Load shedding and spiralling electricity prices are now part of South African daily life. What, then, can be done about it?

Load shedding and spiralling electricity prices are now part of South African daily life. What, then, can be done about it?

If one were to take a long view, one could confidently say that our electricity problems boil down to one thing: South Africa has never been able to price electricity correctly. Eskom’s own doubtful sustainability on multiple fronts — operational, technical, financial and indeed environmental — all come down to this one fact.

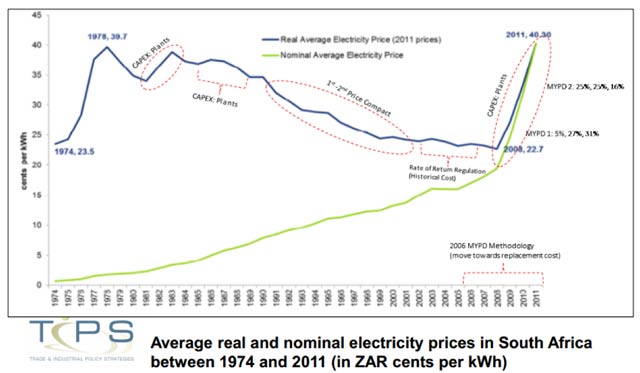

Between 1991 to 2008, when Eskom entered into a pricing compact, South Africa saw a progressive reduction in the price of electricity. A 2014 graph from a paper entitled “Repositioning electricity planning at the core: an evaluation of South Africa’s Integrated Resource Plan”, written by the Trade & Industrial Policy Strategies for the National Economic Development and Labour Council (Nedlac), shows this historical trend. It also shows the steep increases since 2008 which, as we have seen, are continuing:

If one goes back to the 1970’s and 1980’s, there is a repeating pattern. When Eskom builds capacity, it builds far too much capacity, often with untested technology, and electricity prices shoot up.

The real problem we inherited from those years is that excess capacity needed to be mopped up. This was done in several ways: by attract energy-intensive industry like aluminium smelting, but also by pricing electricity less than it costs to produce over the long term. This sort of behaviour wreaks havoc with any sensible energy policy making.

This is not to say that there have not been attempts to develop policy. The 1998 white paper on energy, which sought to liberalise the energy sector, was formally adopted by national government. A cabinet resolution in 2001 prescribed that 30% of Eskom’s generation capacity be sold to the private sector, and in 2004 cabinet decided that 30% of new generation should be built by the private sector.

To support these policies, a moratorium on Eskom building its own capacity was imposed, which was lifted in 2004. None of these initiatives came to anything. Several reasons, including regulatory risk and protracted procurement processes, are blamed, but the real problem was low electricity prices. You simply can’t attract investment into a sector where the product is sold for less than it costs to produce. One can’t expect politicians to drive policy, which, if implemented, results in immediate increases in prices. The result is a slow drift to the precipice, which is where we are now.

It is not just national government policy. Local government, responsible for up to 40% of electricity supplied to end users, has used significant mark-ups on electricity to fund all sort of other projects. In larger urban areas, electricity makes up as much as 40% of total revenues and, although hard to establish, net surpluses from the sale of electricity amount to between 15% and 20% of these revenues. The sale of electricity does not only cross-subsidise other municipal expenses, it it also uses net surpluses generated by high-consumption users through an inclined block tariff to subsidise free and low-consumption users. It is not as though local reticulation has been maintained, with estimates of maintenance and refurbishment backlogs sitting at R27bn and growing by R2,5bn/year — and this excludes debt to Eskom of over R10bn.

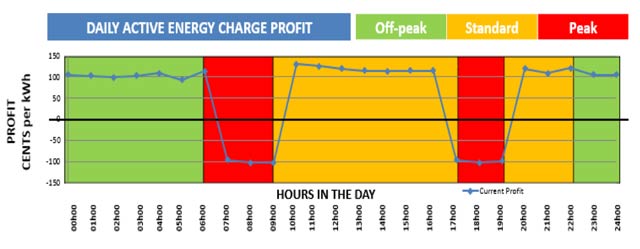

It can’t continue. Most municipalities use Eskom’s MegaFlex tariff. While the trend in Eskom’s average pricing is sharply upward, a more significant change is in the differentials between off-peak and peak pricing, which is closer to R240/kWh, a differential of 14 times. In a constrained supply environment, this differential is set to grow as it should and is closer to the position in other jurisdictions. In a more liberalised electricity market, we would have got to these differentials a long time ago.

