AMD’s stellar share price performance this year reflects its place in the eyes of investors looking to make an artificial intelligence trade: the best backup plan.

The stock’s 87% surge would make it the top performer on the Philadelphia Stock Exchange Semiconductor Index if it wasn’t for the stratospheric gain of rival Nvidia. Nvidia briefly became the first chip maker to have a trillion-dollar market value after delivering concrete evidence that the rush to develop new AI services is translating into a surge in orders for hardware.

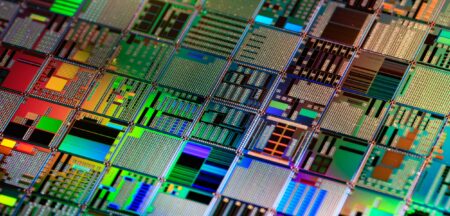

AMD gets its shot to prove it’s also a player in AI computing on Tuesday when executives introduce new data centre chips at an event in San Francisco. Investors will get a peek at its Epyc processor aimed at cloud computing, but they’ll likely be more focused on the forthcoming MI300, a purported rival to the H100 from Nvidia that’s at the heart of that company’s strong position.

“AMD’s strategy is to be a one-stop data centre chip maker,” said Carl Hazeley, senior analyst at Finimize, an investing insights platform owned by Abrdn. “As to whether AMD could be successful in competing with Nvidia, it basically comes down to waiting and seeing — and maybe buying both AMD and Nvidia.”

The stock’s rally assumes that AMD is poised to grab part of what Nvidia CEO Jensen Huang says is the need to replace US$1-trillion of data centre hardware worldwide with gear more suited to AI computing.

So far, investors have given it the benefit of the doubt on that score, briefly pushing its market value to more than $200-billion. A key attraction for them is that the stock is far cheaper than Nvidia, trading at 7.8 times projected sales for the next 12 months, less than half its rival’s 20 times.

Circumspect

Analysts are more circumspect, preferring to wait for AMD to show them how it’s going to make money from the technology. Their aggregate price target is 11% below the last close.

One warning sign, according to Morgan Stanley analyst Joseph Moore, is that AMD’s server business remains sluggish. That indicates the firm is one of a group of companies whose “current portfolios are not a meaningful beneficiary of the AI surge, even though it is helping portions of their business”, he wrote in a research note.

Read: The trillion-dollar man: who is Nvidia’s Jensen Huang?

How long AMD has to deliver the goods remains to be seen. In recent years, the company has taken on Intel, carving out 18% of the server market, one of the most lucrative areas of the semiconductor industry. However, the battle with Nvidia for a slice of AI-driven sales won’t be easy, said Richard Clode, a portfolio manager with Janus Henderson.

“Nvidia is executing pretty flawlessly, so it’s a much tougher competitor for AMD than Intel was,” Clode said. — Ian King and Subrat Patnaik, (c) 2023 Bloomberg LP