After a year of tough headlines, the world’s biggest technology companies showed last week that they’re powering through, continuing to rake in cash and invest in future growth as demand for their goods and services shows little sign of slacking.

After a year of tough headlines, the world’s biggest technology companies showed last week that they’re powering through, continuing to rake in cash and invest in future growth as demand for their goods and services shows little sign of slacking.

Amazon.com, Apple, Microsoft, Alphabet and Facebook all showed increases in revenue beyond what analysts’ had expected in the third quarter. Facebook, one of the most maligned tech companies this year, added 36 million new daily active users around the world and posted its biggest increase in sales in more than a year. Apple, which sagged a bit in August amid concern the latest iPhones would underwhelm, wound up selling more than analysts’ expected and showed a surge in interest for its wearable gadgets and services.

Alphabet, Amazon and Apple all notched a decline in profit, but they are ploughing money into research and big bets, such as cloud computing for Google, where it’s playing catch-up to Amazon and Microsoft, and faster, one-day shipping for the Seattle-based retailer.

The results belied several challenges facing the industry. There are more than a dozen federal, state and congressional investigations into Big Tech, ranging from calls to break up some of them, to stringent regulation that could force a change to the way many do business. A trade war has been raging between China and the US, threatening to increase the costs of everything from iPhones to laptops and crimp the business of companies like Intel that sell to Huawei Technologies. The president himself hasn’t shied away from making his displeasure known in a series of angry tweets.

Investors haven’t shown much concern. Shares of Apple and Microsoft are at record highs and Facebook has logged more than double the gains of the S&P 500 this year.

There have been wobbles. The biggest impact came in June on news that the US Federal Trade Commission and department of justice were preparing to open antitrust investigations of Facebook and Google. That lopped off US$52-billion from Google‘s market value and $41-billion from Facebook.

