Facebook was hours away from the formal announcement of its ambitious foray into financial services, but French finance minister Bruno Le Maire was already broadcasting his discontent.

“It’s out of the question’’ that the social media giant’s digital money compete with sovereign currencies, Le Maire said.

That was just the first shot in a torrent of criticism and scepticism from policy makers around the world. US house financial services committee chair Maxine Waters promised an aggressive response from congress. Former European Central Bank vice president Vitor Constancio called the initiative “unreliable and dangerous”.

Led by the social network with more users than the combined population of China and the US, the project represents a potential challenge that the guardians of money have never faced: a global currency they neither control nor manage. And while the mega-banks and their regulators face no short-term threat to their command of finance, advocates of cryptocurrency say the future has arrived and that there’s no turning back.

“It is the beginning of a new financial system where current gatekeepers are substantially less relevant,’’ said Joey Krug, co-chief investment officer at Pantera Capital, founded in 2013 as the first US investment firm focused on bitcoin.

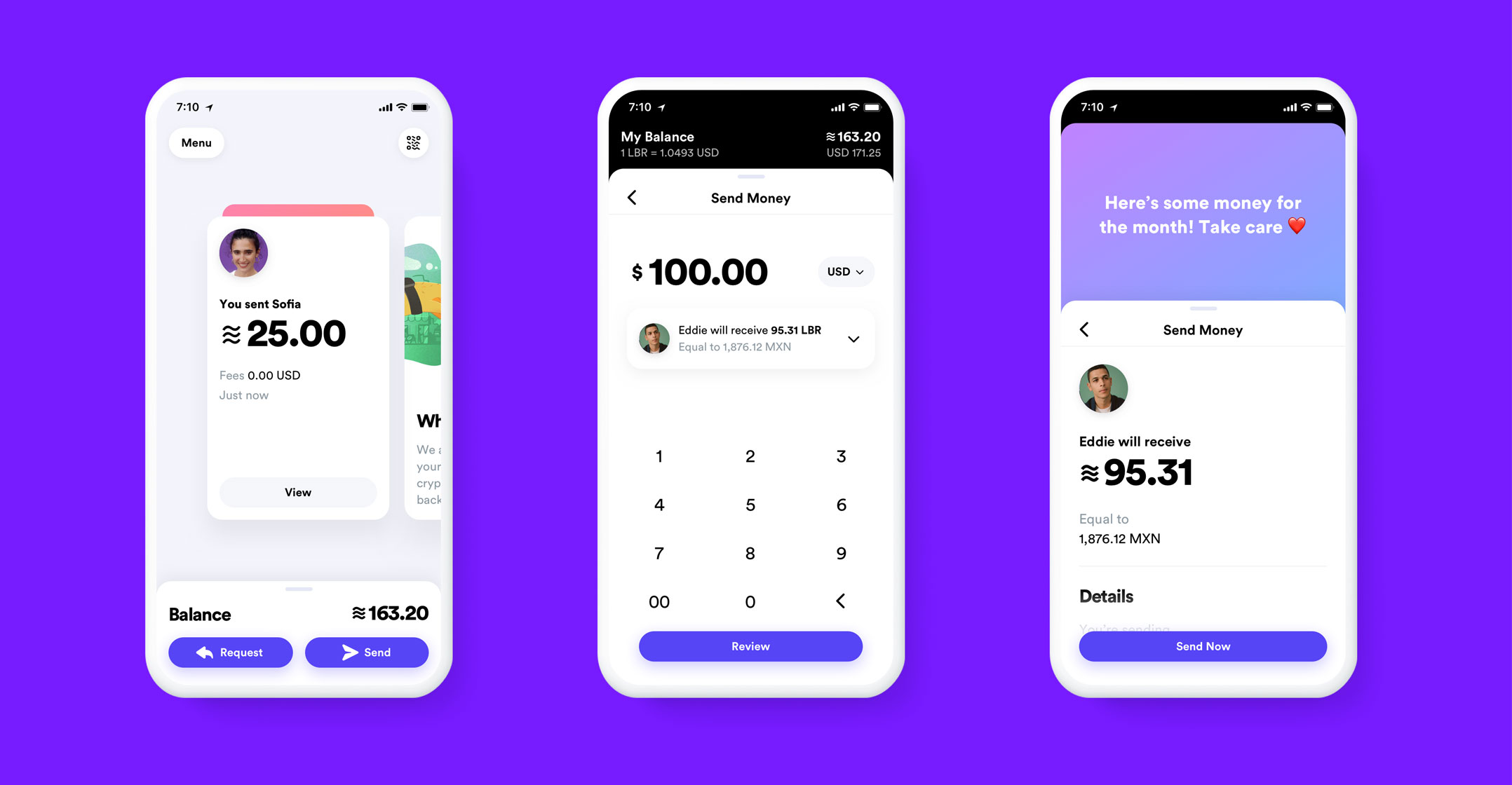

Called libra, Facebook’s new currency will launch as soon as next year. It will initially be used for sending money among friends, family and businesses through the Messenger and WhatsApp services and then be used for routine transactions.