Recent figures released by national treasury and published by Statistics South Africa show the importance of the sale of electricity, particularly in the context of the more urban municipalities or municipalities that supply large industrial customers. We are also aware that Eskom’s tariff trajectory will be steeply upwards for the next few years.

Importantly, it is less about the upwards movement of the average tariff, but more in the increasing differentials between off-peak and peak pricing. Just a few years ago, the differential between peak and off peak in Eskom’s MegaFlex tariff (the tariff applicable to most municipalities) was around eight times; the differential now is more than 15 times. In future, the differential is likely to increase to 20 times. Electricity is expensive to store and, in general terms, has to be consumed as it is produced. The marginal costs of supplying electricity during peak times are much higher than at other times.

These changes to peak pricing are more significant for municipalities that are more exposed to the residential sector than Eskom. Although residential use of electricity in South Africa represents 18% of all electricity demand, at peak times residential demand represents over 35% of total demand. At present, large municipalities are already supplying electricity to residents during winter peak times at a loss. The peak period, five hours of the day in winter, accounts for half of the total cost of all electricity supplied on the day in question. A stylised representation for a municipality might be as follows:

The problem becomes more acute when “losses” during peak times are not fully recovered from the sale of electricity during off-Peak and standard times. Higher flat rate residential tariffs mean that South Africans are having to save electricity where they can. But they save during standard and off-peak times which is where the surpluses are generated. Moreover, residents and businesses paying the highest inclined block tariffs are looking to move to solar water geysers and embedded generation (largely installing PV panels). Yet, during the early mornings and evenings (peaks), these customers are still drawing electricity from the grid, which makes them increasingly less profitable. Municipalities are not able to fully recover their position due to the flat tariff imposed on these customers.

The obvious answer is to move to time-of-use metering and charging for consumption accordingly so that municipal customers are aligned with the supply position faced by their local authorities. Any serious demand side management that does not destroy the electricity supply revenue model depends on time-of-use charging.

However, the installation of smart meters, where this has been carried out, has not produced the desired results. The tenders for smart meters issued by Johannesburg and the Tshwane municipality have garnered publicity for all the wrong reasons. This problem is widely recognised and is likely the reason for an RFI issued by the department of co-operative governance & traditional affairs dealing with standardising the specifications of a national standard for smart meters. But we should be cautious about this, too. When dealing with a big change, there is a tendency to over-engineer things. We want smart meters that do all sorts of additional things like remote management of electrical appliances behind the meter. That is a mistake.

The other mistake is to issue large tenders for the roll-out of vendor-specific smart meters based on a tender process. The stakes become too high, and undue influence and bid rigging becomes inevitable. Even apparently low pricing on installation of end-to-end solutions results in vendor lock-in so that, in perpetuity, the municipality concerned becomes de facto dependent on the selected vendor for continued service. Moreover, there is no guarantee of future-proofing the smart meters.

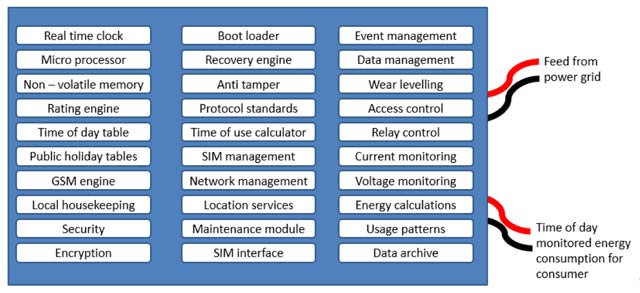

Perhaps, then, it is time to move away from “smart” metering and focus on the main issue: time-of-use metering. This makes meters much simpler. A simple meter, costing about R800, might have just the following:

Any number of local manufacturers could build a time-of-use meter like the one above.

