Zapper, a locally developed smartphone application that facilitates secure smartphone payments, has been launched in South Africa after the company behind it decided to explore international markets first.

The app has already been launched in the UK, Australia, France, Spain, Belgium, the Netherlands and Sweden and will soon also be available in Germany.

The company was founded by former Investec Private Bank head of IT David de Villiers, who now serves as worldwide CEO, and is backed by an unnamed international private equity firm.

“We launched to international markets first as they generally are at the forefront of technology. With a large international footprint, it has made it easier to penetrate the South African market,” says Zapper’s South African country manager, Derek Wiggill.

The homegrown technology was developed by the Zap Group, with research and development done in Pretoria and Cape Town.

Zap Group was launched in October last year and already has 500 merchants and restaurant chains using the system internationally with 40m downloads of its app across the Android, iOS and Windows Phone platforms.

Wiggill says Zapper has many applications, and can be used in anything from the taxi industry to e-commerce.

Businesses that use the mobile payments system also get access to a Web portal that displays custom analytics and real-time notifications of transactions.

Wiggill says merchants can choose how they wish to be notified when a payment is made — this can be done via the Web, the app or SMS.

In South Africa, Zapper is being launched in restaurants first, but will be “rapidly rolled out into other market segments in the near future”.

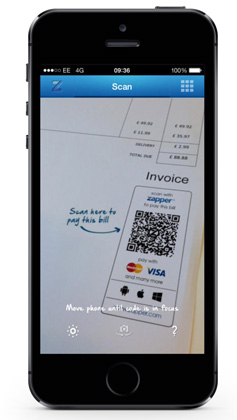

For restaurateurs, the app works in conjunction with their existing point-of-sale systems and automatically adds a QR code to the bottom of a bill. Diners who have the app installed can then scan the code and pay for their bill from the app, electing to add a tip if they choose to do so.

Customers can add personal and company bank cards to the app, allowing them to pay with either.

Customers can add personal and company bank cards to the app, allowing them to pay with either.

Once payment is made, the diner receives an e-mail receipt and the restaurant gets notified that the transaction has been approved.

Wiggill says the company has a number of solutions to integrate its platform with existing point-of-sale systems.

“Zapper is already live at 100 sites in South Africa, with another 150 scheduled to go live shortly,” Wiggill says.

Zapper has already been deployed to a number of restaurants including Spur, the Baron, Mike’s Kitchen and Dulcé.

Zapper uses South African e-commerce gateway PayGate to handle its transaction switching. Wiggill says that the company uses similar service providers around the world, such as Payvision in the UK.

The firm’s South African team is already about 160 strong (60 of whom are developers), while the company employs around 300 people worldwide, says Wiggill.

He claims Zapper offers greater security than using a credit or debit card as the card details are encrypted on the phone and are never transmitted over the network.

Zapper has no setup fees for merchants, and new businesses wanting to use the service will get a three-month trial after which a fee of 2,7% or less is negotiated upfront.

Wiggill hints that people may soon be able to pay for parking using Zapper. “The payment process can be so frustrating. By simply scanning a QR code on your parking ticket, you should be able to pay your parking from the comfort of your car.”

Zapper is available for Android, iOS and Windows Phone platforms. — © 2014 NewsCentral Media