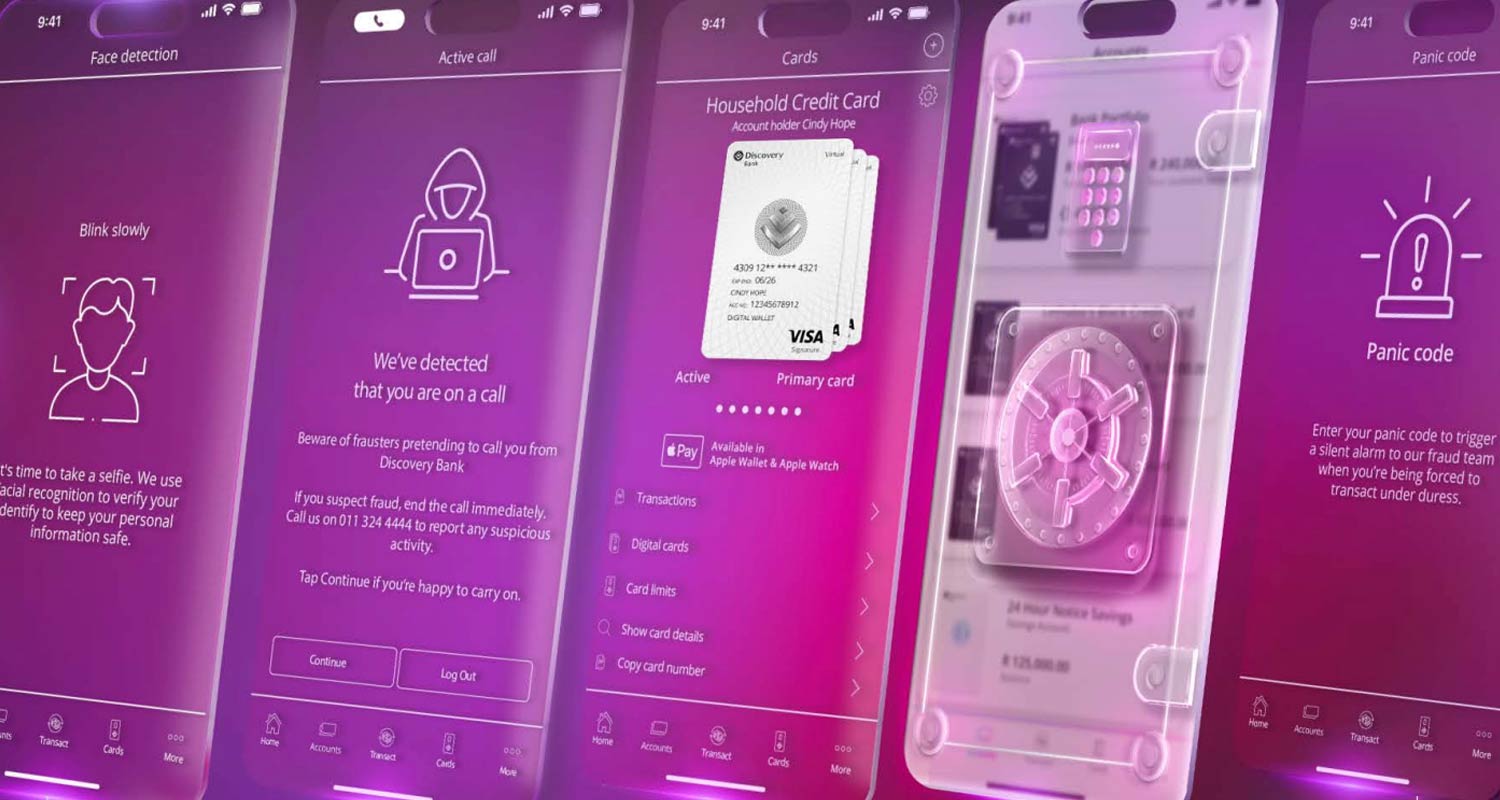

Discovery Bank is adding a raft of security and AI features, giving clients more power to fight criminals, including in instances where they are forced to open their banking app under duress.

As so-called banking app kidnappings increasingly strike fear into the hearts of many South Africans – stoking worries that they’ll be held at gunpoint and forced to unlock their phones and have their money transferred and stolen – Discovery Bank CEO Hylton Kallner said on Thursday that the new tools give its customers the ability to defend themselves and even seek help in dangerous situations.

Not only will bank customers be able to hide large-value accounts in the app – a feature offered by other South African banks – but by setting up a “panic code” in the app, they will be able to alert the bank remotely that they may be under duress, Kallner said.

When they use their panic code, Discovery will receive a notification of a potential situation and will immediately place restrictions on the client’s accounts and will even determine their location using their phone’s GPS to send law enforcement or armed response directly to the scene.

“Once you enter your chosen panic code, transactions will continue to be processed as normal, but it will alert our fraud management team. They will start monitoring transactions and, when necessary, activate an emergency response,” said Kallner.

He said the Discovery Bank app will also link clients to emergency services through the Discovery 911 service for emergency help, whether it’s related to health, home or roadside emergencies.

Kallner said technological threats to financial services industry clients are multiplying as banking becomes increasingly digital.

Sophistication

“The global rise in phishing, website cloning, card fraud and other social engineering tactics highlights the evolving sophistication of fraudsters and the shift of fraud risk to the client and their smartphone,” he said.

“While technology has made payments faster and more secure, banks must go further by empowering clients with the tools and protections they need to navigate these risks confidently.”

Another new security feature announced by Discovery Bank on Thursday will provide persistent in-app fraud warnings that remind clients to think twice and verify who they’re speaking to if they’re on a call when opening the app.

Read: FNB replaces MTN as main Springboks sponsor

The bank also announced that:

- Vitality Money, the bank’s behavioural change programme, now incorporates rewards for financial planning to align clients’ short-term goals and long-term aspirations, including estate planning.

- Discovery AI is now available, offering a more personalised digital banking experience.

“AI is reshaping the future of banking, enabling smarter, faster and more personal financial experiences. It offers banks the ability to move beyond one-size-fits-all services and deliver tailored support that empowers clients, improves accessibility, and brings private banking insights and service to everyone,” Discovery Bank said in a separate statement on Thursday.

“AI is reshaping the future of banking, enabling smarter, faster and more personal financial experiences. It offers banks the ability to move beyond one-size-fits-all services and deliver tailored support that empowers clients, improves accessibility, and brings private banking insights and service to everyone,” Discovery Bank said in a separate statement on Thursday.

“AI is unlocking new ways to connect with clients: from predictive insights and seamless digital support to hyper-personalised financial tools once reserved for high-net-worth individuals.”

Read: Discovery turns to AI for ‘hyper-personalised health care’

Clients will be able to access Discovery AI through the bank’s WhatsApp channel. After being securely authenticated in the app, clients can use text, voice notes or images to get answers about their spending and savings patterns, understand their accounts better, and get suggestions to budget effectively and maximise product features and rewards, it said. – © 2025 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.

Don’t miss:

TCS | Discovery Bank CEO Hylton Kallner on tech, AI and the future of banking