Antitrust threat

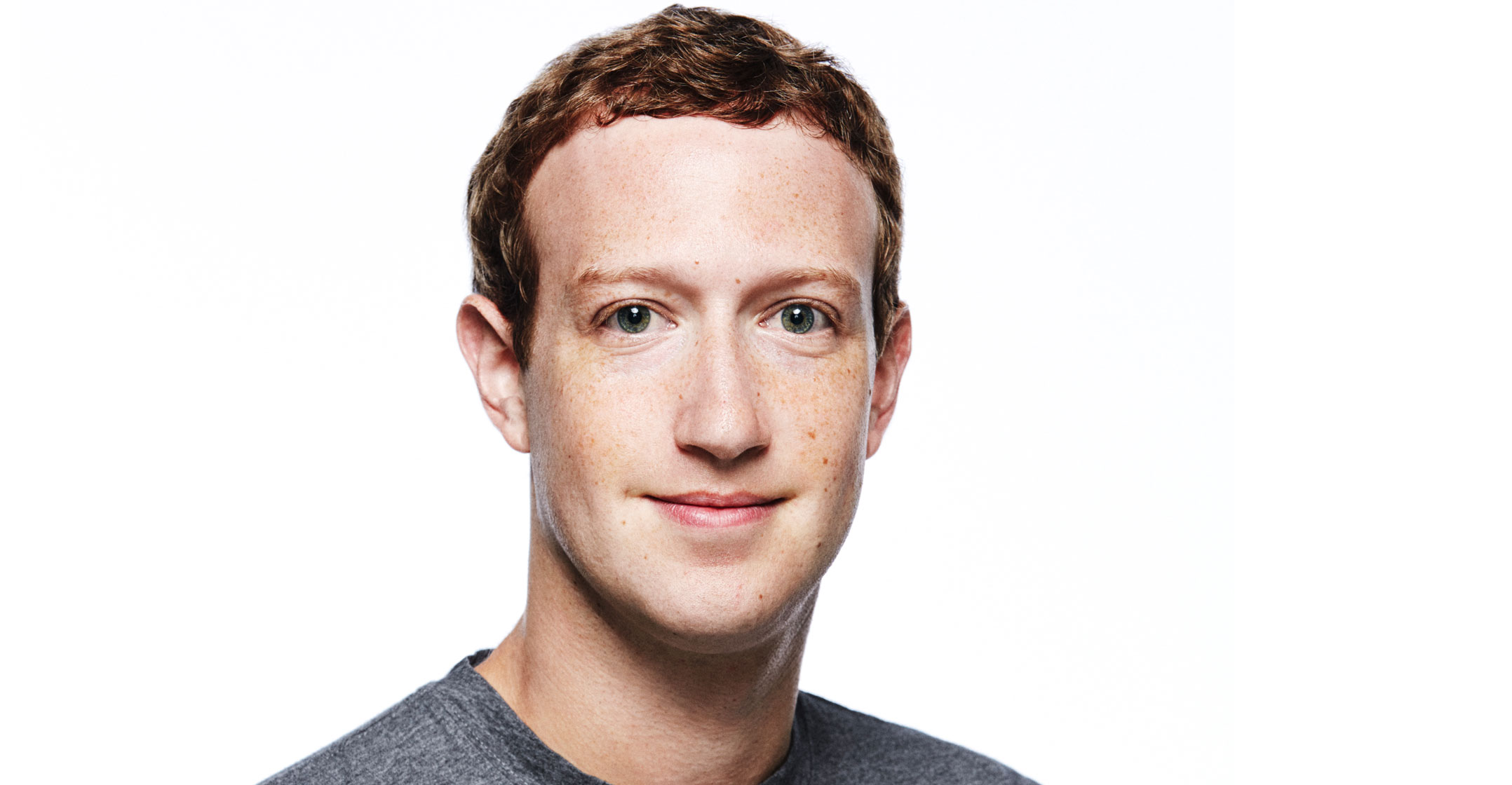

If anything, the threat of antitrust action is only increasing as senator Elizabeth Warren — the presidential candidate who has been leading the charge to to break up the tech companies — is gaining support among Democratic voters. Mark Zuckerberg, CEO of Facebook, faced sharp questioning from the US congress last month, confronted with a long list of grievances ranging from the company’s policy of not fact-check political ads to continued problems with election interference heading into the 2020 election and critiques of its record on workforce diversity.

On a call with analysts to discuss earnings, Zuckerberg said: “I expect this is going to be a very tough year,” as criticism of the company’s role in the political process continues to snowball through the presidential election.

Intel and Apple brushed off concerns about the trade war with China, but additional tariffs on Chinese goods are scheduled to go into effect in December. That will widen the scope of products facing higher prices. On Thursday, Apple filed requests to exclude 15% tariffs on 11 products or components, including the iPhone and Apple Watch, that went into effect on 1 September.

The US relationship with China is particularly important to the hardware maker because it manufacturers and sells many of its phones in China. Apple CEO Tim Cook said demand is improving in China and he’s optimistic for progress in the trade dispute. “I think the trade tension is less and that clearly looks positive,” he said on the earnings call with analysts. Apple’s results underlined the persistent power of its brand and the ability to charge consumers a premium for its products, even if it has had to lower prices on some iPhone models.

Overall sales are grew 2% in the fiscal fourth quarter at Apple, and the company predicted more revenue growth for the holiday shopping season. Still, the results, which included a 9% decline in iPhone revenue, were more of an endorsement of Apple’s strategy of expanding sales from services and selling accessories to iPhone owners than they were a return to growth of its main product.

“We obviously want that to be better,” Cook said. “But we feel good about how we’re doing.”

Amazon appeared to have a pretty serious miss, reporting profit that declined 26% from a year earlier due to massive spending on trying to get its delivery times in some places down to a single day. The company’s shares fell 9% after hours, but pared that to a 4% drop by the time the market opened the next morning. Most analysts remained positive on the stock and several advised to buy the dip, arguing the investment is necessary for the company’s future success. They cited bright spots like advertising, which is quickly becoming a solid, third pillar of revenue for the company, after e-commerce and cloud services. A week later, shares are essentially back where they were.

“The whole picture points to short-term pain for a visible long-term gain,” Bloomberg Intelligence analyst Jitendra Waral said.

Scored twice

Microsoft scored twice, posting profit and revenue up double digits in its fiscal first quarter, surpassing analysts’ estimates, and just days later winning a surprise $10-billion Pentagon contract for cloud computing services, beating the presumed winner, Amazon. The software giant has been making major investments in its Azure cloud business and shifting its Office productivity software online, efforts that are paying off. Although pure cloud revenue growth slowed in the third quarter, margins are improving and the Pentagon win will open the “floodgates”, in the words of Bloomberg Intelligence, for other government contracts.

Wall Street even refused to turn too sour on Alphabet after profit fell 23%, missing analysts’ estimates by a wide margin. But sales beat expectations, rising 22%. That cheered analysts who praised the company for its “stability”, after the first half of the year saw dramatic fluctuations in revenue growth.

Chip makers, who’ve been on the front line of the trade dispute between China and the US, continue to send mixed signals to investors about the lasting impact. China is the biggest market for semiconductors and home of Huawei, one of the world’s largest consumers of the vital electronic components. The US, which is home to the largest pool of producers, has black-listed Huawei as a threat to national security.

Intel gave an upbeat sales and profit forecast and smaller rival AMD also reported solid results. Intel said it wasn’t seeing demand hit by trade tensions. Chief financial officer George Davis said: “China was a modest positive relative to expectations.”

Intel gave an upbeat sales and profit forecast and smaller rival AMD also reported solid results. Intel said it wasn’t seeing demand hit by trade tensions. Chief financial officer George Davis said: “China was a modest positive relative to expectations.”

Many analysts expressed concern that the run-up in orders that’s happened in the second half of the year was juiced by extra purchasing ahead of possible tariffs in December that would make the chips — already the most expensive component in computers — more pricey.

Lurking in the back of investors minds on China and trade is the report by Texas Instruments, which slashed its forecast citing trade and economic concerns. The company has the biggest product and customer lists in the industry and its reach spans components for everything from space hardware to vehicles to home electronics.

Daniel Morgan, an analyst at Synovus Trust Company, said of the industry overall: “Despite all of these headwinds, they did pretty darn well.” — Reported by Gerrit De Vynck and Ian King, (c) 2019 Bloomberg LP