Telkom’s mobile operator, 8ta, surprised the telecommunications industry and consumers on Thursday, launching the most aggressive mobile broadband special offers the SA market has seen to date. But how does its pricing stack up against its rivals?

Though it’s difficult to draw direct comparisons, especially as 8ta’s offer is billed as a once-off special, and because not all operators offer directly comparable packages, it is still possible to illustrate just how aggressive the new offerings are in the market.

Until now, the cheapest mobile Internet offers have come from Cell C, which launched its third-generation mobile broadband network in 2010. Its prices are as low as 3,3c/MB. Some of the company’s rivals have warned Cell C’s offerings are below cost and not sustainable.

However, 8ta’s two new products — both special offers that may not be in the market for long — take broadband pricing to below 2c/MB for the first time. One of the two products offers broadband at effectively less than 1,5c/MB, clearly a loss leader for the company as it tries to build market share as SA’s fourth mobile operator. 8ta can afford to be this aggressive because it’s network is largely underutilised and some of its bigger rivals will struggle to match it because of capacity constraints on their networks.

8ta’s first special offer provides consumers with 10GB/month of data for R199; the second offers an additional 10GB, which can be used from midnight to 5am, for R299/month.

But there are a few catches. Firstly, the products will only work in areas where 8ta has its own network coverage — mainly big urban centres and a few smaller towns — and consumers are expected to sign up for a 24-month contract. Also, no modem is included — users will have to find or buy a modem separately.

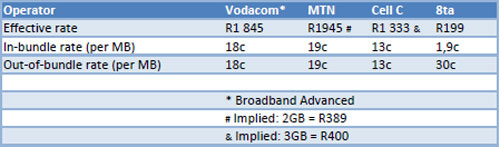

To draw some sort of comparison between the operators, TechCentral has used two separate sets of data. Firstly, we’ve taken the “bundle” rates that Vodacom, MTN and Cell C charge for data. None of these offerings include a modem. It must be noted that these bundles are not special offers and don’t tie users into any sort of long-term contract, unlike the 8ta specials. Also, Cell C and MTN don’t specifically offer 10GB bundles (they’re not advertised on their websites), so we’ve calculated the effective price of buying 10GB of data by using the largest bundles advertised (2GB on MTN and 3GB on Cell C) and extrapolating the numbers.

Despite these caveats, the table above clearly demonstrates just how aggressive 8ta is being with its latest, albeit time-limited, special offer.

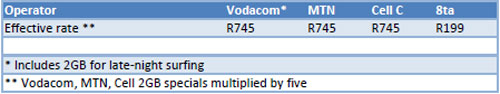

In the second comparison, we’ve taken the aggressively priced 2GB/month specials offered by Vodacom, MTN and Cell C and multiplied the price of these by five to get 10GB/month of data.

Unlike 8ta’s 10GB/month offering, the 2GB products from the other operators include a modem. There are other differences between the products — for example, Vodacom offers an extra 2GB for late-night surfing — so this can’t be seen as a direct comparison but again demonstrates just how aggressive 8ta’s pricing really is. — Staff reporter, TechCentral

- Subscribe to our free daily newsletter

- Follow us on Twitter or on Facebook