South Africa’s stately progress towards implementing fibre to the home (FTTH) has taken a turn for the better after two residents’ associations took matters into their own hands. One, Parkhurst in Johannesburg, has appointed a supplier and the other, nearby Parkview, is asking for quotes on delivering home fibre.

South Africa’s stately progress towards implementing fibre to the home (FTTH) has taken a turn for the better after two residents’ associations took matters into their own hands. One, Parkhurst in Johannesburg, has appointed a supplier and the other, nearby Parkview, is asking for quotes on delivering home fibre.

The big gorillas in South Africa’s telecommunications industry — MTN, Telkom and Vodacom — are all hovering at the edges of FTTH implementation. MTN has launched a pilot at the relatively small Monaghan Estate outside Johannesburg, with 60% of the estate’s households reportedly having signed up. At the announcement of its half-year results, the group’s CEO, Sifiso Dabengwa, said MTN would expand its fibre network to the homes of its wealthier South African clients.

Many people have been guessing that the merger between Vodacom and Neotel will lead to an FTTH product, but that’s as far it’s gone publicly. Telkom has told De Lanerolle that it will upgrade to copper-based very high-speed DSL broadband (VDSL) rather than building FTTH, perhaps fearing it will cannibalise its already strong DSL base in the area. Also, the mentality seems to be that the faster the bandwidth, the more money you can charge for it.

In April, we reported that Mark Elkins of the Internet service provider Posix was planning to build his own fibre route from Pretoria to Johannesburg and to offer FTTH to households along the route. This plan is still in the works and Posix was a bidder for one of the residents’ association contracts.

In June 2014, a new start-up, Vumatel, said it was planning to raise funds to roll-out FTTH to around 200 000 homes in 100 locations across the country at an estimated cost of between R2bn and R3bn. CEO Niel Schoeman said that he wants to create an alternative last-mile infrastructure on an open-access basis. It also secured its first contract from the Parkhurst Residents Association, an area nearby to Parkview.

A Parkhurst residents’ committee reviewed 16 proposals from operators such as MTN, Vodacom, Telkom, Dark Fibre Africa, SA Digital Villages, Atec, Liquid Telecom, ClearlineIS, Posix and Cool Ideas. Security providers Cortac and CSS also submitted proposals.

“I’ve been going to the FTTH Africa conference for two to three years now and it was a fairly sad gathering. No one was doing anything. People would say they’d do it if you paid them but no-one was investing,” said Indra de Lanerolle, who is heading up the fibre initiative in Parkview.

Parkview set the cat among the pigeons by putting out a tender to supply the area with high-speed fibre lines. This kind of “forward leaning” approach, where consumer bodies aggregate demand, has the potential to shift some of the power away from the sluggish business strategies of the big gorillas. The neighbourhood is examining three options for getting FTTH:

- Build, operate and transfer.

- A community-owned company, where the residents would sign a contract with this company and it would ask the residents to make a down-payment of R1 000 to be used as starting capital.

- A contract approval approach, in which the residents’ association approves the contracts with suppliers and in exchange looks to get concessions like free Wi-Fi in public areas and schools.

Parkview already operates its own security company that patrols the public spaces and about 650 out of 1 100 households pay for the service. De Lanerolle said there is some trepidation about the potential monopoly aspect of option two, but says that the key is to avoiding this is that the residents’ association must have the ability to sack the supplier if the service is unsatisfactory.

“I don’t know which model we’ll go for, but we’re saying it must be open access, so I think suppliers like Telkom will ignore it.”

Potential suppliers feel that the service should be priced at between R2 000 and R3 000/month, whereas Parkview’s research shows consumers have a price of less than R1 000 in mind. Speeds as high as 1Gbit/s have been discussed, but not necessarily at these prices. Comparisons with Kenya are instructive. Jamii Telecom offers 20Mbit/s at US$223/month, and Wananchi’s high-end package for 50Mbit/s costs $1 115/month. As with everything, prices will have to come down, even at the top end of the market.

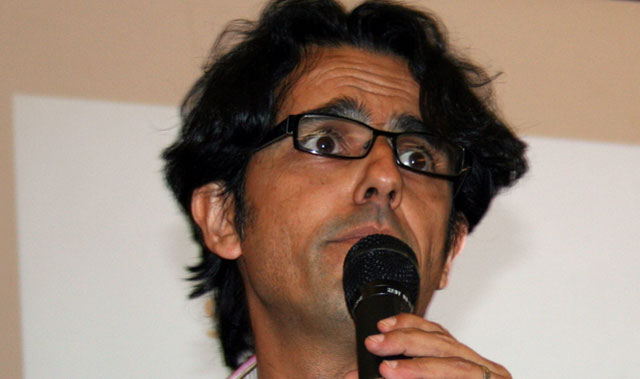

De Lanerolle is not just your average citizen keen on fibre broadband. He’s been closely involved in policy work to get wider Internet access. As someone who spends a great deal of time arguing for Internet for those who can’t afford it, his eyes were opened when he visited Kenya and saw one operator “rolling out fibre in the equivalent of Soweto”.

He understands that by itself, FTTH will be for the wealthier suburbs rather than South Africa’s townships, but sees it as part of a broader need to upgrade and extend the country’s telecoms infrastructure.

- Russell Southwood is head of Balancing Act Africa