There’s a new personal financial management (PFM) website in town and it’s upping the stakes in an increasingly competitive market by offering its service completely free of charge. Pastel My Money is free to all users, even if they’re not current Pastel customers.

PFM tools have enjoyed prominence in SA in the past year, with the launch of 22seven, a graphics-rich website that aims to save users’ money by giving them a clear overview of their income and expenditure.

Pastel My Money went live on Thursday, but has been in private testing for more than three months. The service is the latest online offering from the company and follows the launch of its subscription-based online business accounting service, Pastel My Business Online, which was launched 18 months ago and which now has more than 2 000 users.

It’s partly due to the success of Pastel’s paid-for cloud-based business accounting offering that Pastel My Money will remain free, says Softline Pastel MD Steven Cohen. “We’re going to keep it free,” he says.

“If we can get thousands of people using the service it’s going to create awareness of the benefits of doing accounting online, and that might drive users to the My Business portal for their companies’ needs. We thought this would be a good way to get people used to the idea.”

Cohen says he’s found that although those younger than 30 have no problem with online services, many older people — both Pastel customers and resellers — remain “reluctant to go into the cloud space, even though many of them use Internet banking, which isn’t all that different to online accounting”.

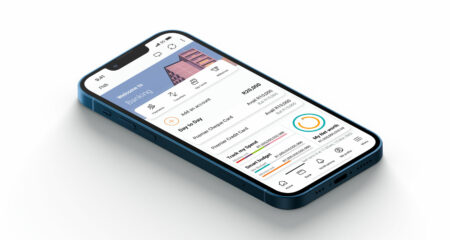

Plans are also afoot to roll out a mobile application in the next couple of months, starting with Android devices. An app for the Apple iPhone will follow, and Cohen says one may also be developed for Windows Phone 8 after it is released.

However, the company has no plans to make a BlackBerry app. Cohen says that although developing for the Web is “a pleasure” because it only needs to be done once, developing for mobile “is becoming a nightmare for programmers”. As a platform that is losing market share, Cohen doesn’t see a need to cater for BlackBerry devices.

He says the new service is meant to show people what they’re spending and help them to manage their budgets better.

“Eventually you might be able to use it to pay traffic fines, top up airtime or book show tickets,” Cohen says. “We’re having a lot of fun here, even though we’re earning no money from [the service]. We want people to go to it not just for personal finance, but for location-based services — like restaurant recommendations — or to use it as a complete digital record of their finances.”

He says users can upload scans of receipts, warranties or other documents and that there are plans to allow this directly from mobile phones in due course.

Cohen says he’s “amazed” at the sudden interest in PFM services and the number of them that have appeared in recent months.

“22seven is making a big noise in this space and now Absa is doing its own service. FNB is working on one, too, and Standard Bank is looking at it.”

The challenge for PFM services remains getting users’ transactional data uploaded in an easy and secure manner. Here the banks have a head start because they already have customers’ data, but Cohen says this omits important salary information such as tax and other deductions. “The banks only see the net amount.”

For the moment, Pastel My Money users need to export their bank statements from their online banking service and then upload these into Pastel My Money. “The last hurdle is getting bank statements to appear automatically, along with credit-card information.”

Cohen says he is in talks with three of the country’s four biggest retail banks about automating the process of importing current-account information. Like other PFM services, Pastel’s categorising tools do the bulk of the work once a user uploads their statement as the system learns to recognise repeat transactions.

“The only ace I have is the Pastel brand,” says Cohen. But with that comes Pastel’s involvement in payroll management. Cohen also wants to integrate payslip information where possible as Pastel handles more than 6m peoples’ salaries each month.

This could be an appealing feature at the end of the tax year as it would mean Pastel My Money could also account for all deductions made to salaries and not just net income.

Though Pastel My Money may not be able to offer the seamless experience of a bank’s PFM solution, it does have on major draw card: it’s free.

“22seven’s business is personal financial management, ours isn’t. Sure, we have an ulterior motive in that we hope to drive traffic to our other platforms and products. But the benefit of that is that we can really play with this service without the pressure of it having to make money.” — (c) 2012 NewsCentral Media