MultiChoice Group has reported a decline in subscribers, while investment ahead of a planned relaunch of Showmax, coupled with foreign exchange losses in Nigeria, has stained its income statement in red ink.

MultiChoice Group has reported a decline in subscribers, while investment ahead of a planned relaunch of Showmax, coupled with foreign exchange losses in Nigeria, has stained its income statement in red ink.

The Randburg, Johannesburg-headquartered group reported a 5% year-on-year decline in subscriber numbers as load shedding and the aftereffects of last year’s soccer World Cup weighed heavily on consumer demand.

In its interim results for the six months to end-September 2023, published on Wednesday, the pay-television group said the decline in subscriber numbers would have been less severe if it hadn’t been for the company cutting off non-paying subscribers.

However, there was some positive news, too: the premium segment, which includes DStv Premium, posted growth of 5%, reflecting a “positive trend for the first time in many years”.

“Coming off a high-growth period linked to the Fifa World Cup in the previous six months, the group’s overall 90-day active subscriber base contracted by 2% to 21.7 million,” it said. The rest of Africa base, accounting for 60% of linear customers, grew by 1% to 13 million, while the South African business had to contend with load shedding with 43% of the days in the reporting period impacted by stage-4 or higher cuts.

“Subscriber growth was also affected by a decision to remove 311 000 non-revenue-generating customers (linked to special load shedding campaigns) from the base. In total, [South African] customer numbers were 5% lower at 8.6 million…”

Cost-cutting

Group revenue grew 4% organically to R28.3-billion. On a reported basis, however, the figure was 1% lower. Trading profit fell 18% on a reported basis but was up 18% on an organic and like-for-like basis (excluding the additional investment in Showmax). With the Showmax costs included, this reduces to a 10% improvement.

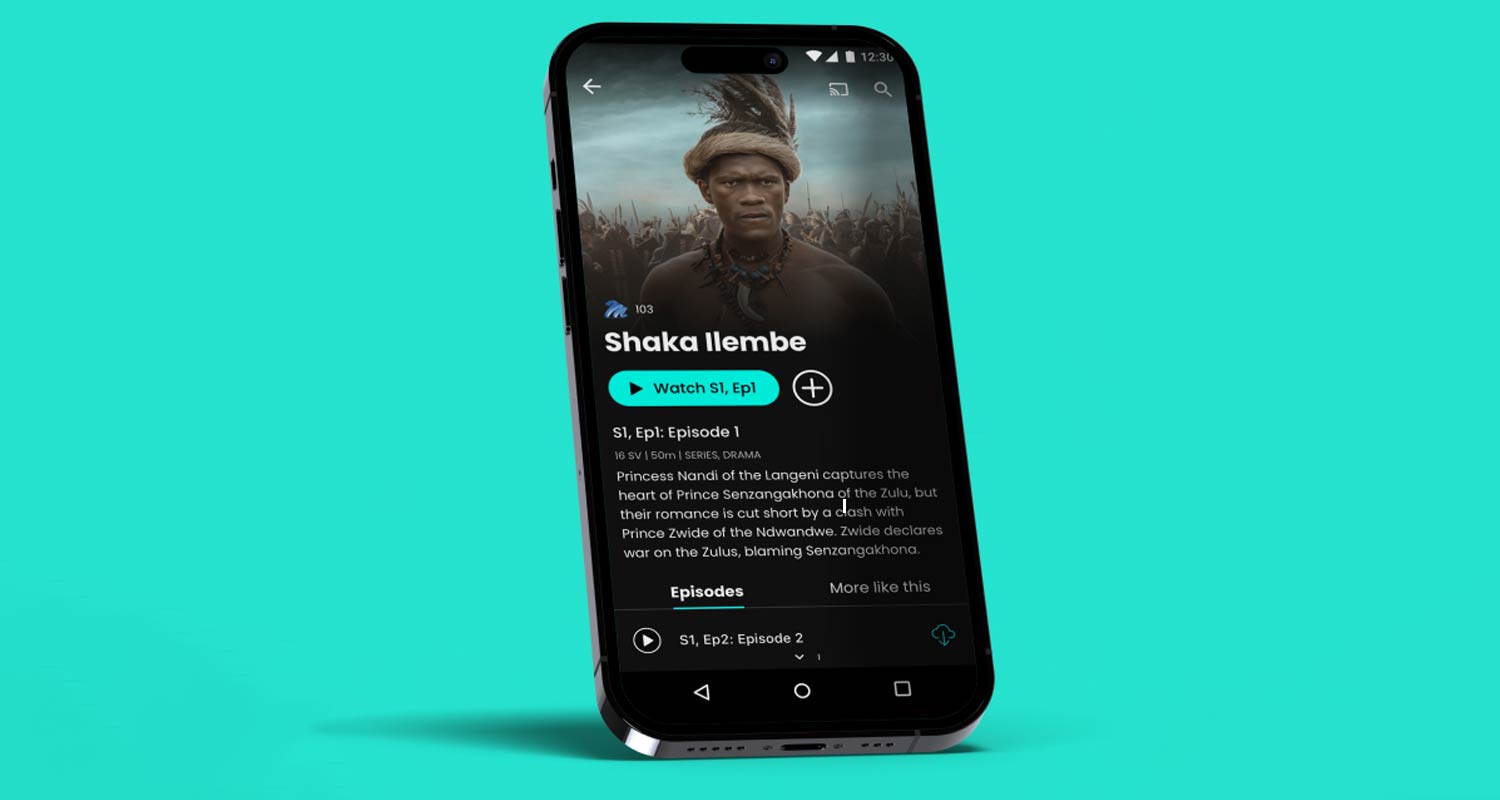

The investment into Showmax was R500-million higher year on year, mainly due to dual platform costs that will normalise once customers have migrated to the new Showmax. Handily, the group also delivered R500-million in cost savings, with a full year target of R800-million lifted to R1-billion. Showmax reported a trading loss in the six-month period of R800-million.

Read: MultiChoice shares fall to record low as forex losses mount

Group core headline earnings, MultiChoice’s measure of the underlying performance of the business, declined by 5% to R1.9-billion, impacted by the same drivers weighing on trading profit, with some offset from realised gains on forward exchange contracts and lower tax and minorities in South Africa.

The group has introduced an adjusted core headline earnings metric to incorporate the impact of losses incurred on cash remittances in markets like Nigeria, as these costs “can no longer be viewed as temporary in nature”.

“This metric reflects an increase of 25% to R1.5-billion, resulting from lower losses on cash remittances as the gap between the official and parallel naira rates narrowed following the material depreciation in the official naira rate during the reporting period,” it said.

“This metric reflects an increase of 25% to R1.5-billion, resulting from lower losses on cash remittances as the gap between the official and parallel naira rates narrowed following the material depreciation in the official naira rate during the reporting period,” it said.

Group free cash flow declined by 40% to R1.1-billion, weighed down by pressure on the South African business and the increased investment in Showmax.

No interim dividend was declared, in line with group policy. – © 2023 NewsCentral Media