Apple’s quarterly results were yucky, but less so than everyone anticipated. Investors and Apple watchers have already basically written off this fiscal year ending in September as a revenue black hole. The big question is whether hints of optimism in Apple’s financial results are the first glimmers of a sustained rebound or simply an emergence from a crater to even ground.

Apple shares typically tick up around this time in even-numbered years, when the company historically releases a significant reworking of the iPhone accompanied by a sales surge for the device, which generates two-thirds of Apple’s revenue. That hasn’t happened this year ahead of the iPhone 7, indicating modest sales hopes. Apple’s shares did rally after market hours on Tuesday when the company beat pessimistic forecasts.

The iPhone 7 won’t have to be a blockbuster to beat the low-bar expectations. But Apple is under pressure to prove its executives’ assurances that the company is in a temporary slow patch because of an inevitable comedown off the smash hit iPhone 6 in 2014. The more time passes, the less that explanation makes sense.

Instead, the wisdom of the market crowds is that Apple is embarking on the early stage of its new normal amid a permanent hollowing out of the smartphone market. The iPhone 7 is a test to determine which was the anomaly: the recent iPhone sales slump before a renewed surge this year or next with the expected big changes coming to the iPhone, or the rapid growth in 2014 and 2015.

Even with the arrival of a new iPhone model, analysts on average expect Apple’s revenue to increase a pedestrian (by Apple standards) 4,5% in the year ending September 2017, according to Bloomberg estimates. Revenue is expected to bump up by 6,4% in fiscal 2018. Those estimates should pick up after Apple issued a forecast for its fourth quarter ending in September that were better than expectations, although revenue is still expected to decline compared with figures in the period a year earlier.

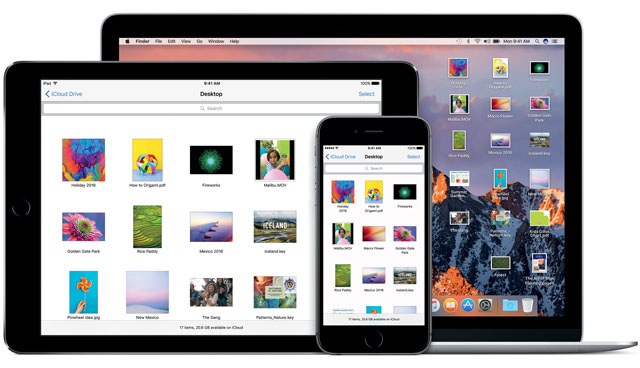

It’s still worth drilling down into the growth challenges Apple faces on every front. Apple’s three top products — the iPhone, iPad and Mac — are each in decline. Revenue from the iPhone fell a record 23% from a year ago, even with the new iPhone SE entering the picture. Granted, Apple generates less revenue from a $399 iPhone SE than it does from a $650 iPhone 6s. To Apple’s credit, the number of iPhones sold fell 21% from the March quarter, better than the 22% sequential decline last year, although that was after the biggest-ever six-month stretch of iPhone sales.

Meanwhile, iPad revenue has dropped for 10 consecutive quarters, though the number of iPads sold increased for the first time since 2013. It seems tablets have become the new PC: a gadget people like and use a lot, but they don’t buy new ones often. That’s bad for Apple, which relies on people regularly splurging on new equipment. Mac sales have fallen for three straight quarters. The region including China is responsible for one-fifth of Apple’s revenue, and sales there fell 33% from a year earlier after a 26% decline in the March quarter. There are signs iPhone-crazed shoppers in China have moved onto other companies’ phones.

CEO Tim Cook had reminded investors that Apple’s revenue typically dips between its March and June quarters as people delay smartphone purchases before new models each fall. The quarter-to-quarter revenue has declined between 11% and 19% since 2012, according to Bloomberg data, and Apple’s 16% sales falloff from the March quarter was right in that zone.

This may simply be Apple’s new normal, even if the company itself doesn’t believe it. Apple needs people to keep replacing their smartphones early and often, and they’re not. AT&T executives have said people are happy with the phones they own and aren’t rushing to buy new models. Citigroup analyst Jim Suva recently estimated iPhone owners are holding onto their phones for 28 months on average, up from roughly 24 months in 2013. He forecasts the period between new iPhone purchases could widen to three years.

Research firm IDC last month cut its expectations for this year’s global smartphone sales increase to just 3,1%, citing changes in consumer buying behaviour, including longer stretches between upgrades. Verizon executives have said in recent days that they expect smartphone sales to continue to slow industry wide. Yet Cook repeated his mantra in an earnings call Tuesday that the smartphone market has plenty of room left to grow.

It will be tough for Apple to buck those trends, and it’s hard to see anything changing until at least the 10th anniversary iPhone in September 2017. That makes this version of Apple like the Chicago Cubs: wait until next year. And like the hapless baseball team waiting for a championship since 1908, next year may never come for Apple. — (c) 2016 Bloomberg LP