at recovering market share and rebuilding its reputation. By the company’s year-end on 31 July 2025, iOCO – previously EOH – had swung from a R54-million loss in 2024 to a R258-million profit. Operating profit skyrocketed 257% to R421-million and headline earnings per share improved to 40c/share, nearly double the 21c/share reported the previous year.

iOCO’s progress is the culmination of the company’s efforts to redirect its fortunes and undo missteps by former leadership that led to a corruption and governance scandal. The rebranding to iOCO was only part of the turnaround, with massive changes in leadership also contributing to its successful turnaround. These include a shift to a co-CEO structure with Rhys Summerton and Dennis Venter at the helm. Other key leadership appointments included Lerato Pule – a former finance chief at Cell C and Liquid Intelligent Technologies – as independent non-executive director, and the retention of group chief financial officer Ashona Kooblall to maintain fiscal stability.

5. Telkom Group (up 77%)

Telkom has successfully redefined itself from being a lumbering state-owned monopoly to a dynamic competitor in South Africa’s telecoms market, especially in the prepaid segment where the company is seeing the most growth compared to competitors MTN and Vodacom.

Among Telkom’s milestones in 2025 was the company’s reinstatement of dividend payments following a four-year drought. In its annual results announcement in June, Telkom declared a total return of R1.3-billion to shareholders following the R6.75-billion sale of its masts and towers business, Swiftnet, to a consortium led by global infrastructure investor Actis.

Read: iOCO’s extraordinary comeback plan

By the announcement of its interim results for the first half the company’s 2026 financial year in November, group CEO Serame Taukobong’s One Telkom strategy had produced 12 consecutive quarters of market-leading service revenue growth, with other key metrics such as earnings before interest, tax depreciation and amortisation also surging (9.5% year on year to R3.5-billion). Ebidta margin – a measure of operating performance – expanded to 27.6% over the same period.

Trailing at the bottom of the list are IT services firm Bytes Technology Group, broadcaster eMedia Holdings and business process outsourcing specialist Nutun (formerly known as Transaction Capital).

Bytes Technology Group achieved a record-breaking financial year ending February 2025, with gross invoiced income exceeding £2-billion for the first time. However, its interim results for the first half of 2026, reported in October 2025, showed a 7% dip in operating profit as it restructured its sales teams and managed changes in partner incentives.

eMedia, meanwhile, reported a 20.9% jump in interim headline earnings despite a 3.2% decline in revenue, successfully offsetting a challenging television advertising environment through aggressive cost optimisation and the growth of its digital streaming platform, eVOD.

Read: Why Telkom is winning in mobile

Meanwhile, Nutun completed a complex, two-year simplification strategy, fully exiting its investment in the loss-making SA Taxi (Mobalyz) business. While Nutun still reported a small continuing core loss of R45-million for its 2025 financial year, it successfully restored liquidity and significantly reduced its overall losses from the multibillion-rand deficits of the previous year. – © 2026 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.