FNB has unveiled a new corporate identity, consisting of a simplified version of its iconic tree logo, and rolled out a redesigned website and banking app.

At a launch event at its head office in downtown Johannesburg on Friday, the bank said it is also shaking up its go-to-market strategy, trying to become more “advice led” and less “product led” in the delivery of its solutions.

The new FNB logo — see it lower down in this article — is designed to be “more versatile and resonate beyond banking and financial services”, said the bank’s chief marketing officer, Faye Mfikwe.

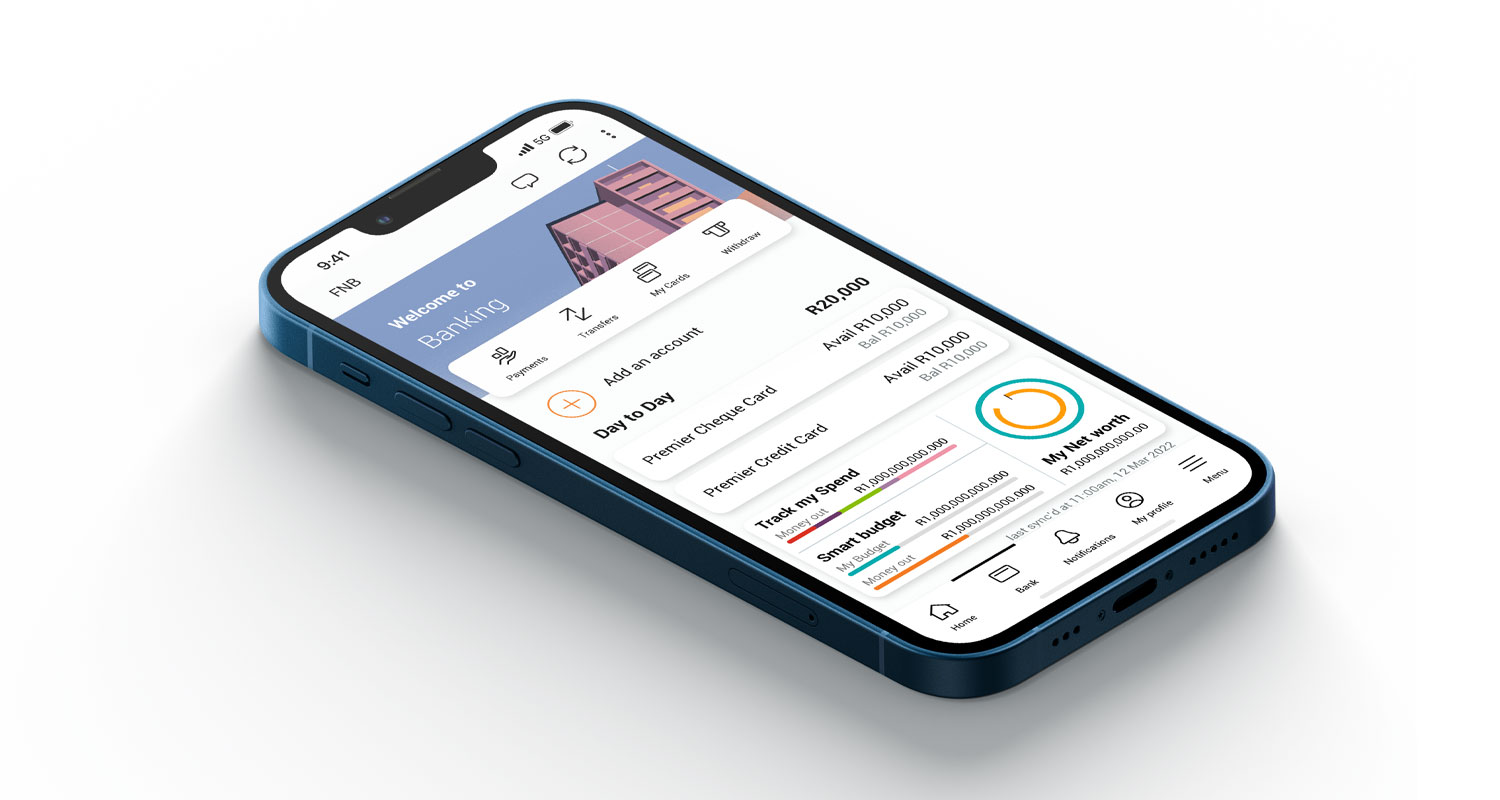

The redesigned FNB app, meanwhile, is designed to be more “personalised”.

“Customers can now personalise their FNB app by customising its home screen and selecting frequently used or preferred features,” FNB said in a statement.

“Customers can also view a snapshot of their transactional accounts, credit, investments, insurance and value-added services. In addition, the search function has been improved to help customers find services much quicker.”

Similar enhancements are being made to the Internet banking channel, it said.

FNB Pay is now the payments umbrella in the FNB app. New or improved payment options in the app include:

- Instant Payments: This allows customers to pay anyone via the FNB app using just a card number. The recipient gets the money instantly in their bank account, irrespective of where they bank.

- PayMe: This allows customers to request a payment digitally to any FNB-banked cellphone number. The person requesting the money follows a few prompts, and the payer is immediately notified and simply needs to accept the request to make an immediate payment.

- ChatPay: This allows customers to pay or request payment from any FNB customer using the app’s chat functionality without the need for an account number. Customers can initiate a chat using their contact list, and because the interaction takes place within FNB’s platform, it is safe.

- Bill Payments: This is a quick way for customers to use the app to pay their EasyPay or Pay@ bills including municipal rates, medical and other services.

- Virtual Card: Customers can now use their global virtual cards for travel bookings such as buying flights or booking accommodation and adding the virtual card to third-party digital wallets such as Google Wallet or Apple Pay for safe payments when traveling abroad.

With a few taps, customers can now also split a bill. And significantly for business owners, business account holders can receive contactless payments on their Android smart devices, without the need for a separate point-of-sale device, through a new service called Speedee. – © 2022 NewsCentral Media