These days, with the fallout from the coronavirus pandemic wreaking havoc on economic and business projections, a company can stand out just by maintaining its outlook. For chip maker Nvidia, it helps that the outlook was already rosy to begin with.

On Tuesday, a day after Applied Materials and Twitter both withdrew their current-quarter forecasts, Nvidia surprised investors by not altering the financial guidance it gave on 13 February. At the time, the chip maker projected revenue of US$3-billion, plus or minus 2%, for its fiscal first quarter ending in April, representing a 35% increase from the prior year. The shares surged more than 17%, and continued their climb Wednesday, adding another 2.9%.

Nvidia may prove more resilient than most in dealing with the negative effects of the virus outbreak. In fact, its two key businesses — gaming and cloud computing — have actually benefited from some of the coronavirus mitigation developments in recent weeks.

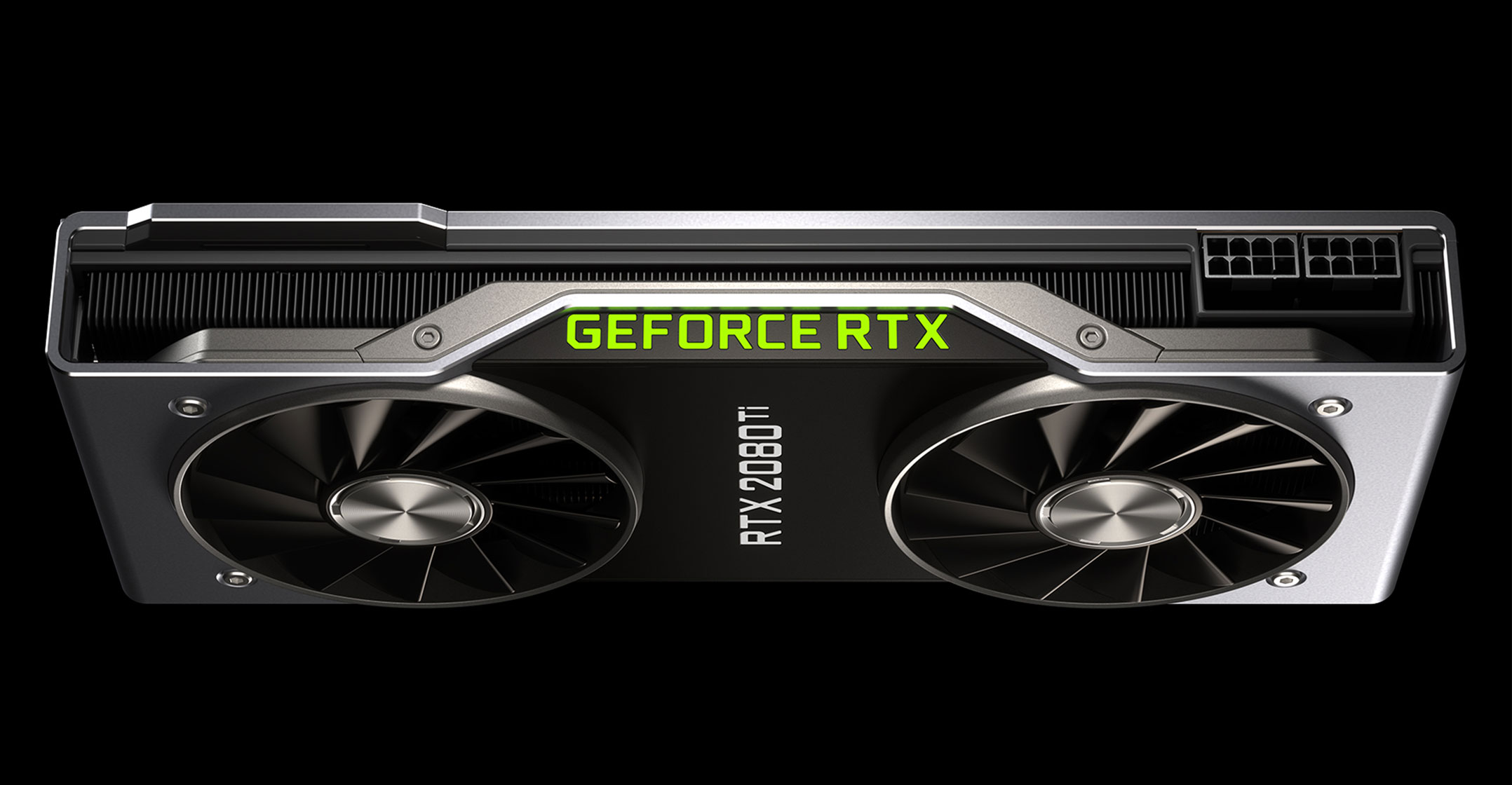

With social distancing, shelter-in-place restrictions and widespread school and other closures leaving more people inside with time on their hands, videogaming trends are soaring. That bodes well for Nvidia, as the gaming segment accounts for nearly half of its revenue. Nvidia management said they saw a 50% surge in total gaming hours from its installed base as many students and workers were staying at home. The company’s other core business — data centres, which generated almost a third of revenue in the latest quarter — is also humming, with usage of Internet services rising as more people work from home. Chief financial officer Colette Kress said companies are increasingly using Nvidia’s chips for artificial intelligence workloads such as natural language understanding and supply-demand forecasting.

Situation improving

Meanwhile, in China — which represents about one-quarter of its revenue — the situation is improving, as gaming cafes reopen and laptop sales rebound. Kress said the company’s manufacturing supply chain is coming back online and expects capacity to return to about 70% to 80% normal levels by month-end.

But even more important, the new products Nvidia originally planned to reveal this week are on track and expected to contribute revenue in the current quarter. Investors shouldn’t overlook this tidbit. Nvidia’s launch of its next-generation chips based on its code-named “Ampere” architecture may be its most promising one since 2016, one that led to a series of positive earnings surprises and large gains for its stock price.

So, while Nvidia is being rewarded for staying the course even as the coronavirus throws many other companies off track, it’s what’s not even baked in yet that may cheer investors the most. — Reported by Tae Kim, (c) 2020 Bloomberg LP