Facebook is heading toward its worst month since May 2013 after an analyst report warned of a temporary pullback in advertising and the US Federal Trade Commission (FTC) confirmed it’s investigating the social network’s privacy practices.

The stock fell 1.4% to US$157.14 at 2.35pm on Monday in New York, bucking the broader positive direction of the markets. Earlier, the shares fell as much as 6.5 percent, erasing about $100 billion in market value in the past 10 days. They closed the session up 0.4%.

Colin Sebastian, an analyst at Robert W Baird & Co, wrote that the firm’s latest social media survey indicates “some moderation in Facebook usage”, and noted potential for brands and small and medium-sized businesses to “pause some Facebook campaigns until headlines subside”. He lowered his price target to $210 from $225 while saying shares remain attractive for investors with medium- to long-term time horizons.

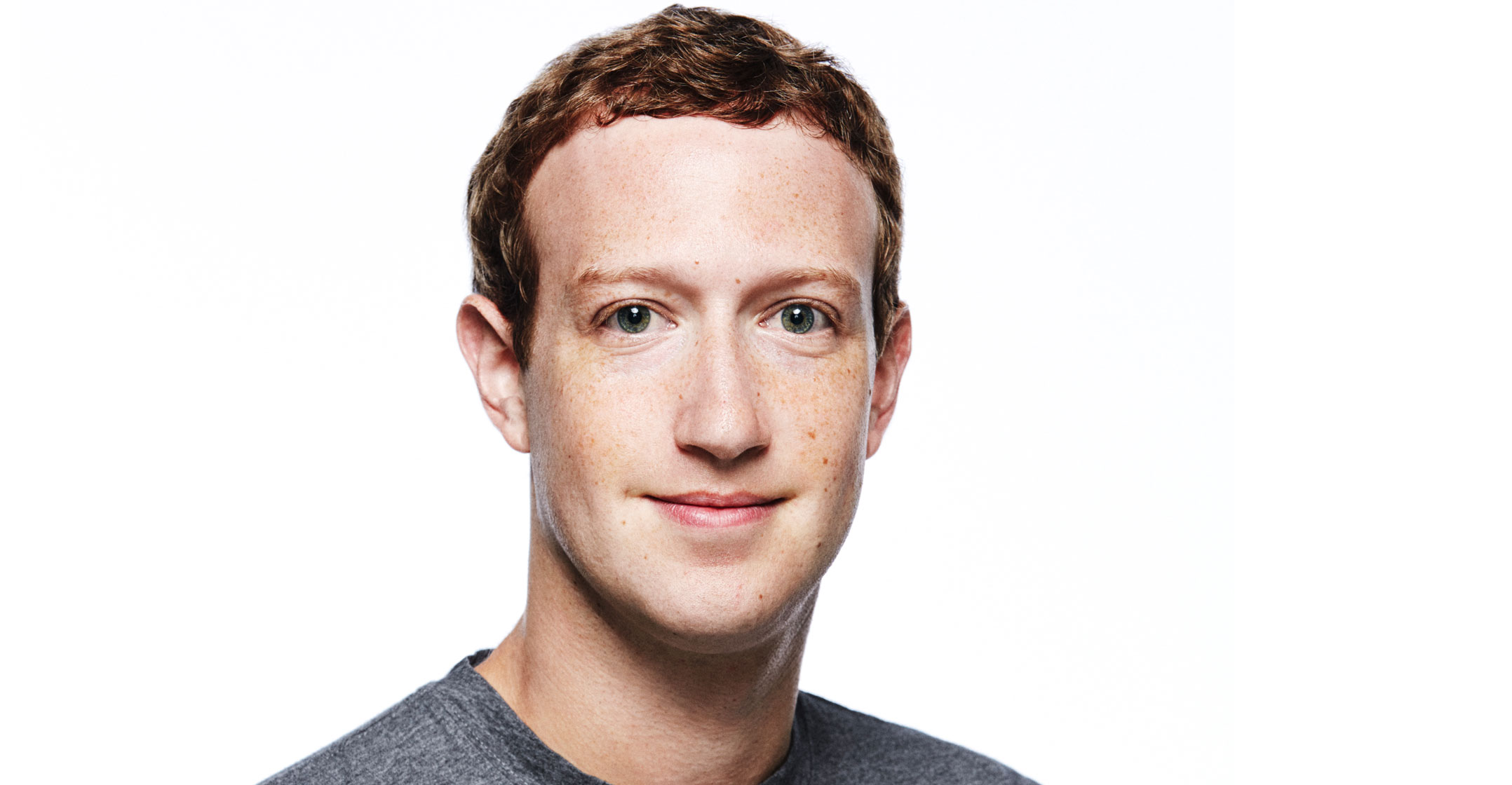

Facebook CEO Mark Zuckerberg is facing one of his worst crises in public confidence yet after reports that Cambridge Analytica, a firm that worked for US President Donald Trump in the 2016 election campaign, improperly obtained and then retained data from 50m Americans.

The FTC confirmed on Monday that it has an open non-public probe into Facebook’s privacy practices, saying it “takes very seriously” recent reports about misuse. Bloomberg reported last week that the FTC is looking into whether Facebook violated terms of a 2011 consent decree over its handing of user data that was transferred to Cambridge Analytica without their knowledge.

Facebook deputy chief privacy officer Rob Sherman said on CNBC that the company remains “strongly committed to protecting people’s information. We appreciate the opportunity to answer questions the FTC may have.”

Later on Monday, Zuckerberg was invited to testify before the US senate judiciary committee on 10 April as questions pile up over the social network’s data-privacy practices. Facebook said it has received the invitation and is reviewing it. Two other congressional committees also have invited Zuckerberg to testify, and last week he said he’d agree if he is the right person to appear.

Short lived

Even if some advertisers temporarily pull back on Facebook spending, Sebastian said he expects the move to be short lived “as there are few channels available that can match Facebook’s return on ad spend”.

And Facebook has other things going for it, such as Instagram, some analysts noted.

“As an offset, Instagram’s growth becomes key,” Bloomberg Intelligence analyst Jitendra Waral wrote in a note. Wells Fargo’s Ken Sena also defended the stock, telling clients in a note that the weakness creates a “buying opportunity”.

Despite the stock drop — about 16% in the past week — and increase in regulatory scrutiny, Facebook still has 44 buy ratings and only two sell ratings. The shares are trading roughly 30% lower than the average Wall Street price target of $221.19.

Facebook is scheduled to report quarterly earnings on 2 May, giving it just over a month before facing more questions on calls to discuss the results and analysts will see if they are willing to still hold on to their optimism. — Reported by Julie Verhage, with assistance from Brandon Kochkodin, (c) 2018 Bloomberg LP