MTN Group’s fintech pivot is paying off for the Johannesburg-listed telecommunications giant.

MTN Group’s fintech pivot is paying off for the Johannesburg-listed telecommunications giant.

Although its core business is showing underlying resilience, its latest results – for the six months to end-June 2024 – were splashed in red ink due to the crashing naira in its key market of Nigeria and the disruptive effects of the civil war in Sudan.

Meanwhile, longer-running issues like the continuous decline in traditional voice service revenues – which have higher margins than data – persist.

Group service revenue was down 20.8% year on year, dragged down by a 52.9% drop in service revenue in Nigeria. Group fintech, however, has continued to grow rapidly.

“Fintech revenue increased by 27.2% year on year, in line with our medium-term guidance, with strong performances in Ghana, Uganda and Cameroon,” MTN said on Monday.

It achieved good growth in “advanced” fintech services revenue (up 58.2% year on year) relative to “basic” fintech services, which grew by 20.6%. The contribution of advanced services to total fintech revenue rose to 24.9%, up 4.9 percentage points.

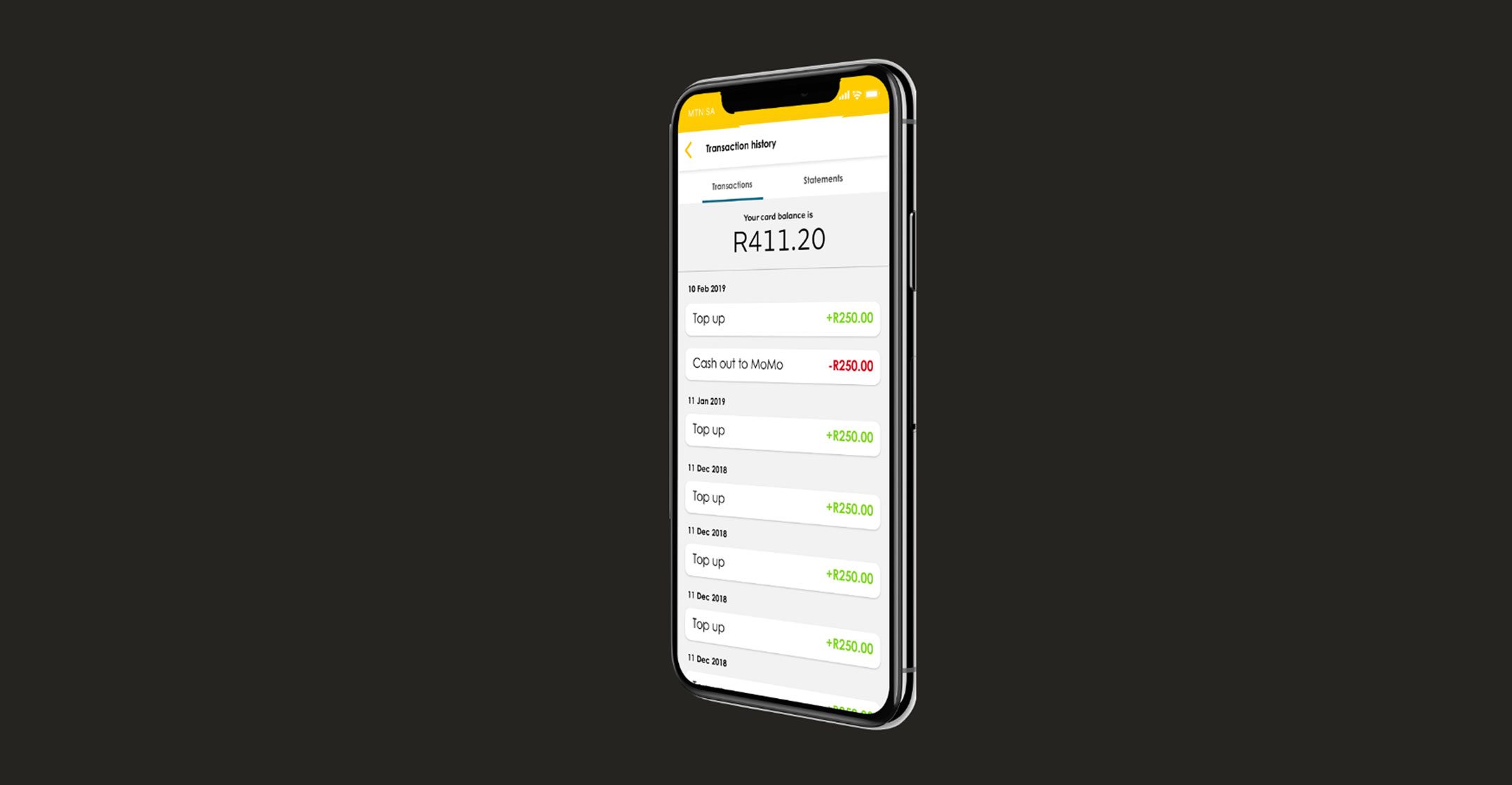

The group’s fintech business is driven by the MoMo (mobile money) application, a competitor to rival Vodacom’s M-Pesa. MoMo active users increased by 9.1% to 66 million as of 30 June, largely driven by growth in Ghana, Uganda and Rwanda.

Remittances

In September 2023, MoMo in South Africa expanded its service offering to include international remittances. At launch, payments could only be made out of South Africa to 12 African countries. MTN expanded its remittance network in April, adding 25 new wallet corridors across 10 African countries. In the first half of 2024, the group’s remittance business grew by 42.4% year on year to US$1.9-billion.

“This was driven by growth in enhanced customer experience, operational optimisation to reinforce real-time service availability, and investment in digital marketing activities. We also activated services in new markets, including eSwatini, South Africa and South Sudan. The number of outbound corridors expanded to 174 and inbound to 577,” said MTN.

Read: MTN Group swings to big loss, dragged down by Nigeria

Another of MoMo’s offerings is a point-of-sale terminal with integrated value-added services and reporting tools to assist merchants in running their businesses. The total value of MoMo merchant payments rose by 31.1% year on year to $9-billion. MTN has 2.3 million merchants across its operating markets.

The group also has a bank-tech offering, which increased the amount of loans made by 73% to $731.6-million. MTN attributed the “robust growth” in its partner lending products to contributions from newly established markets, which it said underpinned the performance.

In all, the group’s fintech ecosystem increased transaction volumes by 18% to 9.7 billion in the period and transaction values rose by 8.5% to a staggering $146.6-billion. Ebitda margins for the fintech business are “in the mid-to-high 30% range”, MTN said.

The move into fintech is part of MTN’s “Ambition 2025” diversification and growth strategy. Mobile operators, including rival Vodacom, have been diversifying into fintech, media, gaming and the internet of things in an attempt to combat the commoditisation of network services, which has resulted in lower margins from core business operations.

“In fintech, we are scaling the business through sequential launches of commercial initiatives with Mastercard across various markets in the remainder of the year, with a focus on maintaining the strong momentum in advanced services growth. We are prioritising seven markets in our card-issuance road map and four markets for card acceptance during 2024,” said MTN Group CEO Ralph Mupita. – © 2024 NewsCentral Media