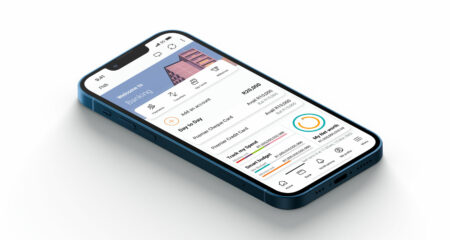

First National Bank has continued its push to get more of its customers using its app as their primary channel for transacting, payments and banking. In previous years, it slowly dangled the proverbial carrot to incentivise customers to use the app ahead of other digital channels such as Internet banking and ATMs (and most certainly ahead of its physical branch footprint). The bank has used its eBucks rewards programme as a wedge to incentivise (and reward) this behaviour and has tweaked this into more of a “carrot” with a change at the top-end of its customer base announced in June.

First National Bank has continued its push to get more of its customers using its app as their primary channel for transacting, payments and banking. In previous years, it slowly dangled the proverbial carrot to incentivise customers to use the app ahead of other digital channels such as Internet banking and ATMs (and most certainly ahead of its physical branch footprint). The bank has used its eBucks rewards programme as a wedge to incentivise (and reward) this behaviour and has tweaked this into more of a “carrot” with a change at the top-end of its customer base announced in June.

Premier (formerly Platinum), Private Clients and Private Wealth account holders were required to log in to the FNB app at least once a month in order to earn eBucks (on the lower-level Gold and Easy accounts, performing one transaction a month using the app equates to one reward level). In hindsight, it seems this approach was probably too heavy-handed and the bank took the somewhat unprecedented step at the start of October of relaxing these changes: first, customers now have until the end of January 2017 to meet this requirement, and second, Premier customers over the age of 60 do not have to use the app (rather, they must use any of the bank’s electronic channels to qualify).

Suffice to say, the older generation doesn’t get this whole smartphone and app thing. Pushback must’ve been very strong to force the 180-degree change.

The second “stick” has come in the form of the bank’s new Smart inContact service, launched with version 5 of its app last week (the bank was the first in the country to launch an app, back in July 2011). Smart inContact replaces the current method of approval, which is via SMS or e-mail. This covers those online banking transactions (once-off payments) that require approval. This service also provides notifications for every transaction, right down to 1c (currently, you’ll only get an SMS or e-mail for those above R100).

It’s no surprise why FNB is pushing transactions and approvals to its app. Chiefly, the app is far more secure than other digital channels and is not susceptible to phishing in the way that online banking is (via spoof e-mails). Again, this push didn’t start last week — FNB has been incentivising customers to use its app over other channels for the last two-plus years. Importantly, and related to SMS specifically, the Smart inContact change also significantly reduces the risk around fraud related to Sim swaps as the app itself needs to be linked (and verified) against each smart device.

And it handily offloads the traditional SMS traffic to the push notification service, which is far more cost effective and more reliable given network congestion during peak periods. The bank is one of the highest volume senders of SMSes in the country, with easily billions of messages a month. (Finally, Smart inContact will mean customers will be able to conduct banking transactions while travelling internationally without enabling roaming, provided they can connect to a Wi-Fi network, which is increasingly a non-issue.)

Given their interactive nature, notifications allow customers to report fraud (for any suspicious swipes, withdrawals, payments, etc) from the message itself. Once logged into the app, details can be viewed of all an account’s debit orders as these are processed, and they can be stopped at the tap of a button (and those below R200 can be reversed immediately). However, the bank has some way to go to surface broader awareness of this functionality across its customer base.

Beyond the current implementation of Smart inContact, one can imagine the next step is to use this for 3D Secure approvals (online purchases which use Verified by Visa or MasterCard SecureCode for MasterCard issuers). A notification service is more secure and more reliable than the current SMS/e-mail workflow. This would help further reduce so-called “card not present” fraud, the single largest type of credit card fraud in the country during 2015, accounting for 75% of losses across the industry.

(Of course, shifting usage to digital channels, especially the app, means that downtime — the likes of which happened on Tuesday morning when the bank’s online channels were down for about two hours — becomes a very big problem.)

But there is one glaringly obvious problem with shifting this all to notifications and the app. For a customer to act on anything, they need to have a data bundle loaded, or an airtime balance for out-of-bundle data. There has been some pushback on Twitter and Facebook by customers against this requirement, particularly in (what seems to be) the lower and middle-market segments of its base.

FNB says customers who don’t upgrade to the latest version of the app will still be routed via the old SMS/e-mail approval process. The alternative is for a customer to delink their device and not to use the app at all, but this means they won’t be eligible for eBucks rewards (from end-January 2017). This will also defer to the old process. But this goes against FNB’s entire push to change behaviour (and to ensure transactions are more secure and cheaper to execute).

There’s a simple way out: strike deals with the four networks to ensure that FNB app traffic is zero-rated — the bank would effectively subsidise this traffic for customers. (Hiding behind the fact that app traffic is zero-rated on its FNB Connect “network” is great for those 350 000-plus Sims but not for anyone else.) Not only would zero-rating solve this particular Smart inContact issue, it would be a great selling point to its customers: “FNB’s app is free and banking doesn’t use a single megabyte of your data!”

I’ve got no doubt this has been thought about and discussed internally (maybe the sums have been done as well). Perhaps the negotiations have already started.

- Hilton Tarrant works at immedia. This column was originally published on Moneyweb and is used here with permission