South African banking customers will soon not need a bank account number or a branch code to transfer money. Instead, they’ll be able to use a cellphone number – or any other piece of personally identifiable information – to make a payment to someone else.

This is one of the big changes coming to South Africa’s payments industry later this year, according to BankservAfrica CEO Jan Pilbauer, who spoke to TechCentral on Friday about a planned overhaul – years in the making – that is going to shake up the financial services sector.

Other projects the company is working on are set to change the face of the payments industry in South Africa, fostering innovation and competition between incumbent market players, telecommunications operators, fintech start-ups and technology companies.

BankservAfrica, a non-profit company established 50 years ago, is a financial clearing house owned by South Africa’s big banks – Absa, Nedbank, Standard Bank and FirstRand each hold about 23.1% of its equity, while the remaining 7.5% is held by an entity called Dandyshelf, whose shareholders include Capitec, Investec, Bidvest and Sasfin. In short, BankservAfrica’s platforms facilitate transactions between financial services companies in South Africa.

The company has spent the past few years overhauling its platforms and systems to prepare South Africa’s payments system for technology-led disruption and innovation, including from emerging fintechs, telecoms operators and social media players.

The technology overhaul, which includes a shift to cloud platforms and a microservices architecture, will usher in an era of cheap and virtually instantaneous payments, Pilbauer said.

Rapid Payments Programme

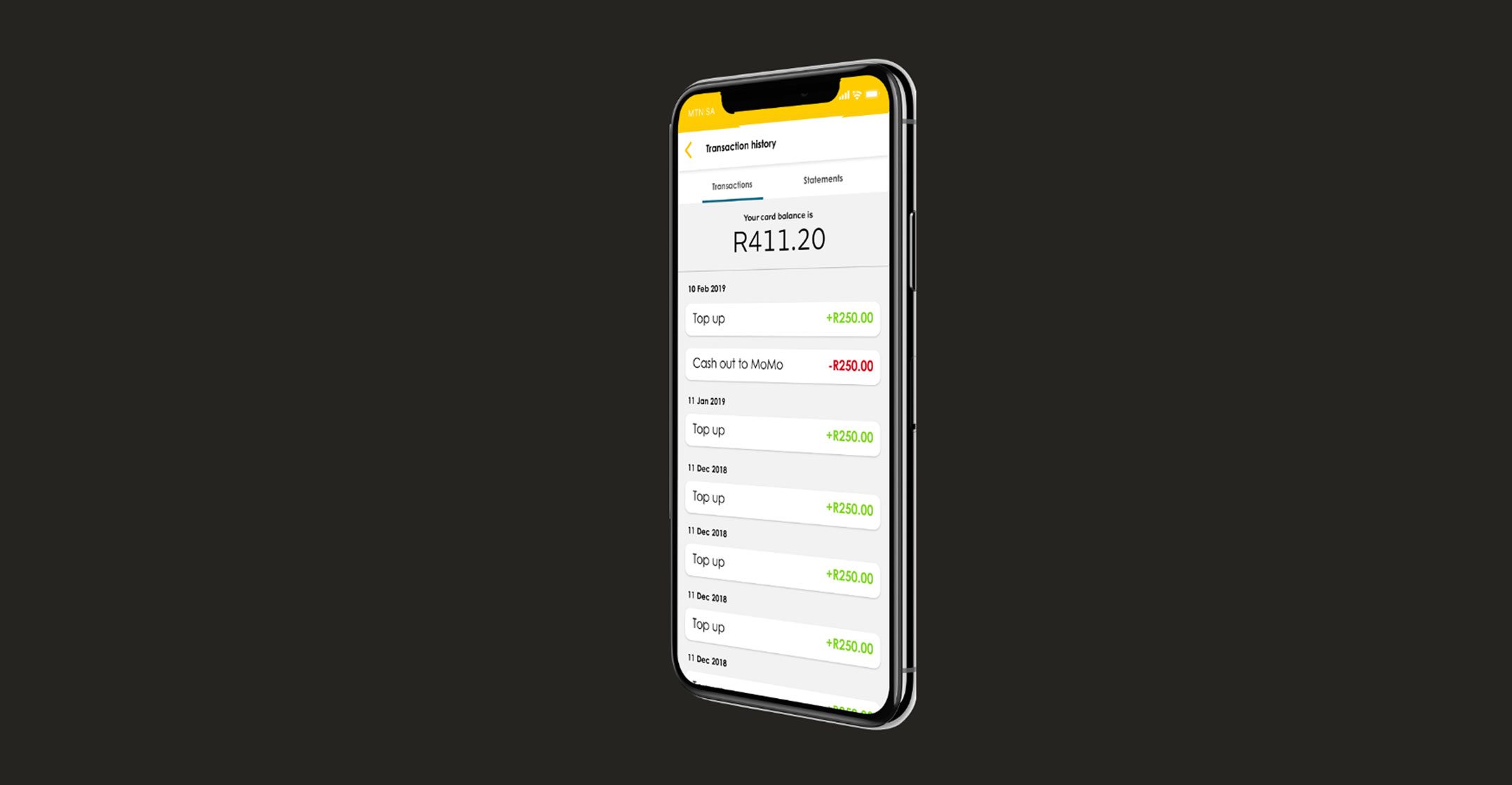

Through a project called the Rapid Payments Programme (RPP), to be launched commercially later this year (possibly under a different name), South Africans will be able to transfer money to one another instantly from their phones, for example, even — once developed — from instant messaging apps.

