While there has been a lot of hype around the South African financial technology (fintech) space, investors are, to some degree, missing the depth and vibrancy in the emerging “health-tech” sector.

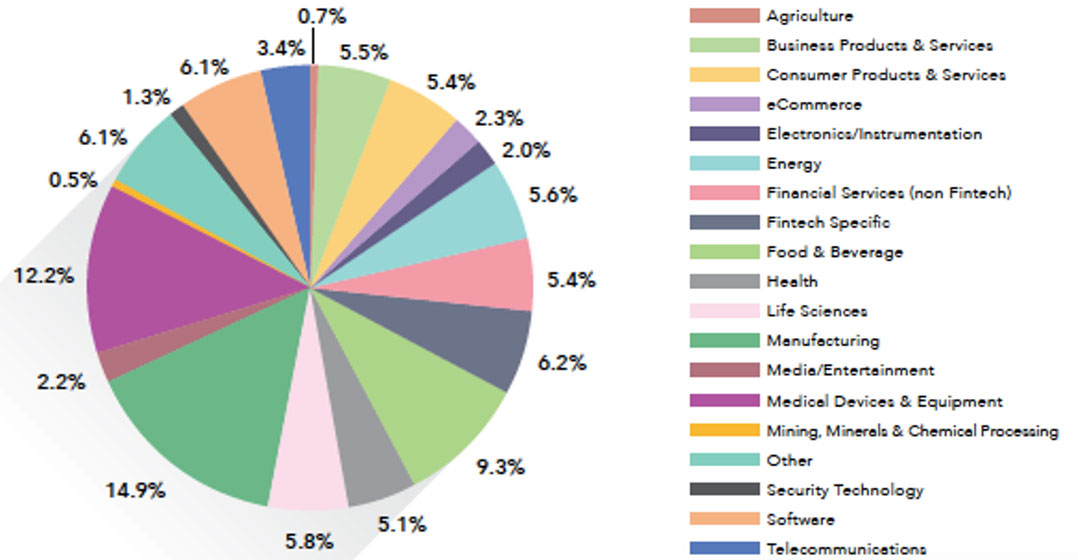

A quick look at the South African Venture Capital Association (Savca) 2017 “Venture Capital Survey” tells an interesting story. The “Life Sciences” category, which comprises biotechnology, medical devices and general health applications, made up 19% of the current active investment portfolio and a quarter of the value of all of the deals.

There are four main reasons why the sector is likely to see noticeable growth in the coming years:

Section12J

Even if we strip out the asset-backed financing, the South African Revenue Service’s 12J tax incentive has created significant interest and inflows into the South African venture capital sector in recent years. The definition of a “venture capital company” remains quite broad and flexible, but the number of venture capital funds has exploded from less than 30 to over 100 in the past couple of years. Fund managers are now under pressure to allocate this capital to ensure that they stay in mandate.

However, 12J has certain limitations around both the property and fintech sectors in terms of whether they would be considered qualifying investments. There are fewer restrictions around the healthcare sector and this should see deal-flow improve.

Margins and market

Invariably this comment will draw some consternation from champions of the fintech sector, but when one looks at several the “fintech” businesses being shopped around, they focus on disruption of the asset management, insurance and payment markets on a cost level. In contrast, the biotechnology and medical device sector is likely to offer exportable intellectual property which can break into international markets at higher margins.

Intellectual property tied up in universities

With nearly R1-billion in damages inflicted during the #FeesMustFall campaign and student financial aid schemes under pressure, universities are being forced to identify new ways to generate new revenue.

The universities have significant intellectual property, including in terms of healthcare, biotechnology and medical devices, tied up inside of their institutions. Wits University and the University of Western Cape have actively geared up their innovation units and are engaging private-sector participants.

While there are still hurdles in terms of IP transfer and rights assignment, but the right questions are being asked.

Public-private partnerships

While the concept of PPPs has been met with some cynicism, there is some positive momentum in this space with the likes of the Innovation Hub trying to bridge the gap between innovators and government institutions and non-profit organisations. Two teams to watch in this space are mLab — which is rolling out dedicated healthcare “labs” in Tshwane, the Western Cape, the Northern Cape and Polokwane — and the team from OneBio who are working closely with the Cape Innovation & Technology Initiative.

Conclusion

While there is debate around the actual implementation of the National Health Insurance System, the South African healthcare market is likely to see significant shifts as the market is opened to the broader population. A quick look at the “critical skills” list published by the department of home affairs highlights the skills shortage in the health science sector.

While “fintech” gets the headlines, “health-tech” has plenty to offer. Savvy investors and partners are making some tangible moves.

- Marc Ashton is CEO of South African medical technology firm Dynamic Body Technology and financial problem-solving resource Decusatio