Big ambitions

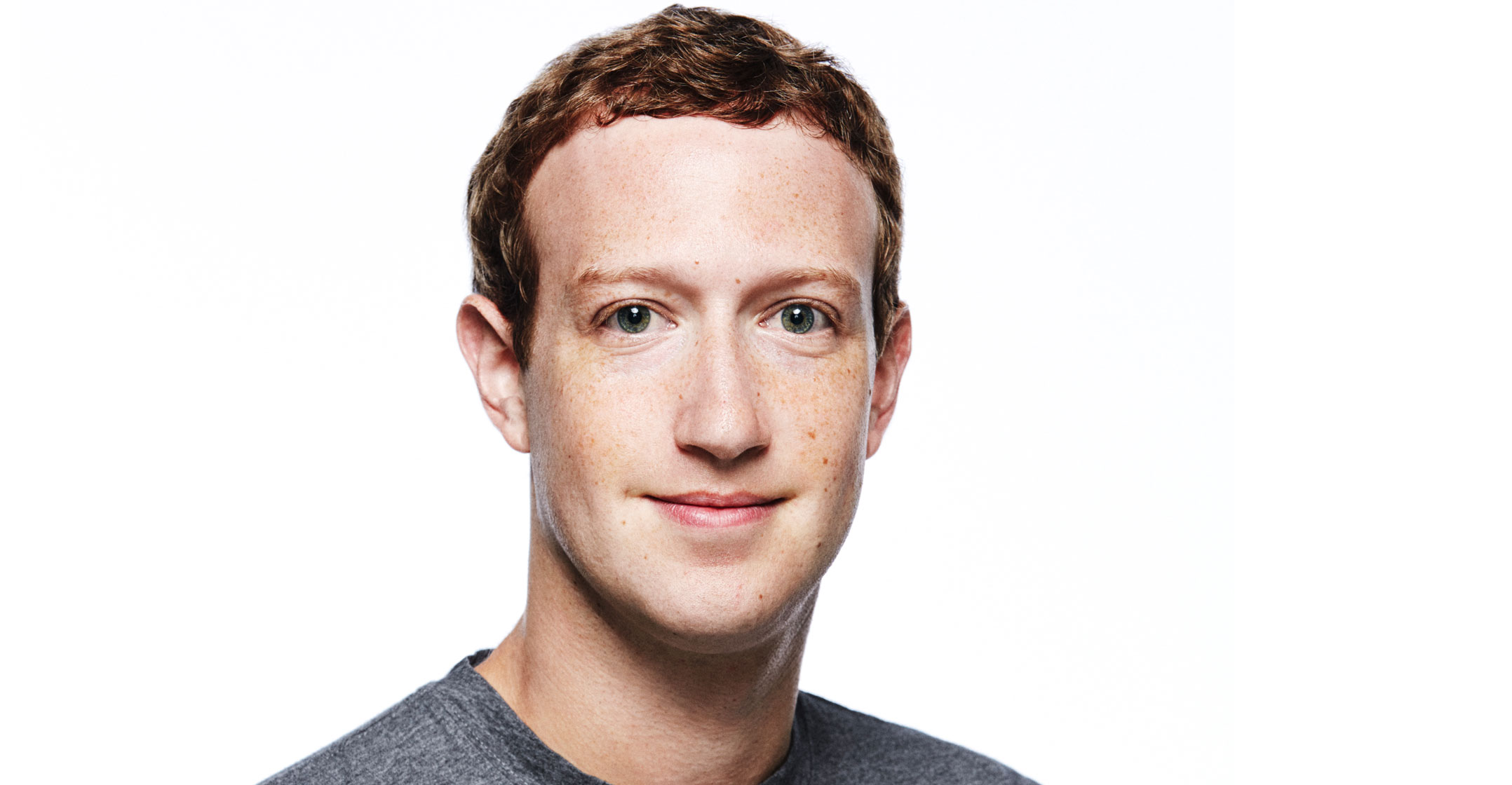

Facebook founder Mark Zuckerberg’s ambitions extend beyond simply minting a new coin. The libra token would contribute to a fairer world, where those now excluded from the banking system would have ready access to cheap and easy payments and financial services, according to a company whitepaper.