A company like Meta Platforms will, for example, be able to utilise the BankservAfrica platform to offer payments directly in WhatsApp or Facebook Messenger – provided they comply with the relevant local regulations.

It will become as easy to move money around as it is to send an e-mail or an instant message, Pilbauer said.

Many South Africans have probably not heard of BankservAfrica, but it is a vital cog in South Africa’s economy. In December 2021 alone, its clearing platform handled R93.5-billion in value from 121.8 million transactions.

Despite this, nine in 10 transactions in South Africa are still cash based. Only 10% are digital, and Pilbauer hopes the company’s new systems will make it so convenient – through banks and other payments players – that many of those cash-based transactions will become digital in the coming years.

“When we go live later this year [with the RPP], if I want to send you money, you’ll just have to know my cellphone number, or another alias. Within 10 seconds, the money will be in your store of value and you will be able to use it right away,” he explained. Pilbauer expects companies, including fintech players, to use the new platform to create innovative new use cases.

The RPP won’t do away with traditional electronic funds transfers (EFTs), however. Businesses, for example, will in many instances continue to use EFTs. “Not every payment has to be done in real time… EFTs will stay around, through a batch kind of service.”

The more pressing focus for BankservAfrica is on targeting the large segment of the market that still transacts using cash. Many of these transactions are micropayments – a taxi fare or paying for lunch, for example.

“The main objective of the platform is to offer South Africans an alternative to cash. If you want to achieve that, the cost of that transaction can’t be R5 or R10; it needs to be as cheap as possible.”

Regulations

The RPP system will likely start with relatively low transaction values – perhaps between R3 000 and R5 000/transaction. This will be to ensure risk is managed and to allow the industry to learn user behaviour and ways to make the service as affordable as possible.

To foster true innovation off the back of the RPP will likely also need a change in regulations. According to Pilbauer, the South African Reserve Bank has said it plans to open direct access to the National Payment System so fintech companies and other interested parties don’t always have to work through a bank to provide payment services to end users.

The challenge, however, is deciding who is allowed to keep deposits. Pilbauer said that in India banks still hold people’s deposits, but users can transact directly through Facebook and WhatsApp.

“That’s the future of financial services… Without leaving an app, you want to be able to transact… What we are trying to do with this platform is to allow you to transact in any environment you want in a secure way…”

Another big project that BankservAfrica is working on is Request-to-Pay, or RTP, a standardised way for people to request a payment digitally. The idea is that someone can request money from someone else and the person paying will simply hit a button on their mobile device to approve the request and the money will be transferred instantly. A gardener, for example, could request payment from a homeowner for work done that month, or people eating out could use the system to split the dinner bill.

The company explains on its website that RTP is a “non-financial message between two consumers that allows one to ask for payment. RTP holds the store of value details for the recipient to make payment to the registered proxy as the end destination”. It explains:

This simple and structured way of asking for payment works in many contexts. It has great potential to contribute to SMME empowerment by making digitisation easier and helping these entrepreneurs grow by accessing financial services and technological efficiencies that were never available to them before.

There are also opportunities for corporates who use RTP to schedule their billing and invoice distribution every 30 days. With its clearing facility and built-in proxy-enabled payments, on receipt of a request to pay, the person will acknowledge the request and, if they opt to, pay instantly.

BankservAfrica is also working on a digital identity project, which Pilbauer said is an extension of what it is doing in the “money movement” space. Though not nearly as far down the line as the RPP, Pilbauer said the project will eventually help foster financial inclusion in South Africa.

Ultimately, the idea is to create a platform that stores information, and not only what’s used or needed in financial services. Last September, BankservAfrica published a research paper highlighting what it believes is feasible in this space, and has since developed a business case for a few use cases in areas such as financial services and telecoms. It will go to its board soon to seek approval to take the project further, Pilbauer said.

Distributed

The idea is not to create a massive central database, which he said creates unnecessary risk, but rather to give control to citizens to manage their digital identities through a mix of centralised and distributed systems.

BankservAfrica has investigated distributed ledgers as well as traditional systems as a way of doing this. A “hybrid” approach seems to be the likely way forward. “There are pros and cons to both. The home affairs database will always be the centre of the universe [for digital identity]. We will need to make these things all work effectively together. We are not married to one technology.” — © 2022 NewsCentral Media