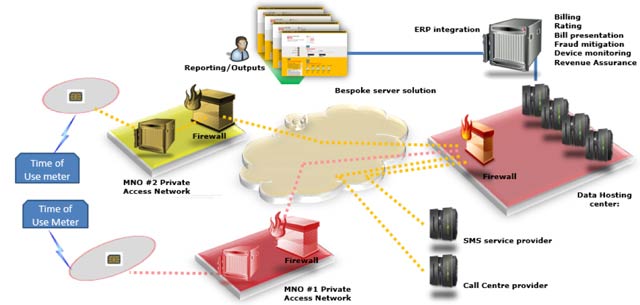

The mains issue, though, is this: electricity and the billing has to remain under the control of the municipality itself. The larger metros have recently committed huge resources to updating their billing systems. To remain in control, they must also be the custodian of the telemetry platform that connects and communicates with all smart/time-of-use meters. Importantly, this telemetry platform will use a cohesive but loosely coupled architecture that ensures any component can be replaced with no impact to the end-to-end solution. Using bulk purchasing, municipalities ought to be the contracting party with the cellphone networks that provide the connectivity to all the devices in the field. Both these elements should not be contracted out to any proprietary vendor or solutions provider.

A schematic of the time-of-use metering environment might therefore look like the following:

The strategically important issue here is that no one entity owns the complete supply chain. However the municipality controls the following:

- The protocol to communicate to the time of use meters fitted/deployed.

- The protocol between the GSM engine in the meter and the management platform.

- The protocol from the management platform to the existing ERP applications.

The municipality must also own and control the access network (for security and liability), the on-boarding process for meter manufacturers, and provide a certification process to approve meters as well as Sim and access networks.

There are several other inherent advantages to the suggested approach:

- It keeps the electricity departments in control of electricity supply. In particular, it maintains full control of billing functions.

- There is a need to build capacity internally and not commence a lengthy and overly complicated tender process.

- Simpler process reduces change management to a minimum by reducing complexity.

- The municipality is able to build local skills and Internet-of-things capacity within electricity departments, among local manufacturers and electronics assemblers.

- It allows municipalities to expand telemetry (Internet of things) services to other applications — traffic lights, remote asset monitoring without requiring a complete, standalone solution for each of those.

- The municipality’s bulk buying power can be leveraged to achieve the best discounts from providers of services (and cost drivers) within the value chain such as connectivity providers (the cellphone networks).

In time, the municipality will be able to use and develop meter data management and analytics engines to help with pricing, measuring demand response initiatives and so on.

The proposed approach also allows for piloting. Instead of getting a vendor to install, say, 100 000 meters, a refinement of requirements can be done through discrete pilot projects, which limits risk and builds internal municipality institutional buy-in. The piloting of smaller implementations across different types of municipalities gives valuable lessons for optimising large-scale deployments. In all cases, the municipality can decide how to proceed, but to do so from a position of knowledge and control.

The biggest benefit, though, is that the roll-out of time-of-use metering would be much, much cheaper than the smart metering implementations that we have seen to date. Indeed, a programme such as the one suggested here pays itself off, reducing the need for earmarked capital budgets for smart metering. Being able to implement time-of-use pricing may increase profitability on the sale of electricity, while consumers, by changing consumption habits, may be able to reduce their electricity bills.

The aligning of incentives creates another virtuous pattern. Presently, several energy-saving initiatives, such hot water geyers and energy-saving light bulbs are subsidised, often at great cost. The benefits of these subsidies are enjoyed entirely by the consumer who installs them (who derive the benefit of the savings). Time-of-use metering (and pricing) changes the dynamic. The capital costs of energy-saving devices or even just change of behaviour becomes the responsibility of consumers — as it is with any other product or service.

Charging electricity at the time that it is used is inevitable. Developing the capacity and means to do so need not be a series of expensive mistakes. There is a much better way.

- Dirk de Vos is an energy expert. He is a founder member of IoTa, an Internet-of-things (IoT) accelerator that focuses on developing capacity for projects using IoT technology. He can be contacted on [email protected]