Libra is the latest example of how tech companies including Apple and Amazon.com have ventured into the financial industry, offering everything from payments to money management and lending. While finance currently makes up a fraction of their business, giant companies with huge customer bases have the potential to trigger rapid changes in the industry and introduce new risks, according to a report on Sunday by the Bank for International Settlements.

“Technology is changing the basis of competition,’’ says Huw van Steenis, senior adviser to Bank of England governor Mark Carney. “It’s tearing up walls between businesses. It’s not just Facebook trying to do a currency.’’

Moving into the heavily regulated financial services industry via cryptocurrencies, which are seen by many officials as nothing more than a conduit for financing illicit activities, Facebook has shown little reluctance to lessen its confrontation with authorities.

“Facebook is under attack by regulators around the world for a litany of specific issues and, generally, for being too powerful,’’ said Kevin Werbach, professor of legal studies and business ethics who specialises in blockchain topics at the University of Pennsylvania’s Wharton School. “Making a massive move into an entirely new industry, financial services, which is crucial to the global economy, is not the action of a humbled company. It looks to many regulators like an aggressive brush-off of regulatory concerns, whether or not that is actually the case.’’

Sheryl Sandberg, Facebook’s chief operating officer and Zuckerberg’s number two, recognised the tension. Speaking at the Cannes Lions International Festival of Creativity in France on Wednesday, just 24 hours after the official announcement, Sandberg said libra was still some way from launch.

“Regulators have concerns,” Sandberg said. “We’re already meeting with them. We know we have a lot of work to do, but this was an announcement of what we would like to do with a road map for people to jump in and help us do it.”

Indeed, Facebook moved to preempt at least some of the criticism. The token will be overseen by an association of 28 companies at the outset — including Visa and Uber Technologies — that it hopes will number 100 by launch. It has also said libra users will be subject to the same verification and anti-fraud checks they’d expect when signing up for a bank account or credit card. David Marcus, who heads the project for Facebook, said the company plans to keep financial data gathered from libra users separate from Facebook user data.

The Bank of England’s Carney didn’t dismiss Libra, saying the full gamut of global regulators must first scrutinise the offering. Not only that, he said on Thursday he’s starting consultations on allowing new payment providers such as libra to hold reserves at the central bank for the first time.

‘Open mind, not an open door’

“The Bank of England approaches Libra with an open mind but not an open door,” said Carney. “Unlike social media for which standards and regulations are being debated well after it has been adopted by billions of users, the terms of engagement for innovations such as libra must be adopted in advance of any launch.”

In libra’s early days, Carney’s embrace has set him apart from many of his rule-making counterparts.

France’s Le Maire wants an investigation into the potential risks of money laundering and terrorism finance. ECB vice president Luis de Guindos said libra will face questions of privacy and money laundering. Australia’s central bank governor, Philip Lowe, said there’s a “lot of water under the bridge before Facebook’s proposal becomes something we’re using all the time”.

Meanwhile, Waters said Libra is “like starting a bank without having to go through any steps to do it”, and that it’s seeking to “compete with the dollar without having any regulatory regime that’s dealing with them”.

While libra is designed to be less volatile than cryptocurrencies like bitcoin and is backed by a basket of securities and traditional currencies, some question how a technology company will interact with the monetary system. “I’m not entirely convinced that a tech company, at the end of the day, can be held accountable,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank in Singapore.

While libra is designed to be less volatile than cryptocurrencies like bitcoin and is backed by a basket of securities and traditional currencies, some question how a technology company will interact with the monetary system. “I’m not entirely convinced that a tech company, at the end of the day, can be held accountable,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank in Singapore.

There are still many questions about how it will operate and its success is far from guaranteed. Yet the endeavour is being taken seriously by the financial services industry because of Facebook’s scale and its already vast impact on the world.

While Facebook is now trying to sign up banks to the association governing the token, its new system is a challenge to banks that often act as middlemen in virtually all transactions, according to Charles McGarraugh, a former Goldman Sachs Group partner who has moved into the digital world as head of markets at cryptocurrency-wallet provider Blockchain.com.

“We are witnessing a re-orientation of financial services,’’ said McGarraugh. “Having custody of your own assets rather than depositing them in a bank is a totally different paradigm and a superior system to the too-big-to-fail construct that dominates the market now.’’ — Reported by Alastair Marsh, with assistance from Michelle Jamrisko, (c) 2019 Bloomberg LP